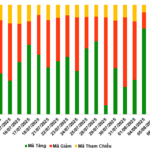

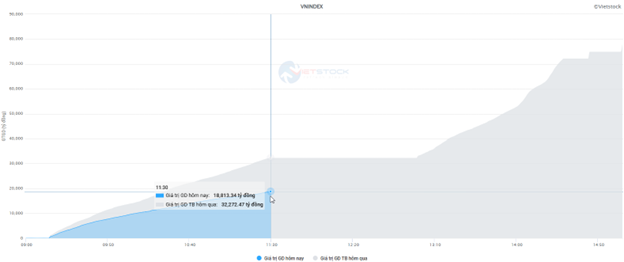

Liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 1.32 billion shares, equivalent to a value of more than 36.9 trillion dong; HNX-Index reached over 131 million shares, equivalent to a value of more than 2.8 trillion dong.

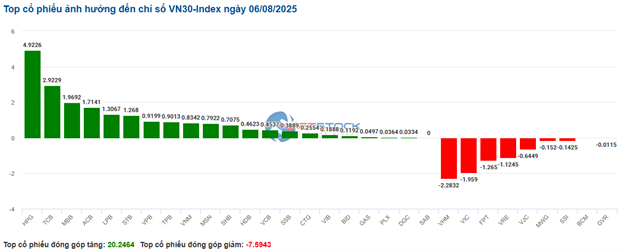

VN-Index opened the afternoon session with continued optimism despite the return of selling pressure, but the index surged and closed in the green thanks to the dominance of buyers. In terms of impact, TCB, VCB, VHM, and MBB were the most positive influences on the VN-Index, with a 6.2-point increase. On the other hand, VRE, FPT, HVN, and VSH were still under selling pressure, but the impact was not significant.

| Top 10 stocks with the strongest impact on the VN-Index on 08/06/2025 (in points) |

Similarly, the HNX-Index also had a positive performance, with positive influences from SHS (+4.31%), PVS (+3.28%), PTI (+8%), and MBS (+1.11%)…

|

Source: VietstockFinance

|

At the close, green dominated most industry groups. The energy sector was the best-performing group in the market, up 3.92%, mainly driven by BSR (+6.86%), PLX (+2.32%), PVS (+3.28%), and OIL (+3.31%). The recovery was followed by the media and financial services sectors, up 3.86% and 2.16%, respectively. On the other hand, the information technology sector was the only group to record a decline in the market, down 0.75%, mainly due to FPT (-0.85%), DLG (-1.5%), HPT (-14.89%), and HIG (-5%).

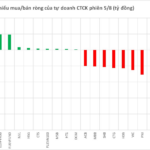

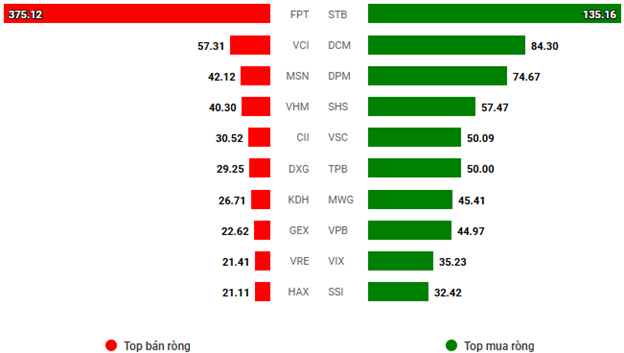

In terms of foreign trading, they continued to net buy over 368 trillion dong on the HOSE exchange, focusing on STB (250.05 trillion), VIX (138.19 trillion), VPB (136.47 trillion), and SSI (127.39 trillion). On the HNX exchange, foreigners net bought more than 214 trillion dong, focusing on SHS (210.16 trillion), PVS (16.73 trillion), LAS (6.04 trillion), and TNG (5.54 trillion).

| Foreign Trading Buy – Sell Net |

Morning session: Expanding the gain

The upward momentum was well maintained across all major indices towards the end of the morning session. At the midday break, the VN-Index rose 21 points (+1.36%) to 1,568.14 points; HNX-Index gained 0.74% to 268.1 points. The market breadth was positive with 434 gainers, 249 losers, and 902 unchanged stocks.

Investors turned more cautious after the previous volatile session. The trading volume on the HOSE in the morning reached nearly 674 million units, equivalent to a value of more than 18 trillion dong, down 41.7% from the previous session’s high but close to the 1-month average. HNX also recorded a volume of 55 million units, equivalent to 1.2 trillion dong.

Source: VietstockFinance

|

In terms of impact, TCB was the most positive influence, contributing over 2 points to the gain. In addition, CTG and VCB also added a total of more than 3 points to the VN-Index. Meanwhile, the top 10 negative influencers only took away more than 1 point from the index.

Looking at the sector performance, green dominated most stock groups. The energy sector temporarily led the market with a 2% gain, driven mainly by BSR (+3.43%), PVS (+2.99%), PVD (+1.67%), PVT (+1.11%), PLX (+1.37%), PVC (+3.33%), and PVB (+2.02%).

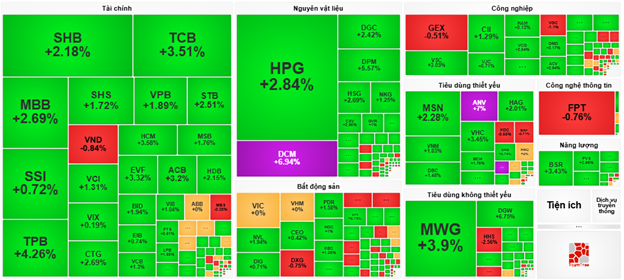

The financial and materials sectors also traded positively, with standout performances from VCB (+1.3%), BID (+1.94%), CTG (+2.69%), MBB (+2.69%), ACB (+3.2%), TPB (+4.26%); HPG (+2.84%), DGC (+2.42%), HSG (+2.69%), CSV (+2.95%), HT1 (+4.68%), DPM (+5.57%), and DCM hitting the ceiling price.

On the other hand, the information technology sector was the only group overshadowed by red, influenced by the decline of FPT (-0.76%), HPT (-12.34%), and HIG (-2.86%).

Source: VietstockFinance

|

Foreigners net bought with a value of more than 126 trillion dong on all three exchanges. The buying focus was on STB with a value of 135.16 trillion. Conversely, FPT was the main target of foreign selling in the morning session, with a net sell value of 375 trillion dong, far exceeding the values of other stocks. If the situation does not change in the afternoon session, this will be the 11th consecutive session of net selling for this stock. Since the beginning of 2025, FPT has also been the stock with the highest net sell value by foreign investors, with a total value of more than 10.7 trillion dong.

Source: VietstockFinance

|

10:30 a.m.: Investors’ hesitation emerges, VN-Index fluctuates around the 1,555-point mark

Investors remained hesitant, resulting in unchanged trading volume, and the major indices fluctuated around the reference level. As of 10:30 a.m., the VN-Index gained 6.96 points, trading around 1,554 points. The HNX-Index rose 0.79 points, trading around the 266-point level.

Stocks in the VN30 basket rose and fell alternately, but buying pressure was slightly stronger. Specifically, HPG, TCB, MBB, and ACB contributed 4.92 points, 2.92 points, 1.96 points, and 1.71 points to the index, respectively. In contrast, VHM, VIC, FPT, and VRE faced strong selling pressure, taking away more than 6.5 points from the VN30-Index.

Source: VietstockFinance

|

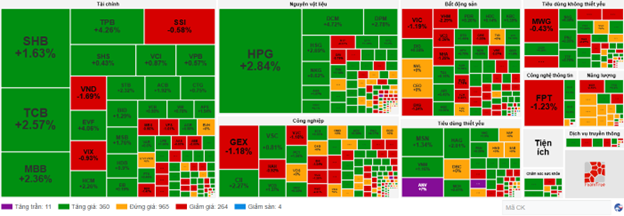

Green dominated most industry groups. The financial sector topped the market with a 2% gain, thanks to the strong performance of VCB (+0.81%), BID (+1.29%), TCB (+2.84%), and VPB (+1.13%)… Conversely, only a few securities stocks such as SSI, VND, MBS, and VIX remained under selling pressure, but the decline was not significant.

Following the financial sector was the materials sector, which also witnessed a broad-based recovery. The strongest gainers included steel stocks such as HPG (+2.52%), HSG (+2.26%), NKG (+2.25%), and fertilizer stocks such as DCM (+4.72%) and DPM (+2.78%)…

On the contrary, the real estate sector exhibited a mixed performance, with selling pressure dominating. Large-cap stocks such as VHM (-2.6%), VIC (-1.28%), BCM (-0.44%), and VRE (-3.07%)… faced selling pressure. Meanwhile, green prevailed in KBC (+1.54%), KDH (+0.72%), SJS (+2.86%), and SSH (+1.1%)…

Compared to the opening, buyers continued to hold the upper hand. There were 360 gainers and 264 losers.

Source: VietstockFinance

|

Opening: Green prevails at the opening, banking and steel sectors lead the gain

At the opening of the 08/06 session, around 9:30 a.m., the VN-Index fluctuated around the reference level after a strong opening, trading near the 1,560-point level. The HNX-Index also edged higher, trading around the 267-point mark.

The financial sector was among the top performers in the early session, with SHB rising 1.36%, MBB gaining 2.86%, TCB climbing 1.08%, and TPB surging 3.98%…

The materials sector also contributed to the market’s positive performance, with most stocks in the sector trading in the green. Specifically, steel and fertilizer stocks such as HPG (+3.03%), HSG (+2.69%), NKG (+1.56%), DPM (+0.43%), DCM (+0.61%), and NVL (+0.97%)… surged from the opening bell.

In addition to the aforementioned sectors, many large-cap stocks in the banking sector also traded positively, including BID, VCB, TCB, and HDB, contributing nearly 11 points to the index.

– 15:35 08/06/2025

Stock Market Insights: Can the Uptrend Persist?

The VN-Index rallied for the third consecutive session, hovering near the upper band of the Bollinger Bands and setting yet another record high. The MACD indicator flashed a buy signal as it crossed above the signal line, while the Stochastic Oscillator remained upward-bound following its previous buy signal. Should these indicators continue to strengthen in upcoming sessions, the positive short-term trajectory is likely to persist.

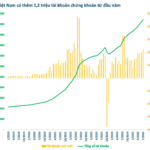

The Stock Market Frenzy: Investors Rush to Open Accounts as VN-Index Soars to New Heights

The number of new securities accounts opened in July hit an 11-month high, marking a significant surge in investor activity.