|

Source: VietstockFinance

|

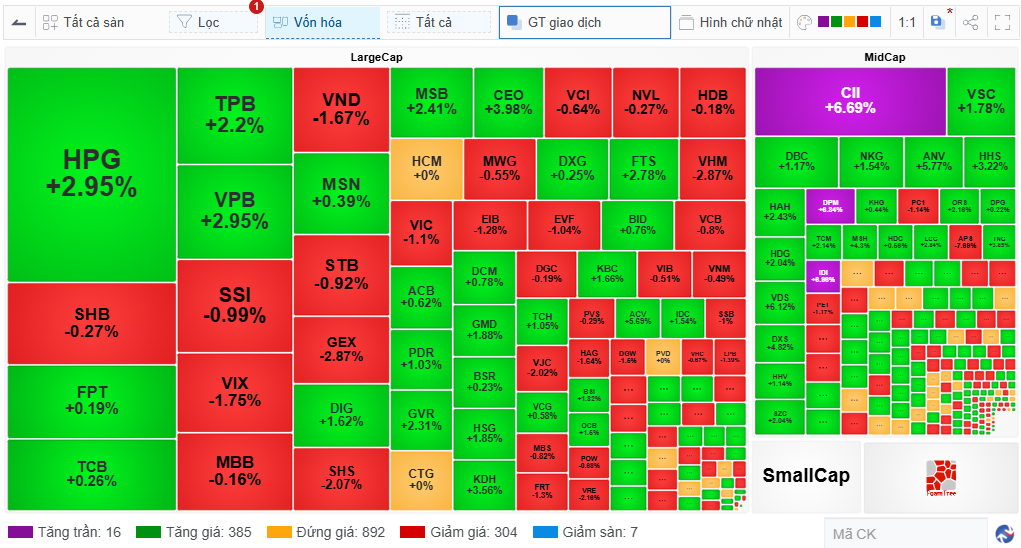

The VN-Index rose by 8.1 points to 1,581.81, while the HNX-Index and UPCoM-Index saw gains of 2.2 and 0.46 points, respectively, closing at 270.86 and 107.92.

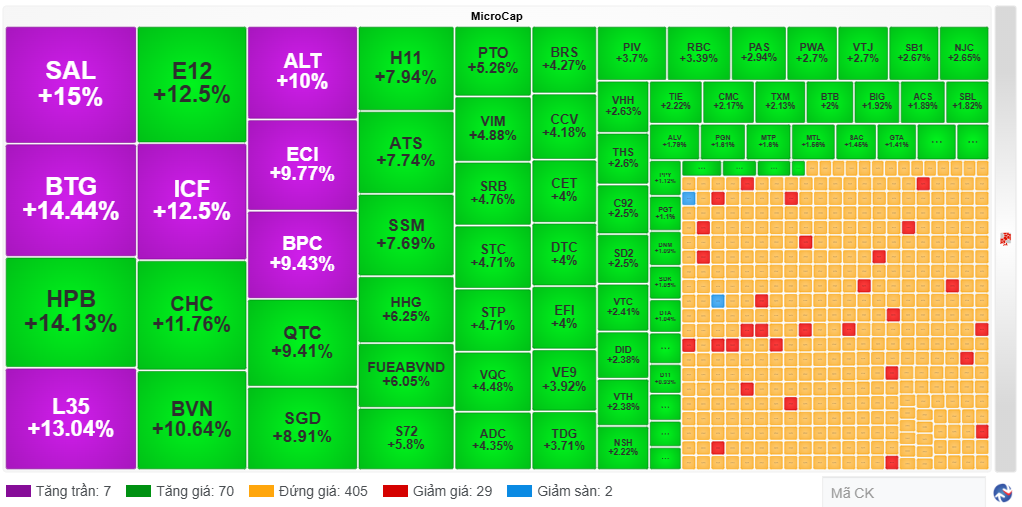

In terms of market cap, the Micro Cap segment stood out with an impressive 3.03% increase, led by seven stocks that hit the daily limit, including SAL, ICF, BPC, BTG, L35, ALT, and ECI.

Source: VietstockFinance

|

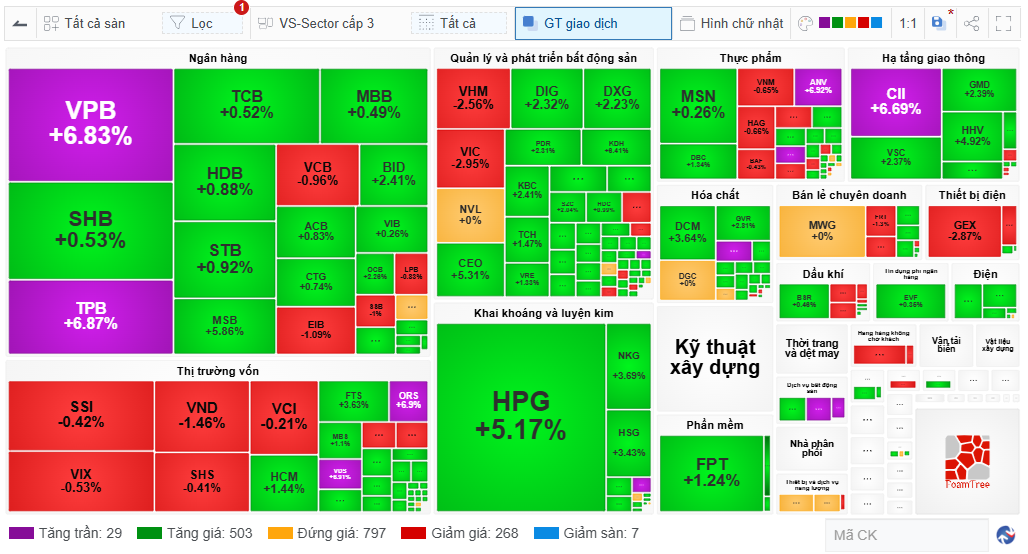

Following closely, the Mid Cap segment posted a 1.33% gain, featuring notable stocks such as CII, ANV, DXS, as well as two securities stocks, ORS and VDS, which reached their daily limit.

Although the Large Cap segment recorded a more modest increase of 0.44%, it significantly improved from a 0.13% loss in the morning session, contributing to the market’s recovery. Notably, two banking stocks, VPB and TPB, hit their daily limit.

A closer look at the market map reveals that the positive momentum in the afternoon session was driven by banking stocks.

Several sectors also painted a predominantly green picture, including transportation infrastructure (GMD up 2.39%, VSC up 2.37%, HHV up 4.92%), software (FPT up 1.24%), and real estate (DIG up 2.32%, DXG up 2.23%, CEO up 5.31%, PDR up 2.31%, KDH up 6.41%), and chemicals (DCM up 3.64%, GVR up 2.81%…).

However, both the banking and real estate sectors witnessed declines in large-cap stocks, with VCB in banking falling by 0.96%, and VHM and VIC in real estate dropping by 2.56% and 2.95%, respectively. These declines in VHM and VIC also exerted pressure on the overall real estate sector, resulting in a market-leading loss of 0.94% despite the majority of stocks in the sector being in positive territory.

Similarly, the securities sector, despite boasting two stocks that hit the daily limit (ORS and VDS), could not be considered successful for the day, as larger stocks such as SSI, VIX, VND, and SHS posted losses of 0.42%, 0.53%, 1.46%, and 0.41%, respectively, creating sizeable red areas on the market map.

Source: VietstockFinance

|

Market-wide liquidity reached nearly 47.9 trillion dong, with HOSE accounting for nearly 43.5 trillion dong. Over 1.9 billion shares changed hands.

Morning Session: Large Cap Turns Red, Mid Cap Surges

The VN-Index continued to exhibit volatility in the latter half of the morning session, fluctuating around the reference level. By the end of the morning session, the index had fallen by 0.72 points to 1,572.99. Meanwhile, the HNX-Index and UPCoM-Index posted slight gains. Market-wide liquidity reached nearly 923 million shares, corresponding to a value of nearly 22.9 trillion dong.

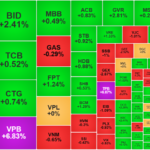

During the morning session, the Mid Cap segment made a strong impression with a 0.77% gain. Notable performers included CII, DPM, and IDI, all of which hit the daily limit, along with several other stocks that posted solid gains, such as VSC, DBC, NKG, ANV, HHS, HAH, HDG, VDS, DXS, HHV, and SZC. Additionally, the Micro Cap segment rose by 0.94%, while the Small Cap segment edged up by 0.02%.

On the other hand, the Large Cap segment shifted from a gain to a loss of 0.13%, significantly impacting the overall market due to its substantial weightage.

|

Market Map by Market Cap

Source: VietstockFinance

|

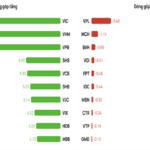

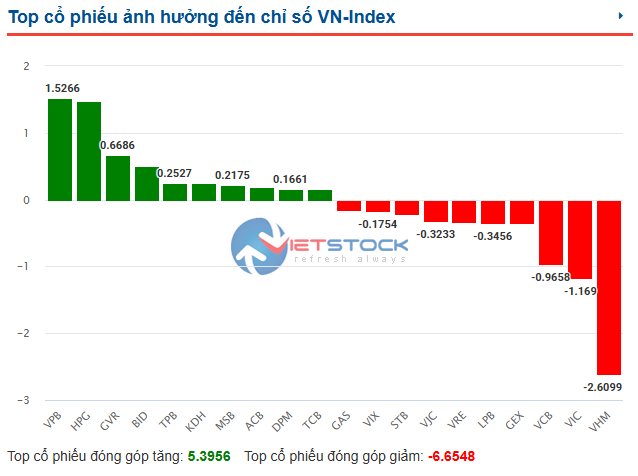

The impact of Large Cap stocks was evident, with VHM and VIC deducting more than 2.6 points and 1.1 points from the VN-Index, respectively, leading the market in negative contributions. Additionally, several banking stocks also featured among the top negative contributors to the index, including VCB deducting nearly 1 point, LPB more than 0.3 points, and STB over 0.2 points.

On the positive side, VPB contributed the most points with over 1.5 points, along with several other banking stocks that provided solid support to the index, such as BID with nearly 0.5 points, TPB with almost 0.3 points, MSB with over 0.2 points, ACB with nearly 0.2 points, and TCB with almost 0.2 points. Moreover, HPG contributed nearly 1.5 points, while GVR added almost 0.7 points.

Source: VietstockFinance

|

Analyzing the market by sector, the shift from green to red in the large-cap segments during the morning session exerted significant pressure on the market. The real estate sector led the losses with a 0.87% decline, followed by securities with a 0.46% drop.

10:30 AM: Market Begins to Fluctuate

After an initial surge, the VN-Index started to fluctuate and briefly dipped below the reference level. However, buying pressure soon returned, pushing the index back into positive territory.

As of 10:30 AM, the VN-Index stood at 1,578.77 points, up 5.06 points, marking a slight decrease from the opening level. Across the market, the number of advancing stocks inched higher compared to the start of the day, with 415 stocks in the green and 14 at their daily limit. However, the number of declining stocks also increased rapidly, with 225 stocks in the red and 5 at their daily limit.

Breaking down the market by market cap, the Mid Cap and Micro Cap segments led the gains with increases of 0.83% and 0.79%, respectively, while the Large Cap segment posted a more modest gain of 0.27%.

Examining the market map, it became apparent that red had started to appear more frequently in the large-cap sectors, notably in banking (SHB, DTB, VIB, EIB, SSB…) and securities (VIX, SSI, VND, SHS…). Additionally, several other large-cap stocks were also in negative territory, including VHM, MWG, and GEX…

While the Vietnamese stock market experienced fluctuations, Asian markets showed more positive momentum, with the Hang Seng and Shanghai Composite turning green, posting gains of 0.29% and 0.11%, respectively. Meanwhile, the Nikkei 225 and Singapore Straits Times maintained their gains from the start of the morning session.

Market Open: A Positive Start

Vietnam’s stock market opened the session on August 7th with enthusiasm. By 9:30 AM, the VN-Index had risen by 9.13 points to 1,582.84, with green dominating across various sectors.

In addition to the VN-Index, the HNX-Index climbed by 2.05 points to 270.71, and the UPCoM-Index gained 0.92 points to reach 108.38. Market-wide liquidity reached nearly 170 million shares, corresponding to a value of nearly 4.3 trillion dong.

Out of all the stocks, 411 were in the green, with 12 hitting their daily limit. Notably, VDS, ANV, and DPM stood out on the market map. On the other hand, only 104 stocks were in the red, with 4 at their daily limit.

Analyzing the market by sector, apart from consumer services, which fell slightly by 0.87% due to a 0.94% drop in VPL, all other sectors were in positive territory. The top-performing sectors included hardware and equipment, up 2.58%; telecommunications services, up 2.44%; and transportation, up 2%. Notably, the large-cap sectors of banking, securities, and real estate all posted gains.

The performance of the Vietnamese stock market contrasted with the mixed results seen in major Asian markets. While the All Ordinaries, Hang Seng, and Shanghai Composite posted declines of 0.15%, 0.1%, and 0.08%, respectively, the Nikkei 225 and Singapore Straits Times recorded gains of 0.79% and 0.65%.

Wall Street edged higher overnight following a string of positive corporate earnings reports. On August 6th, the S&P 500 rose by 0.73% to 6,345.06, the Nasdaq Composite climbed by 1.21% to 21,169.42, and the Dow Jones gained 0.18% to 44,193.12.

Apple shares surged by 5% after a White House official confirmed to CNBC that the iPhone maker would boost its investment in domestic production by an additional $100 billion over the next four years. This brings Apple’s total US investment to $600 billion over the next four years.

The earnings season continued to unfold, with around 81% of S&P 500 companies reporting better-than-expected profits so far, according to FactSet.

Among the standout performers, McDonald’s shares rose nearly 3% after the fast-food chain’s second-quarter results exceeded Wall Street’s expectations for both revenue and profit. Arista Networks shares soared 17% following better-than-expected earnings.

– 4:00 PM, August 7, 2025

Riding the Market’s Wave: Will History Repeat Itself?

The VN-Index witnessed a sharp uptick in the last 30 minutes of the morning session, rebounding to near yesterday’s high. The notable difference was the HoSE’s liquidity, which dropped by 42% compared to the previous morning’s session, hitting a nine-session low.

“Undervalued Bank Stocks with Positive Growth Prospects Attract Cash Flow”

“In the past 1-3 months, a select few bank stocks have witnessed an impressive surge, with gains of several dozen percentage points. These stocks share common traits: they boast low to medium price-to-book ratios compared to the industry average, demonstrate improved financial indicators, and possess unique catalysts that set them apart. These factors have likely contributed to their outstanding performance, catching the eye of discerning investors.”