Mr. Luu Trung Thai – Chairman of the Board of MB.

In the first half of the year, MB’s consolidated pre-tax profit reached nearly VND 15,900 billion, up 18.3% over the same period. The bank’s total operating income (TOI) was nearly VND 32,600 billion, up 24.6% year-on-year, of which net interest income from business activities increased by more than 30% to VND 23,662 billion.

As of June 30, 2025, MB’s consolidated total assets reached nearly VND 1.3 quadrillion, up 14.2% from the end of 2024. Customer lending reached nearly VND 880 trillion, up 13.3% from the beginning of the year. The bank’s NPL ratio was maintained at 1.6%, while the NPL coverage ratio was 88.9%.

Customer deposits also increased by 9.7%, reaching over VND 783 trillion. The current account and savings account (CASA) ratio stood at 38%, down 0.6% year-on-year, however, the absolute number of CASA continued to grow, reaching VND 297 trillion.

Analyzing the CASA ratio, Mr. Vu Thanh Trung, Vice Chairman of the Board of MB, stated that the positive aspect was the higher “stickiness” of CASA, with VND 155 trillion being non-term deposits of individual customers. MB has now served 33 million customers, an increase of 2.2 million from the beginning of the year, and leads the market in the number of digital channel transactions.

The NPL ratio was well-managed at 1.6% for the entire group and 1.47% for the bank alone. The bank’s management affirmed their commitment to closely monitor the NPL ratio in 2025, aiming for 1.5% (bank) and 1.7% (consolidated) by the end of the year.

MB’s net interest margin (NIM) remained stable at 4.1%, on par with the previous year. According to Mr. Luu Trung Thai, despite the decrease in lending rates, MB effectively controlled the cost of funds (COF), thereby maintaining a stable NIM.

Perspective on Maintaining a Moderate CAR Level

Regarding the capital adequacy ratio (CAR), Mr. Luu Trung Thai shared that MB is currently maintaining it at around 11.6%. In comparison, other banks in the industry have CAR levels ranging from 13-14%, while the largest banks in Vietnam have a CAR of about 9%.

“My perspective on this is that a moderate CAR level is reasonable, as we do not want our shareholders to bear additional capital costs. As a result, our return on equity (ROE) and return on assets (ROA) have consistently ranked among the top in the industry. Would you rather increase CAR and sacrifice ROE? I think not. Of course, we also ensure the quality of our operations, especially in credit portfolio management. Given our current scale, we focus on credit growth accompanied by quality,” Mr. Thai emphasized at the event.

Leveraging the Advantage of High “Room” Credit Limit

Regarding credit limits, MB’s management shared that the minimum credit growth limit for the year is 25% (excluding MBV). From now until 2028, the bank will also be granted a high credit growth limit in the market due to its involvement in the mandatory transfer of weak banks.

Chairman Luu Trung Thai expressed his opinion on the credit limit mechanism, stating that in this imperfect stage, controlling credit growth through room limits is an objective requirement and it is challenging to relax this mechanism in the short term. “The idea of releasing the room limit is a good long-term vision, but it requires certain conditions to be met before it can be implemented,” he added. Nonetheless, MB’s management affirmed their confidence in the bank’s competitive position, even in the absence of the room limit mechanism.

At the event, investors also inquired about the loan balances of Novaland and Trung Nam. Mr. Thai assured that there are no issues with Trung Nam. In recent years, the bank has not encountered any non-performing loans related to this customer. Currently, MB is collaborating with Trung Nam on three projects, all of which are generating positive revenue.

In the case of Novaland, the restructuring process involves multiple projects. While the previous phase may have presented challenges, the current phase meets the lending requirements. Novaland’s situation is now much improved compared to the previous year, and MB, along with other banks, is considering providing loans to the company.

MB’s management also addressed investors’ queries about their business strategy. They reaffirmed their leadership in digital transformation with advanced technological capabilities and a commitment to embrace new trends, such as digital assets. Additionally, the bank intends to leverage the strengths of its subsidiaries, enhance cross-selling, and boost the performance of its subsidiary companies.

According to MB, its subsidiary companies have established strong market positions. Military Insurance Joint Stock Company (MIC) ranks in the top 4 in insurance premium revenue, MB Shinsei Consumer Finance Company Limited (MCredit) is among the top 3 in the consumer finance group, and Military Bank Securities Joint Stock Company (MBS) is in the top 7 in brokerage market share as of Q2 2025. The bank that MB acquired, MBV, is closely following the restructuring plan and showing positive signs of improvement.

The Green Airport: CEO Group’s Profitable Venture into Industrial Park Development

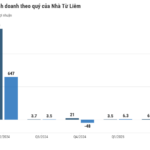

“CEO Group reports a doubling of profits for the second quarter of 2025, attributed to successful cost-cutting measures. The Group’s quarterly profits soared to 39 billion VND. During this period, CEO Group also invested 50.5 billion VND in its newly established subsidiary, which has a charter capital of 450 billion VND.”