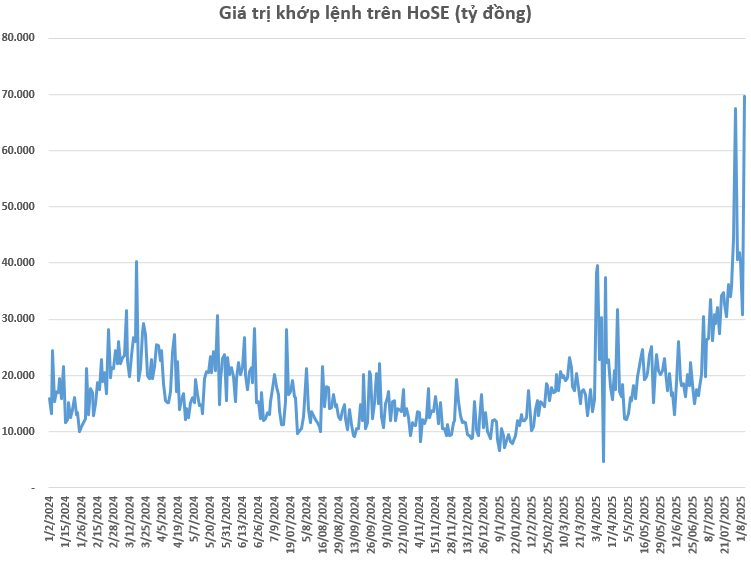

Vietnam’s stock market has just witnessed a historic trading session with unprecedented market liquidity. The matching value on the HoSE reached VND 69,600 billion, the highest ever, surpassing the previous record set just a week ago by 3%. Across all three exchanges, the total matching value reached VND 77,100 billion, equivalent to approximately USD 3 billion.

The VN-Index experienced a dramatic trading session, akin to a rollercoaster ride. Notably, within a 20-minute period in the afternoon session, the VN-Index surged nearly 57 points before plunging into negative territory, only to recover later. At the close of the August 5 session, the VN-Index gained nearly 19 points, climbing to 1,547.15.

The massive influx of money into the market in recent times is a result of several factors. Firstly, low-interest rates and expectations of robust economic growth have stimulated idle funds to flow into the stock market. Additionally, synchronized implementation of market reform and upgrade policies has instilled strong confidence among both domestic and foreign investors.

Notably, the euphoric sentiment as the VN-Index repeatedly hits new highs is attracting speculative money, creating a vibrant trading landscape.

According to Mr. Tran Hoang Son, Market Strategy Director of VPBank Securities Company, at this stage, many investors, especially those with experience, will have a hard-to-describe feeling. Seasoned investors tend to be more cautious.

However, with the large wave of money supporting the economy to achieve the GDP growth target of 8.3 – 8.5%, credit growth is likely to be very high. Therefore, Mr. Son believes that sectors such as banking will benefit significantly.

The VPBankS expert suggests that in this “big wave,” many investors will view the correction as an opportunity to buy stocks at more reasonable discounted prices. He outlines two scenarios:

First, if the index does not break through the 1,480-point support level and maintains a large swing range. This scenario is likely, especially since last week, when the 1,480-point mark was touched, the index repeatedly bounced back, indicating a strong support level.

Second, if the 1,480-point level is breached, investors will have the opportunity to buy at better prices in the 1,430 – 1,450 support range. However, in both scenarios, the market correction will present an opportunity for new money to enter.

In terms of strategy, the expert advises investors who have partially realized profits to reassess their portfolios, identify the strongest sectors, and look for opportunities to reinvest, thus continuing to ride the wave of gains in the coming period.

Sharing a similar view, in a recent letter to investors, Petri Deryng, head of the foreign fund Pyn Elite Fund, attributed the recent uptrend in the Vietnamese stock market to a series of positive factors. Macroeconomic news has fostered optimism for exports and investment inflows.

The Pyn Elite Fund manager believes that the scenario of the VN-Index reaching the 1,800-point milestone by Christmas (late 2025) is not unrealistic. However, the fund manager also cautions investors about the possibility of short-term technical corrections due to profit-taking by domestic investors.

The Stock Market Surge: Banking Sector Leads VN-Index to New Heights

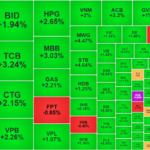

The market slowed down and turned volatile in the afternoon session, but ultimately finished on a positive note. The VN-Index rose 1.72% to 1573.71, closing at a new all-time high. This achievement was largely driven by TCB, VCB, and the banking sector as a whole, which propelled the index beyond its previous peak.

Market Beat: Green Dominance, VN-Index Extends Gains

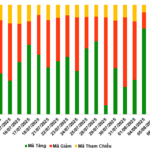

The trading session concluded with significant gains, as the VN-Index surged by 26.56 points (+1.72%), closing at 1,573.71. Meanwhile, the HNX-Index also witnessed a robust increase of 2.54 points (+0.95%), ending the day at 268.66. The market breadth was strongly positive, with 529 advancing stocks versus 254 declining ones. This bullish sentiment was echoed in the VN30 basket, where 28 stocks climbed while only 2 witnessed losses.

Stock Market Insights: Can the Uptrend Persist?

The VN-Index rallied for the third consecutive session, hovering near the upper band of the Bollinger Bands and setting yet another record high. The MACD indicator flashed a buy signal as it crossed above the signal line, while the Stochastic Oscillator remained upward-bound following its previous buy signal. Should these indicators continue to strengthen in upcoming sessions, the positive short-term trajectory is likely to persist.

Derivatives Market Outlook for August 7, 2025: Bullish Market Sentiment Prevails

The market closed on August 6th, 2025, with a positive sentiment. A total of 184 stocks rose, while only 38 declined, and 24 remained unchanged. Foreign investors returned to net buying, with a total net purchase of 1.17 million CW.