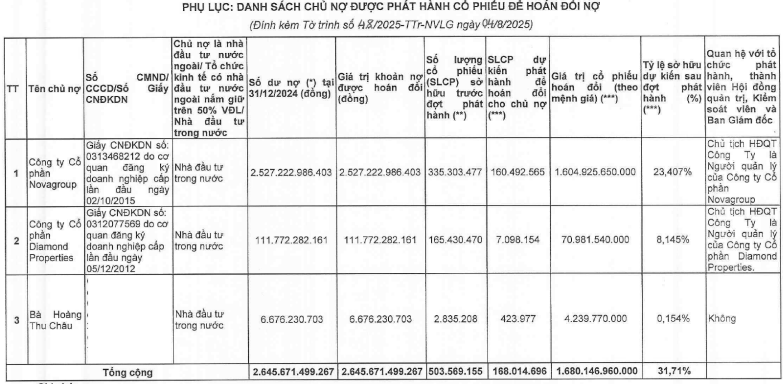

Novaland proposes a private placement of over 168 million shares to settle debts with three creditors

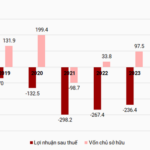

According to the announcement on August 4th, NVL plans to issue more than 168 million shares, equivalent to 8.616% of the total outstanding shares, to restructure its debts and improve the company’s financial situation.

The share swap arrangement values each share at nearly VND 15,747, resulting in a total debt settlement value of approximately VND 2,646 billion.

The creditors participating in this issuance include two companies and one individual. Specifically, the corporate creditors are Novagroup JSC and Diamond Properties JSC, both related to Chairman Bui Thanh Nhon; the sole individual creditor is Hoang Thu Chau.

Source: Novaland

|

NVL stated that this settlement is to repay the parties who had pledged their shares for secured loans, enabling the company to fulfill its payment obligations.

Following the issuance, NVL will have settled its debts with these individuals and entities (as of December 31, 2024), and this group of creditors will collectively hold 31.71% of the company’s capital. Additionally, the total ownership of the major shareholder group (NovaGroup and Diamond Properties) and the family group of Mr. Bui Thanh Nhon will stand at 42.43%.

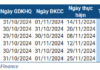

The issued shares will be restricted from transfer for one year. The expected timeline for this issuance is in the fourth quarter of 2025 to the first quarter of 2026, pending approval from the State Securities Commission.

Proposing a maximum VND 5,000 billion convertible loan facility

In addition to the above issuance plan, the NVL Board of Directors proposed to the General Meeting of Shareholders a capital raising plan in the form of a loan facility with a conversion feature. This facility has a maximum limit of up to VND 5,000 billion, with a term of 5 years from the disbursement date.

The borrower has the right to prepay the loan, and the lender has the right to recall the loan after 3 years from the disbursement date. The lender also has the right to request the conversion of part or all of the principal outstanding into ordinary shares after 12 months from the final disbursement date up to 30 days before the due date.

The conversion price shall not be lower than the minimum price approved by the Board of Directors, which is at least 115% multiplied by the closing price of NVL shares on the 5th working day before and including the final disbursement date.

The conversion price may be adjusted upon the occurrence of certain events in accordance with market practice and agreement with the Lender. The specific conversion ratio calculation method and the contents of the adjustment of the conversion price and conversion ratio will be decided by the Board of Directors or the authorized person in accordance with the Company’s Articles of Association and laws, depending on the actual market situation at the time of issuance.

– 08:18 06/08/2025

The Ultimate Cash Cow: Novaland’s Imminent Windfall of 8,000 Billion VND

Novaland Group is set to issue over 168 million private shares to facilitate a debt swap totaling VND 2,645 billion and to execute a convertible loan with a cap of VND 5,000 billion.

“NVL Proposes Two Motions: A Loan Agreement and Private Placement for Debt Restructuring.”

NVL has unveiled two pivotal proposals that are set to transform its financial landscape. The first proposal, titled “Convertible Loan Scheme,” outlines a strategic approach to leveraging convertible loans as a mechanism for balancing debt and equity. The second proposal, “Private Placement of Shares for Debt Swap,” presents a thoughtful strategy for issuing new shares to existing debt holders. These proposals showcase NVL’s proactive approach to financial management and its commitment to exploring innovative solutions.

“Technical Analysis for August 4th: Proceeding With Caution”

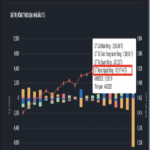

The VN-Index and HNX-Index both climbed, while trading volume dipped compared to yesterday’s morning session, indicating investors remain cautious.

The Sun City’s Fate Post-Novaland

Sun City Real Estate Investment and Development Ltd. has been given the green light to develop a landmark project in An Khanh Ward, Thu Duc City. The project, boasting a staggering investment of over VND 10.5 trillion, encompasses a high-rise complex of residential, commercial, service, and office spaces. This venture stands out as a rare gem among the few projects in Ho Chi Minh City to secure investment approval this year.