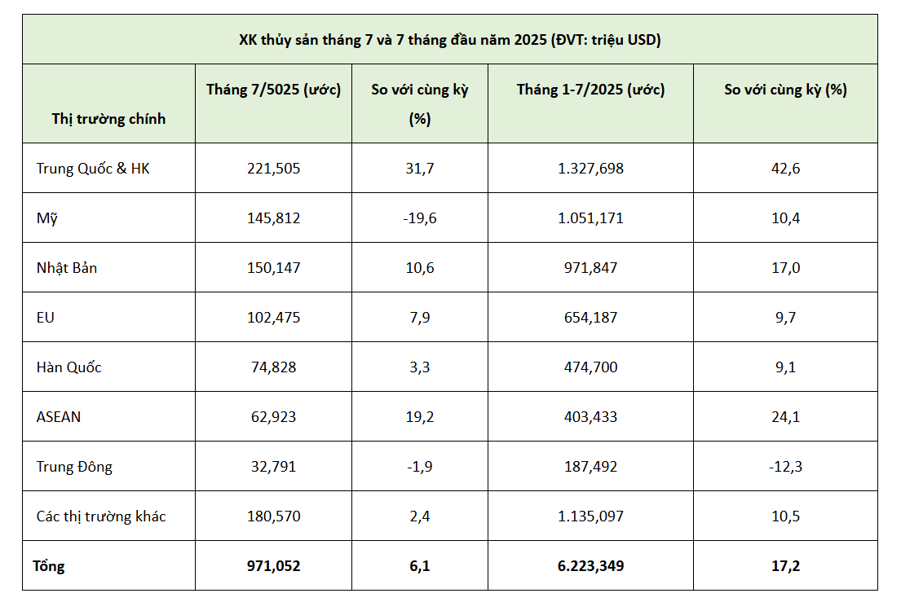

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam’s seafood exports in July 2025 reached $971 million, a 6.1% increase compared to July 2024. Cumulatively, for the first seven months of 2025, the total seafood export turnover reached $6.22 billion, a significant 17.2% growth compared to the same period last year…

THE US AND CHINESE MARKETS: TWO EXTREMES

The US market recorded an export value of $145.8 million in July 2025, a decrease of 19.6% compared to July 2024. However, for the first seven months of 2025, seafood exports to the US market still increased by 10.4%. This was mainly due to the impact of the US tax policy, which was expected to take effect from August 2025, with a rate of up to 20%, along with anti-dumping and countervailing duties, disrupting exports to this market and causing a decline in orders.

On the other hand, the Chinese market witnessed an exceptional growth in Vietnam’s seafood exports, reaching $221.5 million in July 2025, a 31.7% increase compared to July 2024. For the first seven months, seafood exports to China reached $1.33 billion, a 42.6% increase compared to the same period last year.

The reason for this growth is that China has ramped up its imports again, especially for shrimp and squid, creating opportunities for Vietnamese enterprises to accelerate before the US imposes taxes in August. This is also a result of the flexibility of enterprises in proactively shifting their focus and boosting consumption in high-growth markets while taking advantage of FTAs such as RCEP and CPTPP to enjoy preferential tariffs.

Apart from the US and China, the markets of Japan, the EU, South Korea, and ASEAN also showed positive growth, indicating a favorable global consumption trend for Vietnamese seafood, especially with reasonable prices and abundant supply.

In terms of seafood products, shrimp remained the key export item, reaching $2.49 billion in the first seven months of 2025, a 23.6% increase compared to the same period last year. However, the US market, which accounts for a large proportion, is being “choked” by tax policies, causing signs of stagnation in orders. Compared to competitors such as Ecuador (with a tax rate of only 15%) and Indonesia and the Philippines (19%), Vietnamese shrimp is gradually losing its advantage if the 20% retaliatory tax is implemented. The shrimp industry is entering a challenging phase as the preliminary POR19 results announced by the US Department of Commerce in June showed anti-dumping duties of up to 33.29% for many large enterprises.

“The preliminary POR19 anti-dumping tax rate of 33.29% announced in early June shook market confidence. If this rate is maintained in December 2025, there is a real risk that Vietnamese shrimp will lose the US market,” said Ms. Le Hang, Vice Secretary-General of VASEP.

It is forecast that shrimp exports for the whole of 2025 could reach $3.6-3.8 billion if enterprises continue to exploit the Asian market, the EU, CPTPP countries, and promote value-added products to Japan.

Regarding tra fish exports, the turnover reached $1.22 billion in the first seven months of 2025, an 11.1% increase compared to the same period last year. A bright spot is that eight large enterprises, such as Vinh Hoan, were subject to a 0% anti-dumping tax rate according to the POR20 results, helping to restore confidence in the US market. However, if the new retaliatory tax is implemented, tra fish will also be affected by increased costs and prices. With the Chinese market showing signs of stagnation due to inventory, enterprises have to find ways to expand into ASEAN, South America, and the Middle East.

VASEP assessed that in the last five months of the year, the picture of Vietnam’s seafood exports is expected to face both “challenges and expectations.” The challenges come from the US retaliatory tax policy of 20%, which took effect on August 7, the risk of losing the shrimp market and restrictions on tuna, along with geopolitical instability and supply chain disruptions.

According to the latest information from the US, from August 7, 2025, a 20% retaliatory tax will officially take effect on imported products from Vietnam, including seafood. Compared to competitors such as Ecuador (15%), the Philippines and Indonesia (19%), and Thailand (19%), Vietnam’s seafood industry is facing the highest tax rate.

However, opportunities remain abundant. The strong recovery of the Chinese, ASEAN, and Japanese markets, along with signals of removing technical barriers from the EU, opens up growth prospects for deep-processed products. Trade agreements such as EVFTA, CPTPP, and UKVFTA continue to provide superior tariff advantages over competitor countries.

TUNA INDUSTRY FACES CHALLENGES

Tuna exports are facing difficulties, with a turnover of $542 million in the first seven months of 2025, a slight decrease of 2.8% compared to the same period last year, and a sharp decline of nearly 19% in July alone. The main reason for this is the inappropriate domestic regulations, such as Decree 37, which prohibits the mixing of domestically caught and imported raw materials, especially the regulation that sets the minimum allowable catch size for yellowfin tuna at 0.5m. This has discouraged fishermen from fishing, and even if they do, they cannot sell their catch, while enterprises lack domestic raw materials for processing and exporting and cannot take advantage of the tariff quota of 11,500 tons of tuna to the EU under the EVFTA.

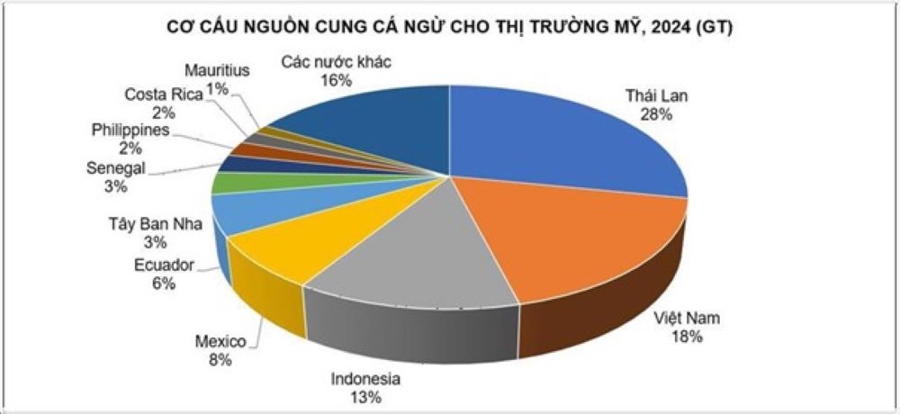

According to statistics from the US Department of Agriculture, the US is the world’s largest tuna consumer market, with an average import volume of more than 300,000 tons per year.

Thailand, Vietnam, Indonesia, Mexico, and Ecuador are the top five tuna suppliers to the US market. Thailand has the highest proportion of the total US tuna imports, at 28%, followed by Vietnam at 18%, Indonesia at 13%, Mexico at 8%, and Ecuador at 6%.

In the first five months of 2025, the US tuna imports increased the most from Ecuador, with a volume growth of 64%. Meanwhile, imports from Thailand increased by 22%, Vietnam by 25%, and Indonesia by 11%. With the lowest tax rate of 15% just announced, Ecuador is emerging as the biggest beneficiary of the new decree. Its geographical advantage, low logistics costs, and internationally standardized processing capacity make Ecuador an attractive option for US importers.

Vietnam, despite its good growth rate in recent years, is now facing a significant challenge due to the highest tax rate among the major suppliers. Specifically, Vietnam’s tuna exports to the US market in the second quarter of 2025 remained at a level comparable to the same period in 2024. In June alone, exports to this market fell sharply by 41%.

US distributors and retailers, especially supermarket chains and processed food groups, tend to prioritize stable and low-risk sources of supply. This may lead to a short-term shift in orders away from Vietnam, Indonesia, and Thailand.

With the new tax rate, the competitiveness of Vietnamese tuna in the US market is being eroded. Vietnamese enterprises will face the risk of losing market share.

VASEP forecasts that seafood exports for the whole of 2025 could reach $9-9.2 billion. Of this, shrimp is expected to bring in $3.6-3.8 billion, tra fish $1.8 billion, tuna about $850-900 million, and other seafood products nearly $3 billion. However, to achieve this goal, enterprises need to continue to proactively ensure raw material sources, improve quality, invest in processing technology, and diversify markets, especially niche markets within CPTPP, ASEAN, and the Asian bloc.

Seafood Exports Surpass $10 Billion: Unveiling the 2 Star Products

The seafood industry has witnessed impressive growth in exports, inching closer to the significant milestone of $10 billion annually. This remarkable journey can be largely attributed to the stellar performance of two key players: shrimp and catfish. As the industry surges ahead, these two aquatic powerhouses have emerged as the primary contributors to its success, solidifying their status as the backbone of this thriving sector.

Seafood Exports on Track to Hit $10 Billion Landmark

With the current growth trajectory, Vietnam’s seafood industry is on track to achieve its target of $10 billion for the full year 2024, marking an impressive 11.5% increase from 2023. Shrimp and catfish will remain the key drivers, with projections of reaching $4 billion and $2 billion, respectively.

Seafood Exports for the First Ten Months Reached $8.3 Billion, with Key Products Showing Strong Growth

The seafood industry is swimming towards success, with October’s achievements pushing the 10-month tally to a remarkable $8.33 billion in export turnover. This impressive figure marks a 12% increase compared to the same period last year, showcasing the sector’s resilience and growth. Key products such as shrimp, pangasius, and tuna have all witnessed positive growth trajectories, contributing to the industry’s overall triumph.

Vietnam Prepares for EU Inspection Delegation in Aquaculture

The European Union (EU) inspection team is set to visit Vietnam to audit its aquaculture industry. The team is expected to evaluate the country’s residue control program for products destined for the EU market and verify the reliability of ensuring that farmed seafood complies with residue regulations.