The report, released by the General Statistics Office (Ministry of Finance) on the morning of August 6, revealed that in the first seven months of 2025, foreign investment registered in Vietnam reached $24.09 billion, up 27.3% from the same period last year. In the context of the current global economic turmoil, foreign investment over the past seven months has been a notable bright spot.

The figure of $24.09 billion came from three main components: newly registered capital, adjusted registered capital, and the value of capital contributions and share purchases by foreign investors.

A deeper analysis reveals that while newly registered capital saw a slight decrease, the number of new projects increased significantly. Specifically, 2,254 new projects were licensed with a total registered capital of $10.03 billion. Compared to the same period, the number of projects increased by 15.2%, however, the registered capital decreased by 11.1%. This indicates that new investors are still flocking to Vietnam, despite the more modest scale of the projects.

The processing and manufacturing industry continued to be the biggest attraction for investment, accounting for 55.9% ($5.61 billion) of the total newly registered capital, followed by real estate business activities with 23.5% ($2.36 billion).

In terms of partners, Singapore led the way among the 74 countries and territories with new projects in Vietnam, with a total registered capital of $2.84 billion, accounting for 28.3%. China ($2.27 billion), Sweden ($1.0 billion), and traditional investors such as Japan, Taiwan (China), and Hong Kong (China) followed.

An impressive and significant bright spot in the picture of attracting investment in the first seven months was the explosive growth in adjusted capital. There were 920 existing projects that registered for additional capital, with a total value of $9.99 billion, a surge of 95.3% compared to the same period last year.

This indicates that investors currently operating in Vietnam highly value the business environment and prospects of the economy. At the same time, the decision of large corporations to inject billions of dollars to expand production and upgrade technology demonstrates their efficiency and belief in a sustainable future in Vietnam.

If we consider both new and additional capital of foreign investors, the processing and manufacturing industry remains the leader with $12.12 billion, accounting for 60.6% of the total. Real estate business activities ranked second with $4.95 billion (24.7%).

Similarly, capital contributions and share purchases by foreign investors also recorded impressive growth. With 1,982 registered contributions and share purchases, the total value of capital contributions reached $4.07 billion, an increase of 61% over the same period. This capital mainly flowed into the processing and manufacturing industry (39.3%) and professional, scientific, and technological activities (20.3%), indicating the interest of foreign investors not only in building factories but also in engaging in activities that require higher intellectual value.

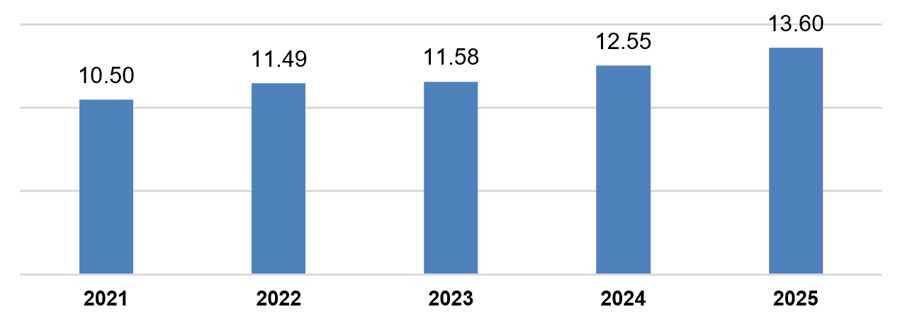

Another important indicator is realized foreign direct investment (FDI). In the first seven months, Vietnam disbursed approximately $13.6 billion, up 8.4% from the same period and the highest figure for the first seven months in the past five years. This demonstrates that investment commitments are quickly turning into substantive production and business activities, creating jobs and contributing to economic growth.

Along with attracting strong capital inflows from abroad, Vietnamese enterprises are also increasingly confident in venturing into international markets. In the first seven months of 2025, registered outbound investment saw an increase of over 200% compared to the same period last year ($398.9 million).

The total investment of Vietnam abroad, including new and adjusted capital, reached $528.5 million, 3.5 times higher than in the same period last year.

The main investment fields of Vietnamese enterprises included electricity production and distribution (21%), warehousing and transportation (20.6%), and wholesale and retail (14.8%).

In terms of destinations, Laos continued to be the leading market, attracting $150.3 million (28.4%) of Vietnam’s total investment. Other Southeast Asian countries such as the Philippines and Indonesia were also attractive destinations, showing a trend of focusing on investing in markets with high potential in the region.

The Great Migration and the Rise of Satellite Megacities

The urban landscape is undergoing a significant shift, with a wave of expansion that is fueling the rise of satellite megacities. These emerging urban centers offer a unique blend of ecological living spaces, world-class amenities, and strong potential for long-term growth, setting a new standard for modern urban development.

How Tycoon Pham Nhat Vuong Is Taking Over Hai Phong With His $2.2 Billion Real Estate, Industrial, and Logistics Projects

With an estimated investment of nearly $22 billion, Vingroup is the largest private investor in Hai Phong, spanning across real estate, industry, energy, and infrastructure sectors. The group has significantly contributed to the city’s goal of becoming the economic center of the northern sea, with its diverse range of projects and developments.

July CPI Rises 0.11% Month-Over-Month

According to the latest data released by the Statistics Bureau, the consumer price index (CPI) rose 0.11% in July from the previous month, primarily due to increases in housing maintenance material prices, food prices, and dining out. The CPI for July increased by 2.13% compared to December 2024, and by 3.19% year-on-year. On average, in the first seven months of 2025, the CPI rose by 3.26% year-on-year, with core inflation up by 3.18%.