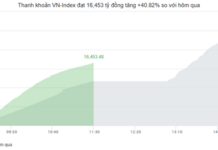

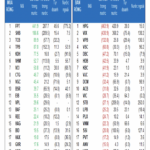

A sharp uptick in the last 30 minutes of this morning’s session brought the VN-Index back to just below yesterday’s peak before an unexpected sell-off. The main difference was that the HoSE liquidity decreased by 42% compared to yesterday morning, reaching its lowest level in nine sessions.

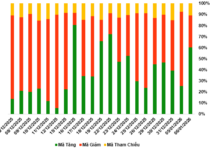

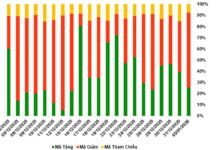

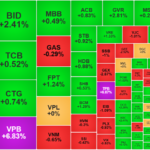

This late-session surge did not have a clear spread: The breadth indicator at 11:00 AM showed 200 gainers and 100 losers, and at the closing bell, it stood at 224 gainers and 85 losers. This suggests that the stock price increases were primarily driven by stocks that were already in positive territory. Additionally, the index’s rise was mainly due to the recovery of VIC and VHM.

Overall, TCB rose 3.51%, CTG 2.69%, VCB 1.3%, HPG 2.84%, and BID 1.94%, remaining the main pillars and contributing approximately 7.8 points to the VN-Index’s total gain of 20.99 points. However, VIC and VHM had a significant impact on the index’s more than 11-point gain in the last 30 minutes.

At 11:00 AM, VIC was still near its intraday low, down nearly 2% from the reference price. In the final 30 minutes, VIC recovered rapidly and returned to the reference price about a minute before the midday break. VHM, which had been down 2.9%, also rebounded to the reference price. Thus, while VIC and VHM did not contribute any points at the morning closing, they pulled the index up in the last 30 minutes and fueled its steep climb, rising 2% and 2.9%, respectively. Other pillars like TCB, VCB, and HPG saw minimal changes during this period.

Most large-cap stocks traded well this morning, except for VIC and VHM, which were weak. The VN30-Index closed up 1.68% with 25 gainers and 2 losers, mainly driven by banks and several large-cap stocks such as HPG, MWG, and MSN. However, these stocks also remained largely unchanged in the last 30 minutes, except for VIC and VHM, which surged. Yesterday’s scorching rally in the afternoon was also largely due to the synergy between VIC, VHM, and other pillars.

FPT, down 0.76%, and VRE, down 1.94%, were the only two losers in the VN30 basket. Twenty-three other stocks in the basket rose by more than 1%. Many bank stocks gained over 2%, including TPB, TCB, ACB, CTG, MBB, SSB, STB, HDB, and SHB. This strong foundation helped sustain the VN-Index’s upward momentum. Interestingly, the vast majority of stocks in the basket failed to hold their intraday highs, even though both the VN30-Index and VN-Index closed at their highs. This further highlights the influence of VIC and VHM, which were pulled up sharply in the last 30 minutes and closed at the morning’s high, despite ending flat.

With a strong breadth throughout the morning, the market generally witnessed a positive rebound after yesterday’s shock. Among the 224 gainers in the VN-Index, 136 rose by more than 1%. This group accounted for 74.2% of the total trading value on the HoSE. This confirms the presence of active buying interest in the green zone. Midcap and small-cap stocks also saw many strong performers, with DCM and ANV hitting their daily limit-up prices with high liquidity of VND 511.4 billion and VND 168.9 billion, respectively. Additionally, DPM, VCI, VSC, HCM, DGW, BSR, and EVF all recorded liquidity above VND 200 billion with impressive gains.

Among the decliners, trading was mostly concentrated in a few stocks: HHS fell 2.56%, VGC 1.1%, VRE 1.94%, HAX 1.94%, SCR 1.6%, and AGG 1.77%. These were the few stocks that saw liquidity above VND 10 billion and experienced significant price drops, indicating genuine selling pressure in the lower range. The rest had sparse trading of just a few dozen million dong, with negligible price movements.

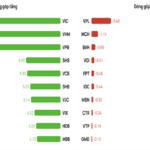

Foreign investors, after turning to net buyers in the afternoon session yesterday (net selling large via negotiated deals), maintained a balanced position today, with a net buy of about VND 63.6 billion on the HoSE. A notable large sell-off occurred in FPT, with a net sell of VND 376.7 billion. This block accounted for nearly 71% of FPT’s total trading volume, and the sale was executed through matching transactions. This selling pressure prevented FPT from rising. In addition to FPT, a few other stocks experienced significant net selling, including VCI (VND 57.2 billion), MSN (VND 42.2 billion), VHM (VND 40.2 billion), and CII (VND 30.5 billion). On the buying side, notable net buys were seen in STB (VND 135.1 billion), DCM (VND 84.9 billion), DPM (VND 75.3 billion), VSC (VND 50.1 billion), TPB (VND 50.1 billion), MWG (VND 45.7 billion), and VPB (VND 45 billion). These bought stocks all witnessed strong gains.

Today’s recovery indicates that the market has shaken off the psychological impact of yesterday’s shock. However, for most of the morning, prices moved sideways. Most stocks hit their intraday highs before 11:00 AM, before the surge in VIC and VHM. In fact, only 15.2% of the stocks in the VN-Index that saw trading today are above their reference prices and closed at their intraday highs, despite the index ending at its peak.

The Tactful Turnaround: When Foreign Investors Go Against the Tide

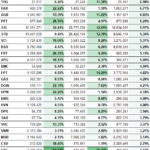

Foreign investors returned to net buying on August 6, with a net purchase value of VND 754.4 billion, of which VND 358.9 billion was net bought in matched orders alone.

“Undervalued Bank Stocks with Positive Growth Prospects Attract Cash Flow”

“In the past 1-3 months, a select few bank stocks have witnessed an impressive surge, with gains of several dozen percentage points. These stocks share common traits: they boast low to medium price-to-book ratios compared to the industry average, demonstrate improved financial indicators, and possess unique catalysts that set them apart. These factors have likely contributed to their outstanding performance, catching the eye of discerning investors.”