At the regular Government meeting for July 2025 on August 7, 2025, Ms. Nguyen Thi Hong, Governor of the State Bank of Vietnam, reported that credit across the system in the first seven months of the year increased by about 10% compared to the end of 2024, a significant rise compared to the same period last year (6%).

Regarding concerns about the high growth rate of credit in the real estate and securities sectors compared to the overall average, Governor Nguyen Thi Hong analyzed that the credit growth rate in these two sectors reflects the reality of the market, especially in real estate, as capital demand increases again when many projects are unblocked legally.

“The flow of capital into the real estate sector is inevitable as the market recovers, but the State Bank will not loosen control,” Ms. Hong emphasized.

“The VND/USD exchange rate has increased by 2.9% compared to the end of 2024 due to the dual impact of the international economic situation and market psychology. If exchange rate pressure continues to increase, the State Bank may not further lower interest rates to maintain macro stability. Regarding inflation, although the average rate is 3.6%, core inflation is rising due to input costs (electricity, healthcare, housing). Inflation is rising rapidly, but reducing it is very challenging, so we need to proactively, actively, and cautiously manage policies.”

Ms. Nguyen Thi Hong, Governor of the State Bank of Vietnam

Regarding the securities sector, although credit growth in this sector was recorded, the Governor affirmed that the outstanding balance in this sector accounts for only about 1.5% of the total outstanding balance, which does not pose a risk to the banking system.

To ensure the safety of the system, the State Bank continues to tightly control the ratio of short-term capital use for medium and long-term loans: “Currently, this ratio is still below the 30% threshold as prescribed. At the same time, we require credit institutions to balance capital by term to ensure a healthy cash flow,” said the Governor.

In the context of the economy’s continued recovery but with many uncertainties from the international environment, the State Bank has operated the interest rate policy towards supporting production and business. According to Governor Nguyen Thi Hong, the lending interest rate level in the first seven months of the year decreased by about 0.4 percentage points compared to the end of 2024.

Total means of payment increased by 7.5% compared to the end of 2024, nearly doubling the increase in the same period last year. According to the Governor’s explanation, this high increase is mainly due to the implementation of projects to restructure the banking system by the State Bank, especially special lending to serve the transfer of banks subject to compulsory purchase.

In addition, the State Bank’s use of the open market operation tool to inject short-term money is aimed at supporting liquidity for the credit institution system, helping to expand credit while maintaining a stable interest rate level. This is particularly important in the context of the Government’s requirement to stabilize interest rates to support production and business, even though credit is on the rise.

However, the Governor said that the room for interest rate reduction may be narrowed due to increasing pressure on the exchange rate. As of the end of July, the VND/USD exchange rate had increased by 2.9% compared to the end of last year, a consequence of complex developments in the international market, including countervailing tax policies from the US.

The Governor emphasized that if the pressure on the exchange rate continues to increase, the State Bank will consider not lowering interest rates further to avoid causing macro imbalances. Exchange rate stability is a key factor in ensuring confidence in the domestic currency and the safety of the financial system.

The Governor also pointed out that although average inflation is being controlled at 3.6%, below the National Assembly’s target of 4.5-5%, core inflation tends to increase due to rising input costs (electricity, healthcare, housing, etc.). This is a signal that cannot be subjective.

“Inflation, when it occurs, is very rapid, but bringing it down is a very difficult process. Therefore, monetary policy needs to be proactively, flexibly, but cautiously managed, closely following actual developments,” shared Governor Nguyen Thi Hong.

The head of the banking industry also said that to achieve sustainable growth, it is necessary to develop capital mobilization channels suitable to the characteristics of each field. For sectors such as real estate and infrastructure – which require medium and long-term capital, it is recommended to mobilize capital through channels such as corporate bonds, local government bonds, or international loans, instead of relying too much on short-term bank credit.

“Only by mobilizing capital through the right channels and in the right nature can we achieve both high growth and stable sustainability,” she emphasized.

In addition, the State Bank proposed expanding the credit guarantee program for small and medium-sized enterprises (SMEs) to create favorable conditions for this sector to access capital effectively through the State’s guarantee mechanism.

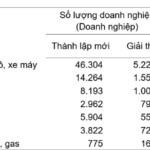

The Contrasting Shades of the 2025 Corporate Landscape

The business landscape in the first seven months of the year presented a picture of stark contrasts. While there was a notable increase in new business formations and a resurgence of previously dormant enterprises, the number of businesses exiting the market also raised warning signs of significant challenges ahead.

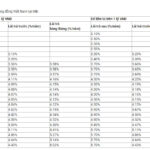

The Ultimate Guide to MB Bank’s Interest Rates: Maximizing Your Returns with the 24-Month Term Deposit

As of August 2025, Military Bank (MB) offers a competitive interest rate of up to 5.8% p.a. for personal savings accounts with a tenure of 24 months or more in the Central and Southern regions of the country. Customers in other regions can also enjoy attractive interest rates, with the highest rate being 5.7% p.a.

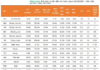

The Consensus Among Banks: Maintaining Stable Interest Rates for Sustainable Growth

As of early 2025, banks have been actively implementing directives from the government and the State Bank to maintain stable interest rates. These efforts have been instrumental in promoting credit growth and providing much-needed support to businesses and individuals alike.

Gold Prices Maintain Uptrend Amid Fed Rate Cut Expectations

The price of gold surged on Friday after a disappointing jobs report from the U.S. Labor Department. The report, which fell short of expectations, revealed a sluggish jobs market with a mere 132,000 non-farm jobs added in July. This prompted a rush to safe-haven assets, with gold leading the charge.