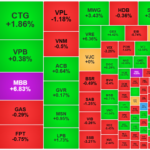

There are strong indications of capital flow towards speculative opportunities, while the blue-chip group is experiencing a divergence. If VCB, VIC, and VHM had not been restrained today, VNI or VN30 could have further stimulated market sentiment.

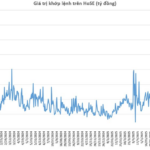

Although VNI has not yet broken out of the wide range from August 5th, this is merely a technical issue. The index is pressured by a few large-cap stocks, while most stocks are performing well. Notably, the strong cash flow shows no signs of slowing down, with matching liquidity on HSX and HNX still above 44.1k billion, excluding negotiated deals.

The ability to maintain high liquidity and capital rotation among stocks/groups of stocks keeps the “party” going. In fact, many “delicious” stocks are being served to investors, creating tremendous pressure on those who are cautious and have largely exited or are holding cash.

A positive aspect today is that the cash flow is not influenced by the large-cap stock group. For most of the day, VNI hovered around the reference price, even turning red at times, but the breadth and intensity of the increase in penny and mid-cap codes remained stable. Perhaps the recent shakes have reinforced the psychology of “the tighter the hold, the greater the profit.” The extremely large-scale distribution sessions that failed to bring down the market serve as a strong psychological foundation.

As long as profit-taking money flows back into buying, new money continue to pour in, and margin levels remain high, this dynamic is unlikely to change. Stocks that have already heated up may get even hotter, and there are always reasons to continue rising. In the past, such “super stocks” were not uncommon. The market is “playing” with investors’ psychology, creating a sense that staying out is a mistake and constantly stimulating greed.

With the divergence in the blue-chip group, it is likely that VNI will continue to trade within a range but with speculative stocks performing very well. Even though the index is not strong, it is sufficient to create a peaceful environment for speculation. Depending on one’s risk appetite, taking bold bets can still lead to wins, but entering stocks that have already risen by several tens of percent carries a high risk of short-term peak-chasing. To relieve the feeling of repression and dissonance, consider risking only a small portion of your capital.

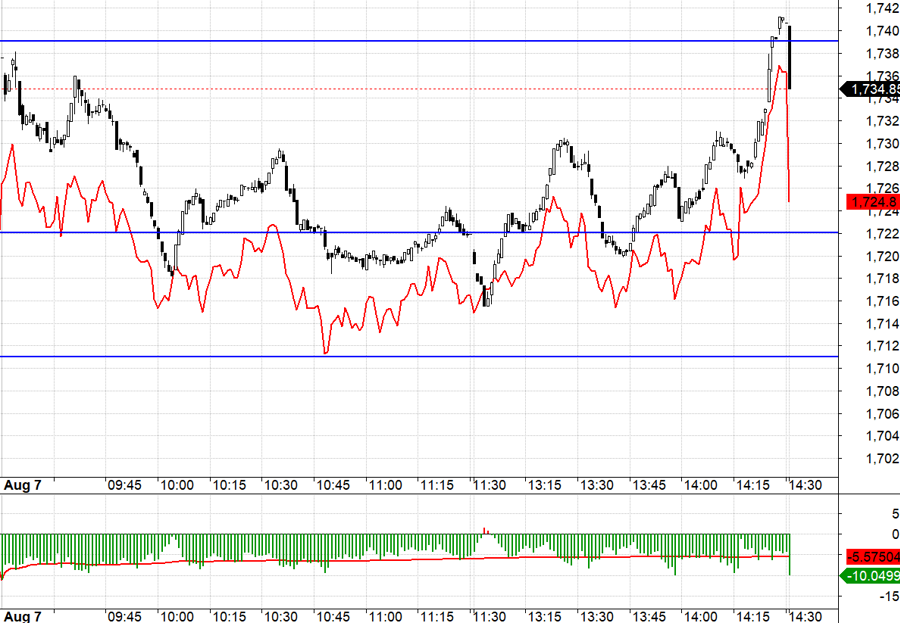

The derivatives market today was influenced by the large caps and fluctuated quite uncomfortably. As soon as the session opened, VN30 jumped into an extremely wide range from 1722.xx to 1739.xx. Basis F1 has been discounting more than 8 points from the start, so going Short was not an option. There was also a significant peak-finding psychology, causing F1 to react slower than VN30 in the rising momentum, and the large caps oscillated today, making the Long points inefficient when VN30 rebounded above 1722.xx due to a lack of momentum. Only the upward momentum in the second half of the afternoon session forced the Short side to cut losses.

F1 closing with a discount of more than 10 points is a new signal. This is likely a response to the divergence and risks within the blue-chip group rather than the overall market. Unless the large caps cause a significant drop in the index, it is unlikely to affect the potential of speculative stocks. The strategy remains to take Long/Short positions with derivatives.

VN30 closed at 1734.85. The nearest resistance for the next session is 1742; 1755; 1765; 1771; 1783. Supports are at 1732; 1723; 1711; 1703; 1695; 1681.

“Blog Securities” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, assessments, and investment opinions are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and investment opinions.

‘The ‘Wave’ of Soaring Asset Prices: A Restlessness Among Many

“As the economy flourishes, the value of assets surges across various investment avenues such as stocks, gold, and real estate. However, experts advise investors to cautiously devise a financial strategy that suits their needs and refrain from succumbing to FOMO (fear of missing out).”

The Shocking Rise and Fall: VN-Index Sets New Turnover Records, But For How Long?

The market took an unexpected turn this afternoon, catching investors off-guard. As the VN-Index soared to a 3.72% gain, a sudden wave of selling hit, sending the index plunging. In just under 30 minutes, the index dropped 0.6%, resulting in a staggering 4.34% swing. Today’s trading volume on the HoSE exchange surged to a new record high of 72,841 billion VND, surpassing the previous record set on July 29.