Hai Phat Investment Joint Stock Company (coded HPX on HoSE) announces the Board of Directors’ resolution to convert its receivables into shares issued by Hoang Quan Real Estate Consulting – Trading – Services Joint Stock Company (coded HQC on HoSE)

Accordingly, HPX will convert HQC’s debt of VND 212 billion into 21.2 million HQC shares at VND 10,000/share and authorize the Chairman of Hai Phat Investment’s Board of Directors to decide on the timing of the conversion. The converted shares will be restricted from transfer for 1 year from the date of issuance.

At the closing price on August 1, HQC shares traded at VND 3,800/share, corresponding to a market value of VND 80.56 billion for 21.2 million HQC shares. At the closing price on August 4, the share price increased by 3.95% to VND 3,950/share.

Thus, if the conversion is successful, based on the current market price, Hai Phat Investment will immediately incur a loss of 62% compared to the debt value, equivalent to VND 131.44 billion.

Previously, HQC shareholders officially approved the plan to issue 50 million private placement shares to convert debt worth up to VND 500 billion. The list includes four creditors, including HQC’s debt of VND 212 billion to HPX, which will be converted into 21.2 million shares, equivalent to 3.383% ownership after issuance.

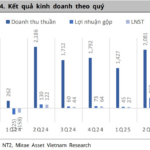

In the second quarter of 2025, HQC recorded after-tax profit of nearly VND 4.9 billion, down 54% over the same period (VND 10.6 billion). This was due to a decrease in revenue as some customers were unable to make payments for subsequent installments. The company agreed to accept the cancellation and return of goods to resell to other customers at higher prices.

For the first six months of 2025, HQC’s revenue reached VND 38.1 billion, up 4.6% over the same period (VND 36.43 billion), and after-tax profit attained VND 10.06 billion, down 34.9% over the same period (VND 15.46 billion)

In 2025, HQC plans to achieve a revenue of VND 1,000 billion, up 189.3% compared to 2024’s performance, and an after-tax profit of VND 70 billion, up 107.1% compared to 2024.

Thus, with an after-tax profit of VND 10.06 billion, Hoang Quan Real Estate has accomplished only 14.4% of its 2025 profit plan.

A Surprise Sell-Out: Bank Stock Soars Ahead of August’s Cash Dividend Payout

The stock market is buzzing with excitement as share prices soar to new heights. Investors are eagerly snapping up stocks, with buy orders piling up at the max price. It’s a thrilling time for those in the know, as the market surges with energy and potential profits.

“HPX Swaps HQC Shares – A Move to Recover Outstanding Debt”

The real estate market is witnessing a gradual recovery from its slump, and the debt swap agreement between Hai Phat Investment Joint Stock Company (HPX) and Hoang Quan Trading Services Real Estate Consultancy Joint Stock Company (HQC) is a testament to their proactive financial restructuring efforts. This bold move showcases their commitment to sharing growth opportunities and navigating through challenging economic times.

The Green Airport: CEO Group’s Profitable Venture into Industrial Park Development

“CEO Group reports a doubling of profits for the second quarter of 2025, attributed to successful cost-cutting measures. The Group’s quarterly profits soared to 39 billion VND. During this period, CEO Group also invested 50.5 billion VND in its newly established subsidiary, which has a charter capital of 450 billion VND.”

The Summer Heatwave’s Silver Lining: A Surprise 910% Profit Spike for the “Money-Printing Machine”

In the first half of the year, this company witnessed an astounding 910% surge in business, surpassing its annual profit plan by 30%.