According to the socio-economic report for the second quarter and the first half of 2025, released by the General Statistics Office (Ministry of Finance) on July 5, 2025, the consumer price index (CPI) in June 2025 increased by 0.48% compared to the previous month, mainly due to the rise in the prices of housing maintenance materials, especially sand, stones, and bricks, as well as the surge in global fuel prices.

CPI in June 2025 rose by 2.02% compared to December 2024 and by 3.57% from the same period last year. The average CPI in the second quarter of 2025 increased by 3.31% year-on-year. For the first six months of 2025, CPI climbed by 3.27% compared to the same period in 2024, while core inflation rose by 3.16%.

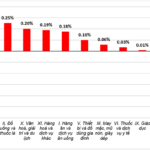

Out of the 0.48% rise in CPI for June 2025, 10 groups of goods and services witnessed an increase in their price index. The transportation group recorded the highest surge of 1.66%, contributing to a 0.16 percentage point rise in the overall CPI.

Specifically, the price index for diesel oil rose by 5.37%, while gasoline increased by 4.12% due to domestic price adjustments following global fuel market trends. Additionally, railway transport prices climbed by 5.15% as a result of heightened travel demand during the summer holidays, and luggage handling services witnessed a 0.55% price hike.

The second-highest price increase was observed in the housing, electricity, water, fuel, and building materials group, which rose by 1.42%, contributing to a 0.27 percentage point increase in overall CPI. This was mainly driven by price hikes in certain items: Housing maintenance materials increased by 2.93% due to soaring brick, sand, and stone prices, attributed to scarce supply, elevated production and transportation costs, and high construction demand.

According to the General Statistics Office, the average CPI for the second quarter of 2025 rose by 3.31% compared to the same period last year. Specifically, medicine and healthcare services increased by 13.35%; other goods and services by 6.57%; housing, electricity, water, fuel, and building materials by 6.35%; and food and catering services by 3.60%.

The average CPI for the first six months of 2025 rose by 3.27% year-on-year. This increase was driven by a 3.69% rise in the food and catering services group, contributing to a 1.24 percentage point increase in overall CPI. Within this group, the price index for pork surged by 12.75% due to limited supply and high consumer demand during holidays and festivals, leading to a 0.43 percentage point rise in CPI. Additionally, food prices increased by 4.15%.

The housing, electricity, water, fuel, and building materials group witnessed a 5.73% rise in its price index, contributing to a 1.08 percentage point increase in CPI. This was influenced by rising rental prices and housing maintenance costs. Within this group, the price index for electricity climbed by 5.51% due to increased electricity demand, coupled with EVN’s adjustment of retail electricity prices on October 11, 2024, and May 10, 2025, resulting in a 0.18 percentage point rise in CPI.

The price index for medicine and healthcare services increased by 13.87%, contributing to a 0.75 percentage point rise in CPI. This was due to adjustments in healthcare service prices according to Circular No. 21/2024/TT-BYT dated October 17, 2024, issued by the Ministry of Health.

According to the General Statistics Office, core inflation for the second quarter of 2025 rose by 3.16%. Factors that helped curb CPI growth in the first six months of 2025 include a 3.63% decline in the transportation group’s price index, which lowered overall CPI by 0.35 percentage points. This was influenced by a 12.56% drop in fuel prices. Additionally, the price index for postal and telecommunication services decreased by 0.45%, leading to a 0.01 percentage point drop in CPI due to reduced prices for older-generation mobile phones.

Core inflation in June 2025 increased by 0.31% compared to the previous month and by 3.46% from the same period last year. For the first six months of 2025, core inflation rose by 3.16% year-on-year, slightly lower than the overall CPI increase of 3.27%. This was mainly due to the exclusion of food, electricity, and healthcare services from the core inflation calculation, as these items witnessed significant price hikes.

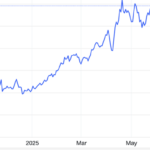

As of June 28, 2025, the average global gold price stood at 3,369.73 USD/ounce, marking a 1.93% increase compared to May 2025. The surge in gold prices during this period can be attributed to a combination of factors, including geopolitical tensions in the Middle East, increased buying from central banks and gold investment funds, and speculative demand.

Domestically, gold prices in June 2025 decreased by 1.27% compared to the previous month, while posting a 48.01% year-on-year increase. Gold prices also rose by 33.54% compared to December 2024, with the average price for the second quarter of 2025 surging by 43.62% year-on-year. For the first six months of 2025, gold prices witnessed a significant increase of 37.4% compared to the same period last year.

The movement of domestic gold prices contrasted with global trends due to the already high domestic gold prices and the persistent price gap between domestic and global gold markets. Additionally, the State Bank of Vietnam is in the process of finalizing amendments to Decree No. 24/2012/NĐ-CP on gold business management, aiming to abolish the monopoly on gold bar production and trading.

The US dollar index, on the other hand, moved in the opposite direction of global trends. As of June 28, 2025, the US dollar index stood at 98.6 points, reflecting a 1.34% decrease compared to the previous month. This decline can be attributed to investors’ expectations of an imminent interest rate cut by the Federal Reserve in July 2025, coupled with concerns about potential political influence on monetary policy, prompting a shift in capital flows to more attractive investment channels.

In the domestic market, the US dollar index for June 2025 increased by 0.32% compared to the previous month due to higher import payment demands. It also rose by 3.06% year-on-year, 2.92% compared to December 2024, and posted an average increase of 2.98% for the second quarter of 2025. For the first six months of 2025, the US dollar index climbed by 3.3% compared to the same period last year.

9 Commodity Groups and Services that Increased CPI by 0.11% in July

The housing, utilities, fuel, and construction materials group witnessed the highest increase, with a 0.36% surge, contributing to a 0.07 percentage point rise in the overall CPI.

Gold Prices Maintain Uptrend Amid Fed Rate Cut Expectations

The price of gold surged on Friday after a disappointing jobs report from the U.S. Labor Department. The report, which fell short of expectations, revealed a sluggish jobs market with a mere 132,000 non-farm jobs added in July. This prompted a rush to safe-haven assets, with gold leading the charge.

The CPI for the first seven months is estimated to increase by 3.2-3.3%.

The Ministry of Finance reports that the consumer price index (CPI) for the first seven months of the year is estimated to have increased by 3.2-3.3% compared to the same period last year. This is an appropriate level that supports economic growth, especially as resources are being focused on achieving the highest possible economic expansion. Vietnam’s inflation is being carefully managed within the target range set by the National Assembly and the Government of 4.5-5%, contributing to macroeconomic stability.