According to the latest statistics from the General Statistics Office (Ministry of Finance), there were 174,000 new and returning businesses in the first seven months of 2025, a 22.9% increase compared to the same period in 2024. This indicates that businesses remain optimistic about existing opportunities, despite the challenges posed by the global economic landscape.

Of these 174,000 businesses, 107,700 were newly registered with a total capital of VND 928.4 trillion, representing a 10.6% increase in quantity and a 5.5% increase in capital compared to the previous year.

Notably, the additional capital injected into the economy during this period surged by 93.7%, totaling over VND 3,300 billion. This signifies that both new and existing businesses are actively investing and expanding their operations, reflecting their confidence in the economic recovery.

The National Business Registration System recorded an increase in additional capital from operating enterprises in the first seven months of 2025, amounting to more than VND 2,400 billion, nearly 2.9 times higher than the same period in 2024.

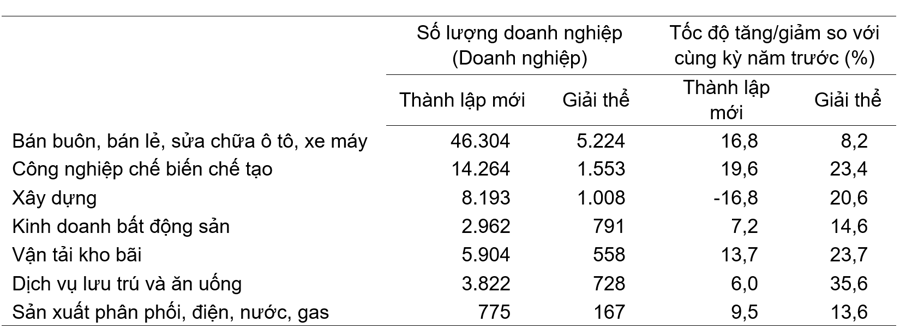

In terms of sector breakdown, the service industry remains the primary driver, with 83,200 new businesses, a 13.1% increase. Wholesale, retail, and manufacturing industries also exhibited robust growth, at 16.8% and 19.6%, respectively, indicating the resilience of the economy’s pillars.

However, the less optimistic aspect of the business landscape during this period is reflected in the number of businesses exiting the market and a slowdown in new business registrations in July 2025. Compared to June 2025, the number of new businesses in July decreased by 32.3%, and registered capital also dropped by 33.6%. The average registered capital per enterprise stood at VND 7.1 billion, a 15.6% decrease compared to the previous year, indicating a trend towards smaller-scale startups.

This slowdown coincides with a persistent high number of businesses exiting the market. In the first seven months, 144,400 businesses had to temporarily cease operations, undergo dissolution procedures, or complete dissolution. On average, 20,600 businesses per month were forced to exit the market, nearly equaling the number of new entrants. This creates a delicate balance and highlights the challenging business environment.

Of the 144,400 businesses that left the market, the number of enterprises temporarily ceasing operations with a time limit increased by 13.6% (88,600 enterprises), those temporarily ceasing operations awaiting dissolution procedures increased by 16.7% (41,500 enterprises), and those completing dissolution procedures surged by 20.5% compared to the same period last year (14,300 enterprises). These figures reflect the challenges businesses face regarding competition, input costs, and shifting market demands.

A closer look at specific industries reveals a clear differentiation in performance.

The construction industry is facing significant challenges, with a 16.8% decrease in new businesses compared to the previous year. In contrast, the manufacturing industry demonstrates resilience with a 19.6% increase in new enterprises.

Even in seemingly vibrant sectors like accommodation and food services, the dissolution rate soared to 35.6%, underscoring the intense competition and high turnover within these industries.

The Ultimate Lifestyle Choice for the Discerning Achiever

In the midst of a booming second-home market in Northern and Central Vietnam, riverfront property Aquamarine in Dien Chau, Nghe An is emerging as the choice for discerning individuals seeking a ‘second home’. This exclusive development offers a unique blend of work and vacation, attracting those who desire a balanced lifestyle without compromising on financial stability.

“Land Prices Soar Post-Merger in This Region”

The newly-merged provinces of Ho Chi Minh City, such as Ba Ria-Vung Tau, are witnessing a steady rise in land prices.

Tokenizing Real-World Assets: Dragon Capital Proposes Pilot with ETFs

The Vietnamese economy has witnessed remarkable growth over the past few decades, resulting in a significant increase in household wealth and a heightened demand for more diverse investment options. Notably, digital assets have captured the interest of individual investors seeking to diversify their portfolios and embrace higher risk to maximize their wealth.