Gold prices fluctuate with mixed sentiment in the market.

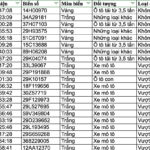

Two prominent jewelry companies, Saigon Jewelry Company (SJC) and PNJ, simultaneously increased their gold bar purchase price by 200,000 VND per tael while maintaining the selling price. Currently, both companies offer gold bars at 122.4 – 123.8 million VND per tael (buy-sell).

Regarding gold rings, PNJ maintains its price at 117.5 – 120 million VND per tael, while SJC stays at 116.8 – 119.3 million VND per tael.

Other renowned brands, such as Bao Tin Minh Chau and DOJI, have not made any adjustments to their gold ring prices compared to the previous day. Bao Tin Minh Chau’s gold rings remain at 117.8 – 120.8 million VND per tael, while DOJI holds steady at 110 – 111 million VND per tael.

The gold bar prices at these two companies also remain unchanged, currently trading at 122.2 – 123.8 million VND per tael.

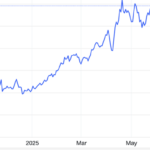

In the international market, spot gold prices are recorded at the level of 3,378 USD per ounce, an increase of nearly 11 USD from the previous trading session’s close.

As of midday trading on Wednesday (US time), gold prices were largely range-bound. Profit-taking pressure that emerged at the start of the session was quickly absorbed by bottom-fishing buying interest, reflecting sustained buying sentiment during price corrections. However, improved risk appetite in the broader financial markets this week has somewhat capped the upside for the safe-haven metals, gold, and silver.

On the Comex, the December gold contract edged up by 0.60 USD to settle at 3,435.50 USD per ounce. According to Kitco News, gold bar inventories in warehouses affiliated with the Shanghai Futures Exchange (SHFE) have risen to a record high, indicating robust gold demand in China.

Currently, over 36 tons of gold are registered for delivery against futures contracts as investors and banks take advantage of the price spread between the spot and futures markets.

Mr. John Reade, a senior strategist at the World Gold Council (WGC), commented: “This demonstrates strong gold buying in China, particularly the surge in arbitrage due to increased futures demand.”

Financial institutions have been purchasing physical gold at lower prices in the spot market and then delivering it into the exchange’s warehouses to fulfill futures contracts, thereby locking in spread profits.

Technically, the December gold contract maintains a positive short-term outlook. The next target for bulls is to close above the strong resistance level of July’s peak: 3,509 USD per ounce. Conversely, bears will seek to push prices below the solid technical support level of 3,300 USD per ounce.

The Price of Gold Soars on Wednesday Evening, Defying Predictions of an Imminent Stock Market Downturn.

The dip in the US stock market has bolstered safe-haven metals like gold and silver. This dip presented an opportunity for investors to snap up bargains in the precious metals space, following a downward correction.

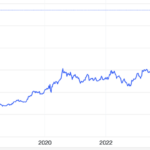

Gold Prices Maintain Uptrend Amid Fed Rate Cut Expectations

The price of gold surged on Friday after a disappointing jobs report from the U.S. Labor Department. The report, which fell short of expectations, revealed a sluggish jobs market with a mere 132,000 non-farm jobs added in July. This prompted a rush to safe-haven assets, with gold leading the charge.

The Golden Boom: Gold Prices Soar as US Dollar Plunges Post-US Jobs Report

“Gold prices surged to a one-week high during Friday’s session. This upward momentum was driven by a worse-than-expected non-farm payrolls report, which painted a grim picture of the labor market’s health.”