In the afternoon, Saigon Jewelry Company increased the price of SJC gold bars by VND 500,000 per tael compared to the morning session, reaching VND 122 – 123.8 million per tael. This price is VND 200,000 lower than the historical peak reached on April 22nd.

Bao Tin Minh Chau JSC, Phu Quy Jewelry Group, PNJ, and state-owned banks also raised the price of SJC gold bars to VND 123.8 million per tael.

The price of gold rings followed the upward trend of gold bars. Specifically, Phu Quy Jewelry Group listed the price of gold rings at VND 116.7 – 119.7 million per tael, an increase of VND 700,000 per tael compared to the morning session.

SJC gold bar price approaches historical peak.

Bao Tin Minh Chau JSC listed the price of gold rings at VND 117.8 – 120.8 million per tael, an increase of VND 600,000 per tael…

Recently, the State Bank of Vietnam responded to a proposal by voters in An Giang province regarding the control of the gap between domestic and international gold prices, the situation of gold price fluctuations, and the behavior of speculation, hoarding, and market manipulation.

According to the State Bank, Vietnam is not a gold-mining country, so the domestic gold supply mainly depends on imports. Therefore, domestic gold prices are influenced by fluctuations in world gold prices.

The agency also stated that according to the Law on Prices of 2012 and the amended Law on Prices of 2023, gold is not classified as an essential commodity and does not fall under the category of goods and services subject to price stabilization. The State Bank only intervenes in the gold market when gold price fluctuations negatively affect the foreign exchange market, exchange rates, or monetary policy.

Regarding the policy on gold market management, the State Bank has coordinated with ministries and sectors to evaluate and summarize Decree 24/2012 on gold business management.

Based on the evaluation results, the agency submitted to the Prime Minister the orientation for amendment to enhance the effectiveness and sustainability of gold market management. Currently, the Draft Amended Decree 24 is being appraised by the Ministry of Justice.

In terms of inspecting and supervising gold business activities, the State Bank has coordinated with the Ministry of Public Security, the Government Inspectorate, the Ministry of Finance, and the Ministry of Industry and Trade to inspect compliance with legal regulations.

On May 30, the agency announced the conclusion of an inter-sector inspection of six enterprises and banks that account for more than 90% of the gold bar market share. The State Bank also directed its local branches to coordinate closely with functional forces to inspect and supervise gold business activities in their localities.

The State Bank affirmed that it would continue to strengthen inspections and examinations of the gold market in the coming time to ensure the transparency and efficiency of the market, as well as strictly handle speculative and manipulative behaviors.

“Central Bank Meets with Commercial Banks to Discuss Interest Rates”

The State Bank of Vietnam (SBV) has instructed credit institutions to follow the directives of the Government, the Prime Minister, and the SBV itself by maintaining stability in deposit interest rates. Institutions are also encouraged to further streamline operating expenses, embrace digital transformation, and be prepared to share a portion of their profits to reduce lending rates, demonstrating a commitment to supporting the broader economic landscape.

The Price of Gold Today, August 3rd: A Rare Prediction for Gold’s Week Ahead

For the first time, an overwhelming 94% of experts surveyed predict a continued rise in gold prices in the international market today.

DongA Bank: A Troubled Institution’s Forcible Handover and the End of Shareholder Power?

Prior to being placed under special control, DongA Bank’s institutional shareholders included: Bac Nam 79 Construction, owned by Vu “Nhom”, which held 10%; PNJ with 7.7% of the charter capital; Ho Chi Minh City Party Committee Office with 6.9%; Ky Hoa Tourism and Trading with 3.78%; An Binh Capital with 2.73%; and Nha Phu Nhuan with 2.14%.

“State Representative Nguyen Thanh Tung: Guardian of Vietcombank’s 30% State-Owned Capital”

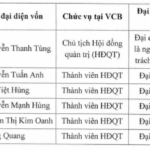

On January 10, 2025, the State Bank of Vietnam (SBV) appointed a representative to manage the state capital at Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank, HOSE: VCB).