The manufacturing industry maintains its growth momentum

|

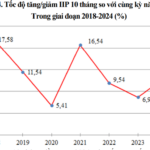

The industrial production index (IPI) in July is estimated to increase by 0.5% month-on-month and 8.5% year-on-year. Among the sectors, water supply, waste management, and sewage treatment activities increased by 9.1% year-on-year; manufacturing increased by 9.3%; electricity production and distribution increased by 7.0%; and mining increased by 2.6%.

For the first seven months of 2025, the IPI is estimated to increase by 8.6% year-on-year (compared to an increase of 8.5% in the same period of 2024). During this period, manufacturing increased by 10.3% (compared to an increase of 9.6% in the same period of 2024), contributing 8.5 percentage points to the overall growth; electricity production and distribution increased by 4.6% (compared to an increase of 12.0% in the same period of 2024), contributing 0.4 percentage points; water supply, waste management, and sewage treatment activities increased by 10.4% (compared to an increase of 7.1% in the same period of 2024), contributing 0.1 percentage points; mining decreased by 2.7% (compared to a decrease of 6.6% in the same period of 2024), resulting in a reduction of 0.4 percentage points.

The IPI for the first seven months of 2025 showed an increase in key secondary industries compared to the same period last year: Motor vehicle production increased by 29.9%; rubber and plastic products increased by 16.9%; leather and related products increased by 15.4%; other non-metallic mineral products increased by 14.8%; garment production increased by 14.5%; other transport equipment increased by 12.2%; fabricated metal products (excluding machinery and equipment) increased by 11.0%; furniture production increased by 10.9%; metal production increased by 10.1%; food processing increased by 10.0%; and electronic products, computers, and optical products increased by 7.9%.

On the other hand, some industries showed low growth or decline: Beverage production increased by 3.1%; electrical equipment manufacturing increased by 3.0%; crude oil and natural gas extraction decreased by 8.1%; and pharmaceutical, chemical, and medicinal products decreased by 4.9%.

The IPI for the first seven months of 2025 increased in all 34 localities compared to the same period last year. Some localities achieved significant growth thanks to the strong performance of the manufacturing industry and the electricity production and distribution sector. Conversely, some localities experienced low growth due to the underperformance of the manufacturing industry, mining sector, and electricity production and distribution sector.

Several key industrial products during the first seven months of 2025 showed an increase compared to the same period last year: Automobiles increased by 64.4%; televisions increased by 21.1%; NPK compound fertilizer increased by 19.7%; ready-to-wear garments increased by 14.9%; cement increased by 14.8%; leather shoes and sandals increased by 13.6%; aquatic feed increased by 11.9%; rolled steel increased by 11.5%; liquefied petroleum gas (LPG) increased by 11.4%; steel bars and angles increased by 11.0%; and refined sugar increased by 10.4%. Conversely, some products decreased compared to the same period last year: Natural gas in gaseous form decreased by 12.9%; synthetic fiber fabrics decreased by 5.2%; crude oil decreased by 3.1%; and mobile phones decreased by 0.4%.

The number of employees in industrial enterprises as of July 1, 2025, increased by 1.0% compared to the previous month and by 3.9% compared to the same period last year. State-owned enterprises showed a corresponding increase of 0.5% compared to the previous month and the same period last year; foreign-invested enterprises increased by 1.2% and 4.6%, respectively; and non-state enterprises increased by 0.6% and 2.7%, respectively.

By sector, the number of employees in mining and quarrying enterprises increased by 1.2% compared to the previous month and by 1.6% compared to the same period last year; the number of employees in manufacturing enterprises increased by 1.1% and 4.1%, respectively; electricity, gas, steam, air conditioning supply, and waste treatment enterprises decreased by 0.1% and 0.5%, respectively; and water supply and waste management enterprises increased by 0.2% and 1.5%, respectively.

– 09:55 06/08/2025

“GRDP of Nghe An Province Estimated to Increase by 7.5-8% in the First Nine Months, with Notable Highlights in Investment Attraction”

The latest figures show a positive shift in Nghe An’s economic growth rate for the third quarter, outperforming the first and second quarters.

The Golden Province of Vietnam: Unveiling Nghe An’s Magnetic Appeal to Investors with a Whopping 18.7 Trillion VND Investment Attraction

Despite the current challenging economic climate, Nghe An province has managed to maintain a resilient economy with several positive highlights. One of its key strengths in recent years has been its ability to attract investments, which has played a significant role in its overall economic resilience and growth.

Unlocking the Bottleneck in Public Investment Disbursement in Bac Ninh

“As of September 14th, the province has disbursed 2,435 billion VND, according to Mr. Vuong Quoc Tuan, Chairman of the People’s Committee of Bac Ninh Province. The low disbursement rate is attributed to a combination of subjective and objective factors, including a lack of proactive coordination between departments, localities, and the resolution of bottlenecks in project implementation. Additionally, the capacity of some contractors remains a challenge, impacting the overall progress.”