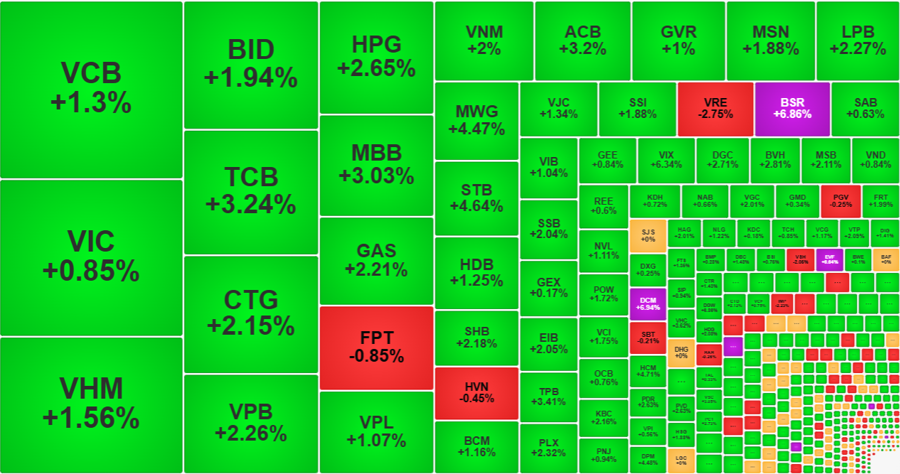

The market slowed down and meandered in the afternoon session, but ultimately finished on a high note. The VN-Index gained 1.72% to reach 1573.71 points, officially closing at a new all-time high, although the margin was not as high as yesterday’s peak. TCB, VCB, and the banking sector in general played a significant role in pushing the index beyond its previous peak.

Many bank stocks also reached new historical highs today, despite a 58% decrease in the sector’s overall liquidity compared to yesterday. STB led the group in terms of growth rate, surging 4.64% and setting a new peak. In fact, STB had already surpassed its historical peak yesterday and was one of the few pillar stocks that held its value remarkably well during the intense fluctuations. TCB, which contributed the most to the VN-Index’s advancement, rose by 3.24%. This stock also broke its historical record yesterday and accelerated further today, although its overall strength was slightly inferior to STB. TCB attained its intraday high at 9:33 am and remained relatively flat for the rest of the day, closing 2.05% lower than its intraday peak.

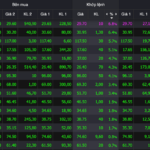

Other bank stocks that reached new peaks today include ACB, up 3.2%; CTG, up 2.15%; MBB, up 3.03%; SHB, up 2.18%; and VPB, up 2.26%. However, the sector was not uniformly robust, with 5 out of 27 stocks closing below the reference price and 5 others increasing by less than 1%. Notably, all bank stocks within the VN30 basket demonstrated exceptional strength, with 10 stocks rising by more than 2%. The liquidity of the banking sector on the HoSE decreased significantly compared to yesterday, reaching just over 9,686 billion VND, which is approximately 23% lower than the average of the previous week.

As expected, the influence of bank stocks positively impacted the VN30-Index, which outperformed the VN-Index with a gain of 1.95% compared to 1.72%. Nonetheless, the blue-chip group remained robust, with 28 stocks advancing and only 2 declining. Notably, excluding the banking sector, 12 other stocks witnessed increases of more than 1%. MWG stood out with a 4.47% gain, followed by DGC at 2.71%, HPG at 2.65%, PLX at 2.32%, GAS at 2.21%, and VNM at 2%.

For the VN-Index, bank stocks accounted for 7 out of the top 10 contributors to the index’s ascent. However, due to the robust performance of numerous other blue-chip stocks, these 7 bank stocks contributed only 9.4 points to the index’s total increase of 26.56 points.

The rest of the market, bolstered by the resilience of the large-cap segment, also witnessed impressive gains. The HoSE’s breadth at the end of the day showed 247 gainers and 78 losers, including 156 stocks that increased by more than 1% (compared to 136 in the morning session). The number of stocks that hit the ceiling price rose to 7, including ANV, IDI, and DCM, which had already reached that level in the morning. Two new outstanding performers joined this group: BSR, with a liquidity of 584.4 billion VND, and EVF, with a matching value of 521.3 billion VND. Additionally, VIX rose 6.34% with a liquidity of 1,673.9 billion, HCM increased 4.71% with 622.1 billion, DPM climbed 4.48% with 424.5 billion, VHC advanced 3.62% with 232.2 billion, and VSC rose 3.05% with a matching value of 433.1 billion, attracting notable trading interest.

The afternoon session witnessed no significant events, and while buying pressure did not intensify, selling pressure also remained subdued. HoSE’s liquidity in the afternoon session increased slightly by 1% compared to the morning session, while trading in the VN30 basket decreased by 10%. However, the breadth improved in the afternoon, and the number of stocks with significant gains (over 1%) also increased.

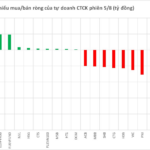

Notably, foreign investors unexpectedly returned to net buying, recording a substantial figure of 464 billion VND on the HoSE, following a small net purchase of 63.6 billion VND in the morning session. While foreign selling increased by 38% compared to the morning, buying activity surged by 57%. FPT continued to witness intense selling pressure, with a net selling value of 775.2 billion VND (compared to -376.7 billion VND in the morning). Other stocks that experienced notable foreign selling included KDH, VCI, MSN, CII, HAX, and VRE. On the buying side, the same stocks from the morning session witnessed increased buying activity: STB (+250 billion VND), MWG (+167.3 billion VND), VIX (+138.6 billion VND), VPB (+136.3 billion VND), VHM (+130.9 billion VND), SSI (+127.3 billion VND), DCM (+99.5 billion VND), and VSC (+96.2 billion VND)…

The VN-Index closing at a new all-time high is a positive outcome, especially considering the intense fluctuations witnessed yesterday. This demonstrates the market’s resilience to high-intensity fluctuations and indicates that investor sentiment remains stable, with expectations still running high.

Market Beat: Green Dominance, VN-Index Extends Gains

The trading session concluded with significant gains, as the VN-Index surged by 26.56 points (+1.72%), closing at 1,573.71. Meanwhile, the HNX-Index also witnessed a robust increase of 2.54 points (+0.95%), ending the day at 268.66. The market breadth was strongly positive, with 529 advancing stocks versus 254 declining ones. This bullish sentiment was echoed in the VN30 basket, where 28 stocks climbed while only 2 witnessed losses.

Stock Market Insights: Can the Uptrend Persist?

The VN-Index rallied for the third consecutive session, hovering near the upper band of the Bollinger Bands and setting yet another record high. The MACD indicator flashed a buy signal as it crossed above the signal line, while the Stochastic Oscillator remained upward-bound following its previous buy signal. Should these indicators continue to strengthen in upcoming sessions, the positive short-term trajectory is likely to persist.

The Stock Market Rollercoaster: Record-Breaking 83,000 Billion VND Trading Day

The VN-Index witnessed a thrilling session, soaring to a peak of 1,584 points before plunging 63 points, leaving investors on the edge of their seats. However, the market staged a remarkable recovery during the ATC session, with the benchmark index surging by nearly 19 points. Today’s trading value broke records, surpassing 83 trillion dong.