Return to Profitability

At a recent investor meeting to discuss VPBank’s financial results for the second quarter and the first half of the year, Ms. Luu Thi Thao, Executive Vice President and CEO of VPBank, shared an update on the bank’s progress. Despite being a later entrant into the mandatory transfer scheme, VPBank is making swift strides.

Since the mid-January acquisition of GPBank through a mandatory transfer scheme, VPBank has embarked on a comprehensive restructuring process.

“While laying the foundational groundwork, VPBank simultaneously assigned business plans to the GPBank team. The 2025 plan was crafted with a conservative approach, but we are already witnessing positive outcomes,” shared Ms. Thao.

Over a five-month period, GPBank achieved a 20% growth in deposits and a 3% organic growth in credit. Notably, June marked a pivotal moment as the first month GPBank recorded a profit, signaling a significant turnaround after years of losses. VPBank has set a modest pre-tax profit target of VND 500 billion for GPBank this year.

GPBank returns to profitability.

“The restructuring plan for GPBank goes beyond financial objectives,” emphasized Ms. Thao. “We are committed to two primary goals: developing a detailed action program to foster sustainable financial results and gradually offset accumulated losses, and the larger ambition of transforming GPBank into a modern and reputable bank in the market, with a distinct and clear mission.”

The bank’s representative revealed that in the third quarter of this year, GPBank will unveil its development strategy alongside a new brand identity and image for the market.

As per the Law on Credit Institutions, a mandatory transfer is one of the measures to restructure credit institutions under special control. The transfer aims to restore normal operations gradually, address weaknesses, and steer GPBank toward becoming a financially healthy bank that can sustain continuous operations.

VPBank’s representative confirmed that post-transfer, GPBank would continue operating as a one-member limited liability bank, wholly owned by VPBank. The legitimate interests of depositors and the rights and obligations of customers at GPBank remain assured, adhering to agreements and regulations. GPBank is an independent legal entity and does not consolidate its financial statements with VPBank’s consolidated financial statements.

A New Name and an End to Losses

During an investor conference held online on August 5, MB’s leadership shared insights into the status of MBV following the mandatory transfer.

In 2024, MB acquired OceanBank through a mandatory transfer and renamed it MBV. According to Mr. Vu Thanh Trung, MB’s Vice Chairman and MBV’s Chairman, MBV’s business operations are closely aligned with the set plans and objectives.

“After over a decade of consecutive losses, MBV is certain to put a stop to the losses this year,” asserted Mr. Trung.

While acknowledging the challenges in MBV’s restructuring process, the bank’s representative assured that MBV’s impact remains minimal compared to MB’s overall scale.

Mr. Luu Trung Thai, Chairman of MB, stated that MB’s credit growth for this year would be a minimum of 25%. For the 2026-2028 period, the bank has been allocated the highest credit growth limit in the market due to its role in restructuring MBV.

Addressing suggestions to abolish credit limits, Mr. Thai opined, “In the context of an imperfect financial market, controlling credit limits is an objective necessity. For now, we cannot afford to relax our vigilance. There was a seven-year period when we didn’t control credit limits, which led to various repercussions, including the case of OceanBank. Thus, removing credit limits is a long-term strategy that requires appropriate conditions and a well-thought-out roadmap.”

International Experts Predict HDBank’s Profit to Surpass 23,000 Billion VND by 2025

In Q2 of 2025, HDBank reported a remarkable pre-tax profit of VND 4,713 billion, bringing its total profit for the first half of the year to VND 10,068 billion. This impressive performance marks a 23% increase compared to the same period in 2024, solidifying the bank’s position among the top-performing financial institutions in the country.

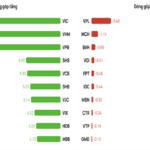

“Undervalued Bank Stocks with Positive Growth Prospects Attract Cash Flow”

“In the past 1-3 months, a select few bank stocks have witnessed an impressive surge, with gains of several dozen percentage points. These stocks share common traits: they boast low to medium price-to-book ratios compared to the industry average, demonstrate improved financial indicators, and possess unique catalysts that set them apart. These factors have likely contributed to their outstanding performance, catching the eye of discerning investors.”

The Consensus Among Banks: Maintaining Stable Interest Rates for Sustainable Growth

As of early 2025, banks have been actively implementing directives from the government and the State Bank to maintain stable interest rates. These efforts have been instrumental in promoting credit growth and providing much-needed support to businesses and individuals alike.