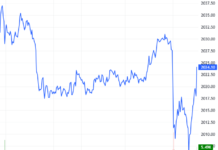

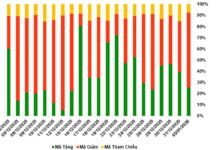

The VN-Index officially closed at a new all-time high, with a session gain of 26.56 points to close at 1,573.71. The market breadth was overwhelmingly positive, with 247 gainers and only 78 losers.

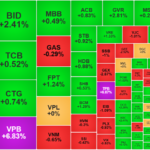

Banks continued to lead the rally, with no stock reaching the maximum daily limit, but a broad-based advance in the sector. Large and small caps surged, with prominent lenders such as VCB, BID, and TCB rising by as much as 3.24%; CTG also climbed 2.15%, followed by mid- and small-cap peers STB, SHB, ACB, TPB, and MBB.

The banking sector and a few large caps like HPG and VHM contributed almost 11 points to the index gain. Real estate rebounded, led by the Vingroup trio: VIC, which rose by 0.85%; VHM, up by 1.56%; and industrial zone developers like KBC and BCM, as well as other property stocks such as PDR and NVL.

Brokerage stocks also witnessed strong buying interest, with VIX recovering twice as much as its previous day’s loss, climbing 6.34%; SHS and HCM also rose by 4.31% and 4.71%, respectively…

Overall, the market is witnessing a high level of consensus, with both large and small caps attracting investors. Telecommunications surged 4.18%, while materials, exporters, and seafood names hit the daily limit up, including ANV and IDI. Oil and gas stocks also witnessed strong momentum…

Market sentiment is highly positive and reminiscent of the 2021 bull run, with money continuously flowing into equities and not allowing for deep corrections. However, investors are becoming more discerning and refraining from chasing prices higher at any cost.

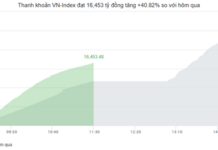

Market-wide liquidity weakened to VND 42 trillion, but the positive sign was the return of foreign investors, who were net buyers to the tune of VND 754.4 billion, with a match volume of VND 358.9 billion. Their top match buys were in banks and financial services: STB, VIX, VPB, SS1, MWG, DCM, VSC, HCM, DPM, and VHM. On the other hand, they net sold information technology stocks, offloading FPT, KDH, VCI, MSN, FUEVFVND, E1VFVN30, HAX, and VRE.

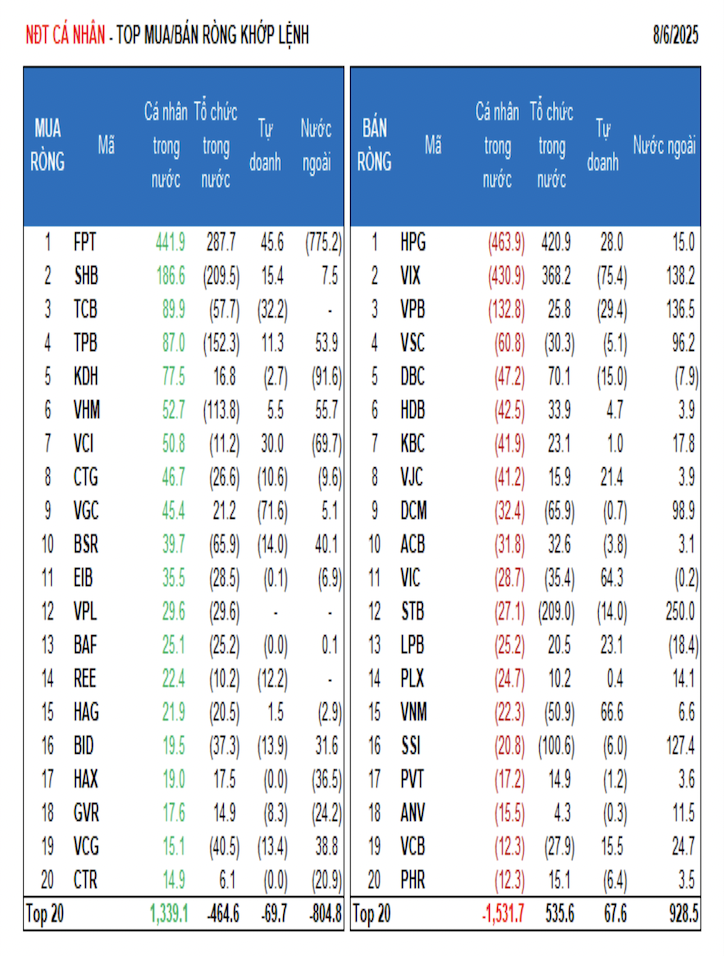

Retail investors were net sellers to the tune of VND 282.7 billion, with a match volume of VND 191.8 billion. In the match volume, they bought 9 out of 18 sectors, mainly information technology. Their top buys were FPT, SHB, TCB, TPB, KDH, VHM, VCI, CTG, VGC, and BSR. On the selling side, they offloaded 9 out of 18 sectors, mainly basic materials and financial services. Their top match sells were HPG, VIX, VPB, VSC, DBC, HDB, VJC, DCM, and ACB.

Proprietary traders were net sellers at VND 204.6 billion, with a match volume of VND 125.3 billion. In the match volume, they bought 7 out of 18 sectors, with the strongest purchases in food & beverage and information technology. Their top match buys were VNM, FUEVFVND, VIC, MSN, FPT, E1VFVN30, VCI, HPG, LPB, and VJC. On the selling side, they offloaded industrial goods & services, with top sells including GEX, VIX, VGC, MBB, TCB, VPB, GEE, DBC, DXG, and PC1.

Local institutions were net sellers at VND 40.7 billion, with a match volume of VND 41.7 billion. In the match volume, they sold 10 out of 18 sectors, mainly banks. Their top sells were SHB, STB, TPB, MWG, VHM, SSI, DPM, DCM, BSR, and HCM. On the buying side, they purchased basic materials, with top buys including HPG, VIX, FPT, GEX, DBC, MBB, CII, HHS, HDB, and DXG.

Block deals amounted to VND 2,140.2 billion, down 61.0% from the previous session and contributing 5.0% to the total trading value. Notable transactions included foreign institutional trades in banks (TCB, MBB, HDB, CTG) and large caps (VHM, MWG, FPT, VIC).

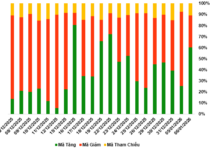

Cash flow allocation increased in Securities, Chemicals, Retail, Food & Beverage, Oil & Gas, and IT, while decreasing in Real Estate, Banks, Construction, Steel, Electrical Equipment, Warehousing, and Logistics. In the match volume, cash flow allocation increased in mid-caps (VNMID) and decreased in large caps (VN30) and small caps (VNSML).

‘The ‘Wave’ of Soaring Asset Prices: A Restlessness Among Many

“As the economy flourishes, the value of assets surges across various investment avenues such as stocks, gold, and real estate. However, experts advise investors to cautiously devise a financial strategy that suits their needs and refrain from succumbing to FOMO (fear of missing out).”

The Sun Group’s Cau Giay Project: Rethinking Smart Urban Space

At Sun Feliza Suites, residents are offered a multilayered ecosystem of amenities, catering to a premium lifestyle. With five meticulously planned towers, each with its unique function yet harmoniously interconnected, the project unveils a modern and convenient living space in the heart of the capital.

Attracting FDI in the Past 7 Months Surpasses $24 Billion, Up 27.3% Year-on-Year

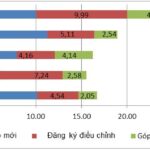

As per the latest statistics released by the Foreign Investment Agency, foreign investment registered in Vietnam as of July 31, 2025, including newly registered, adjusted, and contributed capital, and share purchases by foreign investors, amounted to an impressive $24.09 billion, marking a significant 27.3% increase compared to the same period last year.

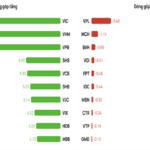

“Undervalued Bank Stocks with Positive Growth Prospects Attract Cash Flow”

“In the past 1-3 months, a select few bank stocks have witnessed an impressive surge, with gains of several dozen percentage points. These stocks share common traits: they boast low to medium price-to-book ratios compared to the industry average, demonstrate improved financial indicators, and possess unique catalysts that set them apart. These factors have likely contributed to their outstanding performance, catching the eye of discerning investors.”