Telcom’s Delisting and Its Impact on Shareholders: An In-Depth Analysis

Telcom has recently passed a resolution at its 2025 Extraordinary General Meeting of Shareholders to cancel its public company status. The company will submit the necessary documents to the State Securities Commission (SSC) starting July 24th to initiate the delisting process.

Following the SSC’s official announcement, the Hanoi Stock Exchange (HNX) will proceed with the delisting of all 5 million TEL shares, and the Vietnam Securities Depository (VSDC) will also delist this stock code.

Insider trading and exemption from public acquisition

Along with the decision to withdraw from the stock exchange, the General Meeting of Shareholders also approved a proposal to exempt Mr. Le Hai Doan, a member of the Board of Directors and Executive Director of Telcom, from the requirement to make a public offer for the transaction of transferring shares from Mr. Vu Anh Tuan.

|

Mr. Doan is permitted to acquire up to 600,000 TEL shares without undergoing a public offering process, through the method of negotiated trading. Based on the market price as of August 4th, which was VND 9,000 per share, this transaction is valued at approximately VND 5.4 billion.

Currently, Mr. Le Hai Doan is the largest shareholder in Telcom, with a ownership rate of 29.7%, and this rate is expected to increase to nearly 41.7% after the transaction, allowing him to maintain a controlling role in the company. Prior to this, Mr. Doan registered to purchase an additional 250,000 TEL shares from July 8th to August 5th, which is likely part of the ongoing share transfers.

The second largest shareholder of Telcom is currently the Chairman of the Board of Directors, Mr. Nguyen Hoa Hiep, who holds 29% of the capital.

|

Simultaneously, the Joint Stock Company of HIPT Group (UPCoM: HIG), where Mr. Le Hai Doan serves as Chairman of the Board of Directors, has also received a decision from HNX to delist all of its nearly 22.6 million shares from August 22nd. This decision was proposed and approved by HIG itself at the 2025 General Meeting of Shareholders. Additionally, at the HIG General Meeting of Shareholders, shareholders agreed to allow Mr. Le Hai Doan to repurchase up to 200,000 shares from Mr. Mai Hoang without having to make a public offering. If completed, Mr. Doan’s ownership in HIG will surpass the 55% threshold compared to the current rate of 54.96%. |

Telcom’s struggling business performance and audit qualifications

Telcom has a long history in the field of telecommunications infrastructure construction, dating back to its establishment as the Construction Department under the Vietnam Radio and Television Bureau in 1954. After numerous transformations, Telcom became a joint-stock company in 2004.

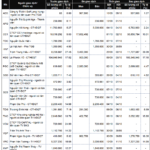

However, the company’s financial performance has been lackluster for many years. In the past 15 years, Telcom has either incurred losses or made meager profits of a few hundred million VND. In 2020, the company recorded a record loss of nearly VND 18 billion, while in 2024, it barely broke even with a profit of about VND 600 million. As of the end of 2024, the company’s accumulated loss amounted to nearly VND 25 billion.

| Telcom’s Dismal Financial Performance |

In the 2024 audited financial statements, the auditors raised several significant qualifications. The company has not performed a fair value assessment for long-standing items such as short-term receivables of over VND 4 billion, advances of nearly VND 584 million, and production and business expenses of over VND 2.1 billion.

Additionally, Telcom has not made any provisions for these items. The auditors stated that they did not have sufficient basis to determine whether adjustments to these figures were necessary.

Stock price volatility prior to delisting

TEL shares were officially traded from September 2017. For most of the time, the share price traded below par value. However, there was a period of significant increase from the VND 5,000 per share range in July 2020 to a peak of VND 19,500 per share in September 2020, almost quadrupling in less than two months, before plummeting and becoming highly volatile.

In the past two years, TEL shares have also experienced sharp rises, such as reaching nearly VND 17,000 per share in October 2023 and surpassing VND 16,000 per share in June 2024, but then falling sharply back to around VND 9,000 per share at present.

| TEL Share Price Movement in the Past Year |

By Thế Mạnh – 3:17 PM, August 4th, 2025