Multi-Channel Investments on the Rise

Ms. Minh Hoa, a 35-year-old resident of Cau Giay Ward in Hanoi, shared her concerns: “I have VND 1 billion in savings at the bank. Recently, with the stock market continuously breaking records, apartment prices doubling or tripling, and gold remaining at a high level, I’m feeling anxious.”

Ms. Hoa further explained that over a year ago, she intended to purchase land in the outskirts of Hanoi and made several surveys but couldn’t decide. Soon after, real estate prices, including both apartments and land plots, started surging, making her hesitant to invest.

“First real estate, then gold and cryptocurrencies started surging, leaving me confused about where to invest. The stock market has been breaking records, and everyone seems to be making a 30% profit, which makes me restless,” she added.

Apartment prices have been on a constant rise.

Mr. Duc Long, a resident of Phuc Dong Ward in Hanoi, shared similar sentiments: “When the gold price reached VND 100 million per tael, I thought it couldn’t go any higher, but it surged to VND 120 million per tael. Now, with the price hovering at VND 123.8 million per tael, I’m unsure if I should withdraw my savings and invest in gold, waiting for it to reach VND 130 million per tael, or wait for a price drop to buy.” He added, “All investment channels are rising rapidly, and I can’t keep up.”

What Should Investors Do?

Economist Nguyen Huu Huan attributed the sharp rise in domestic gold prices to the increase in global gold prices. However, when global prices drop significantly, domestic prices only decrease slightly or remain unchanged due to low gold selling demand and high buying demand among the population, coupled with limited supply. Whenever the price drops, people tend to buy more, supporting the market.

According to Mr. Huan, the gap of over VND 15 million per tael between domestic and global gold prices poses risks for those holding gold in Vietnam. At any time, if the State Bank tightens its control over the market, or the Prime Minister directs measures to narrow the gap between domestic and global gold prices, or Decree 24 is amended—meaning when policies change and supply is unblocked—domestic gold prices could drop sharply to align closer with global prices.

Regarding future trends, Mr. Huan opined that global gold prices are in a “peak distribution zone,” despite fluctuations, they remain at peak levels.

“It’s challenging to predict global gold prices at this point as they fluctuate around the $3,300-3,400 per ounce range. To establish a new upward trend, it needs to surpass the $3,500 per ounce mark. Currently, gold prices are moving horizontally within a highly volatile range, indicating that both decreases and increases will be significant,” Mr. Huan analyzed.

Domestic gold prices are surging due to global price increases. Photo: Duy Pham.

In Mr. Huan’s view, global gold prices are influenced by geopolitical factors and the psychology of US President Donald Trump, so they are likely to remain “anchored” at high levels. In this context, capital may flow to other more attractive investment channels.

“If the gold price remains sideways in the VND 120-125 million per tael range over the next few months, while the real estate market shows signs of warming up, a large amount of capital will likely shift from gold to real estate. This is a normal phenomenon. Investors need to be extremely cautious during this period,” Mr. Huan advised.

Investors Need to Be Cautious

Mr. Tran Hoang Son, Market Strategy Director at VPBank Securities (VPBankS), noted a clear differentiation in investor psychology during this period. Experienced investors tend to be more cautious. Mr. Son pointed out that if the market is undergoing a normal correction, liquidity is usually not high. However, in the recent session where the VN-Index fell by 60-70 points, liquidity still reached $3 billion, indicating that buying demand remained strong during the sharp decline. Therefore, the possibility of a deep market correction is not high.

“Investors should be more open-minded and view the fluctuations as buying opportunities before the next wave of increases. The fluctuation range in August may be wide, so it’s necessary to closely monitor the market in the second half of the month. After the recent correction week, the market rebounded with positive liquidity, indicating the formation of a new equilibrium in the first two weeks of August, before entering a stronger upward trend,” Mr. Son assessed.

According to real estate experts, many investors’ early “cash-out” actions are a clear sign of the fear of missing out (FOMO) psychology. This mentality is resurfacing after the market downturn from 2022 to mid-2024 due to tightened legal procedures and high-interest rates.

The period from the beginning of 2023 to mid-2024 was a time of significant adjustment for the real estate market. However, since the third quarter of 2024, recovery signals have emerged, such as falling interest rates, legal issues being resolved for some projects, and new supply entering the market… This has created new expectations among investors.

Many individual investors are concerned about “staying put” for too long and missing the first recovery wave, especially in projects with potential for price increases. This mentality tends to spread quickly within the investor community through social media groups, trial sales events, and real estate companies’ communication strategies. Nevertheless, experts advise investors to cautiously develop suitable financial plans to avoid risks.

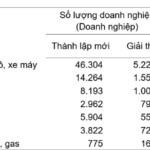

The Contrasting Shades of the 2025 Corporate Landscape

The business landscape in the first seven months of the year presented a picture of stark contrasts. While there was a notable increase in new business formations and a resurgence of previously dormant enterprises, the number of businesses exiting the market also raised warning signs of significant challenges ahead.

Amid the Supply Chain Remapping Wave, ACB and FDI Enterprises Explore Opportunities in Vietnam

Vietnam is among the first nations to strike a deal with the US on mirror taxes, with expected rates of 20% for exports from Vietnam and 40% for transshipped goods.

The Sun Group’s Cau Giay Project: Rethinking Smart Urban Space

At Sun Feliza Suites, residents are offered a multilayered ecosystem of amenities, catering to a premium lifestyle. With five meticulously planned towers, each with its unique function yet harmoniously interconnected, the project unveils a modern and convenient living space in the heart of the capital.

The Ultimate Lifestyle Choice for the Discerning Achiever

In the midst of a booming second-home market in Northern and Central Vietnam, riverfront property Aquamarine in Dien Chau, Nghe An is emerging as the choice for discerning individuals seeking a ‘second home’. This exclusive development offers a unique blend of work and vacation, attracting those who desire a balanced lifestyle without compromising on financial stability.

The Astonishing Numbers Behind Tay Ninh’s Projects

The province of Tay Ninh has disbursed 7.491 trillion VND, achieving nearly 48% of its plan, which is higher than the national average.