VN-Index ends August 4th with a close at 1,528 points

VN-Index Surges by 33 Points

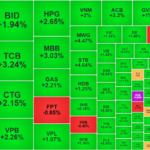

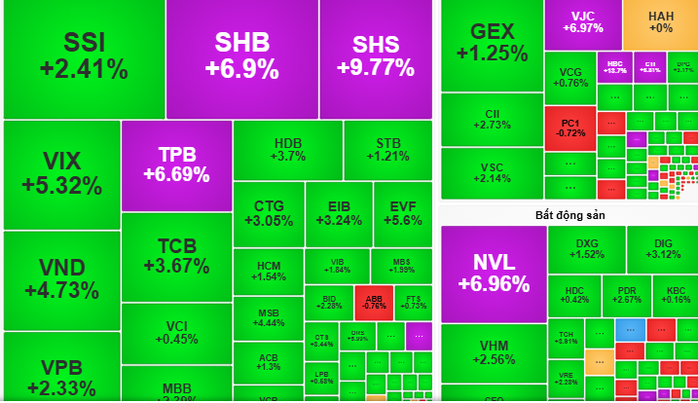

The VN-Index opened the trading session on August 4th in a lackluster manner, hovering around the reference mark for the first 30 minutes before surging ahead thanks to large-cap stocks. Notably, Vingroup’s VIC (reaching the ceiling) and VHM (+2.56%), along with SHB (also reaching the ceiling) from the banking group, staged an impressive recovery after last week’s adjustment. These stocks played a pivotal role in expanding the index’s gains, resulting in a morning session close over 12 points higher.

Mid-cap stocks also witnessed robust demand, particularly in the Electricity, Seafood, and Real Estate sectors. ANV rose by 5.46%, NT2 hit the ceiling, and NVL saw a 5.22% increase.

In the afternoon session, buying pressure intensified, coupled with consensus from large-cap stocks, pushing the VN-Index closer to the 1,530-point mark by the end of the day. Green dominated with 242 gainers, including 21 ceiling prices, versus 89 losers, reflecting investors’ enthusiasm. The leading sectors included Banking, Real Estate, Securities, and Electricity.

At the close, the VN-Index settled at 1,528 points, climbing 32.98 points (approx. 2.21%).

Latest Moves by Foreign Investors

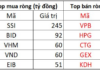

Foreign investors continued net selling on August 4th, but the pressure eased significantly, with a total net sell value of VND 371.78 billion. Heavily sold stocks included SSI, VIC, and VHM, with VIC facing the most pressure, recording a net sell value of nearly VND 1,000 billion. Nonetheless, the cooling off in foreign investors’ net selling activity is a positive signal, boosting domestic investors’ confidence.

According to VCBS, the VN-Index witnessed an impressive recovery on August 4th, led by large-cap stocks and a broad-based market advance. With this robust momentum, investors anticipate the VN-Index to venture further in the August 5th session, propelled primarily by large caps such as VIC, VHM, SHB, and stocks in the banking, real estate, and securities sectors.

Some other securities companies advise investors to maintain their holdings in recovering stocks, especially large caps. They also suggest partial investments in stocks with impressive Q2/2025 business results for short-term goals. Additionally, investors need to closely monitor supply-demand dynamics and foreign investors’ actions as the VN-Index is in a sensitive zone. The market may experience volatility, warranting caution and flexibility in trading decisions.

Is the Market Valuation Still Cheap?

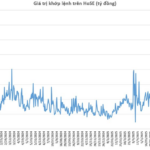

The Q2 2025 earnings season has reflected positively on the market, with EPS witnessing an impressive 8% uptick from the prior quarter. This improvement pulled the P/E ratio of the VN-Index down to a compelling 13.8x as of the market close on July 31, 2025.

The Stock Market Surge: Banking Sector Leads VN-Index to New Heights

The market slowed down and turned volatile in the afternoon session, but ultimately finished on a positive note. The VN-Index rose 1.72% to 1573.71, closing at a new all-time high. This achievement was largely driven by TCB, VCB, and the banking sector as a whole, which propelled the index beyond its previous peak.

“Foreign Sell-Off Reaches New Heights: Over 10,000 Billion Liquidated – Which Stocks Are in the Eye of the Storm?”

The foreign investors showed strong buying interest in GEX stocks, with a net buy value of approximately VND 151 billion, while NVL stocks also witnessed a notable net inflow of VND 100 billion during today’s trading session.

Market Beat: Green Dominance, VN-Index Extends Gains

The trading session concluded with significant gains, as the VN-Index surged by 26.56 points (+1.72%), closing at 1,573.71. Meanwhile, the HNX-Index also witnessed a robust increase of 2.54 points (+0.95%), ending the day at 268.66. The market breadth was strongly positive, with 529 advancing stocks versus 254 declining ones. This bullish sentiment was echoed in the VN30 basket, where 28 stocks climbed while only 2 witnessed losses.