Bank Stocks Soar: Bright Spot in the Stock Market

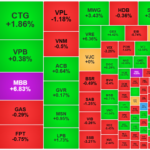

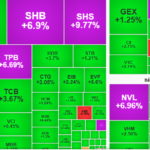

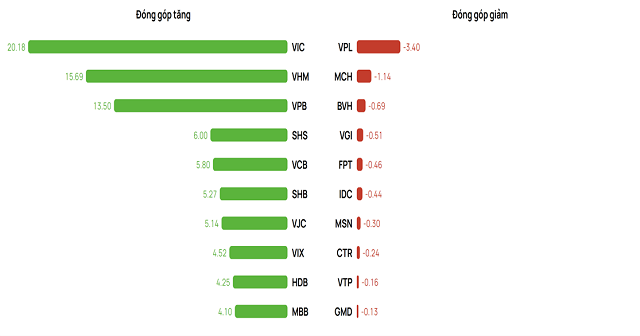

The banking sector has emerged as a shining star in the stock market, attracting significant attention and capital inflows. This positive development has propelled the VN-Index to the 1,550-point level. A closer look at the top contributors to this upward momentum reveals that the VIC and VHM stocks have played a significant role, followed by a strong showing from several bank stocks, including VPB, VCB, SHB, HDB, and MBB.

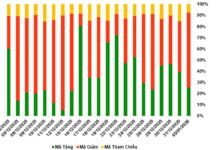

Top performers and laggards within the VN-Index over the past month (as of August 4th).

Data source: Vietcap IQ |

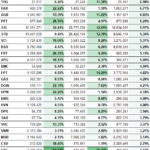

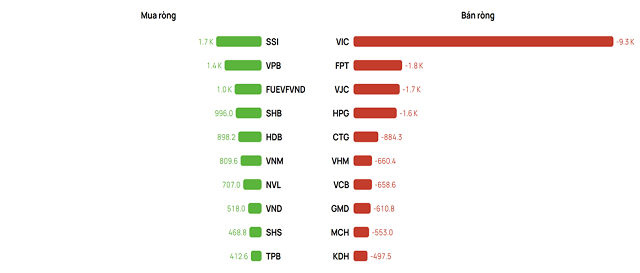

This positive momentum has been further bolstered by strong buying activity from foreign investors. Since resuming net buying on July 2nd, foreign investors have net purchased nearly VND 11,296 billion and net bought back over VND 1,900 billion in the last week of July (July 21-27). Over the past month, several bank stocks have witnessed strong net buying by foreign investors, including VPB, VCB, SHB, HDB, and MBB… Additionally, some names have already reached their foreign ownership limit, such as TCB, HDB, and ACB…

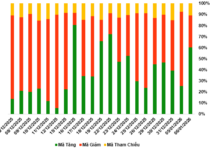

Foreign investors’ top net buys and sells over the past month (as of August 4th)

Data source: Vietcap IQ |

SHB, a standout performer in July with impressive price gains and strong foreign buying support, still has considerable room for additional foreign ownership. SHB has impressed investors with a 43% increase in its share price over the past month (as of August 4th) and consistently high trading volume, averaging over 100.7 million units traded per session. Over the past quarter, the stock has risen more than 53%, with an average trading volume of over 75 million shares per session. In terms of price-to-book (P/B) valuation, SHB has historically traded at around 0.7x, well below the industry average. However, thanks to its strong upward momentum, SHB‘s P/B ratio has now reached 1.1x.

Recently, SHB announced that its pre-tax profit for the first half of the year reached VND 8,913 billion, a 30% increase compared to the same period last year, and achieved 61% of its full-year plan of VND 14,500 billion.

SHB‘s credit structure is strategically oriented towards priority sectors in line with macroeconomic directives, such as supporting industries, renewable energy, infrastructure development, and high-tech agriculture. As of the end of the second quarter, credit growth stood at approximately 14.4%, outpacing the average growth rate of the banking system, reflecting the bank’s proactive and prudent approach to targeted growth.

Key operational efficiency indicators remain robust. Specifically, the return on equity (ROE) has been consistently maintained at 18%, placing SHB among the top performers in the banking system. The bank’s cost-to-income ratio (CIR) is impressively low at only 16.4%, indicative of the management’s effective cost control measures.

Amid this backdrop of strong price performance and high trading volume, SHB continues to attract market attention. The bank recently announced a 13% stock dividend payout, resulting in an increase in its charter capital to VND 45,942 billion. With this move, SHB solidifies its position as one of the top five joint-stock commercial banks with the largest charter capital in the system.

From a strategic perspective, this increase in equity capital enhances the bank’s financial strength, improves its capital adequacy ratios, and expands its capacity to drive credit growth in the upcoming quarters while adhering to Basel II and III guidelines.

As the stock market experiences euphoric trading sessions, with both indices and liquidity surging, investors witness the rotation of capital across sectors. Money flows from leading stocks to undervalued stocks in the same sector, with specific catalysts such as undervalued stocks with untapped potential, positive business improvements, and catalysts like foreign capital sales, dividend payouts, benefits from market upgrades, and leadership changes. As a result, some undervalued bank stocks are also witnessing a surge in market prices.

High Expectations for the “King” Stocks

The trend of capital seeking opportunities in “king” stocks is evident in the second half of the year, driven by the argument that this sector offers attractive valuation and achievable profit growth potential.

As of June 30, 2025, the credit growth of the entire banking system reached 9.90% year-to-date (YTD), significantly outpacing the 6.1% growth rate recorded in the same period last year. This impressive growth is mainly driven by corporate lending, benefiting from the maintained low lending interest rates. In contrast, retail credit growth has been slower due to weak credit demand, reflecting the cautious recovery in the market for home purchase and consumer loans.

As a result, companies with a strong focus on corporate clients have attracted the attention of many investors. For instance, during the recent Q2/2025 financial statement season, SHB once again demonstrated its unique approach, with corporate clients accounting for over 80% of its outstanding loans.

This strategy involves focusing on large corporations and SMEs with well-established ecosystems and supply chains, enabling SHB to implement its cross-selling strategy effectively. By leveraging the interconnectedness between parent companies and their subsidiaries, SHB can expand its customer base and cross-sell financial products and services to individuals. This model not only boosts fee income but also efficiently expands the bank’s retail customer base.

Additionally, serving large corporate clients with strong relationships helps SHB significantly reduce operating costs by optimizing loan approval, disbursement, and risk management processes through historical customer data and industry-specific monitoring systems.

This model also creates long-term net interest margin (NIM) expansion opportunities by enabling the bank to efficiently deploy capital into high-profit, well-managed industries. This strategy has been successfully implemented by leading international and private joint-stock banks in Vietnam, and SHB has consistently demonstrated its ability to execute this model over the years.

In the second half of the year, the banking sector is expected to maintain its positive business momentum, particularly in lending activities. Several factors are likely to drive loan disbursements, including accelerated public investment disbursements, Resolution 68 enhancing the role and position of the private sector, and effective removal of legal and administrative bottlenecks in the real estate market.

– 17:58 06/08/2025

Which Stocks Usually Rise in August?

Despite the steep decline witnessed in late July, expectations remain high for the VN-Index to rebound and resume its upward trajectory in August. Historical data trends suggest that a recovery is on the horizon.

Is Q3 the Comeback Quarter for Industrial Real Estate Stocks?

The industrial sector is set to benefit from the new tariff landscape, which reinforces Vietnam’s inherent competitive advantage in terms of cost, infrastructure, and strategic geographic location. This quarter’s standout stocks are SIP, ANV, and FMC, poised to capitalize on these favorable conditions and offer promising opportunities for investors.

The Shocking Rise and Fall: VN-Index Sets New Turnover Records, But For How Long?

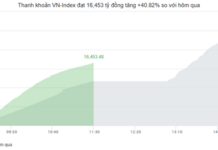

The market took an unexpected turn this afternoon, catching investors off-guard. As the VN-Index soared to a 3.72% gain, a sudden wave of selling hit, sending the index plunging. In just under 30 minutes, the index dropped 0.6%, resulting in a staggering 4.34% swing. Today’s trading volume on the HoSE exchange surged to a new record high of 72,841 billion VND, surpassing the previous record set on July 29.

Tomorrow’s Stock Market Outlook: Anticipating VN-Index’s Uptrend to Persist, Driven by Large-Cap Stock Resilience

With a stellar performance by leading stocks such as VIC, VHM, and SHB on August 4th, investors are optimistic about the continued rise of the VN-Index.