Illustrative image

Preliminary statistics from the Customs Department reveal that Vietnam’s crude oil exports for June reached over 127,000 tons, valued at more than $71 million, marking a 19% decrease in volume and a 24.7% decline in value compared to the previous month.

For the first six months of 2025, the country exported over 1.1 million tons of crude oil, worth more than $653 million, representing a 25.5% drop in volume and a 37.5% decrease in value year-on-year.

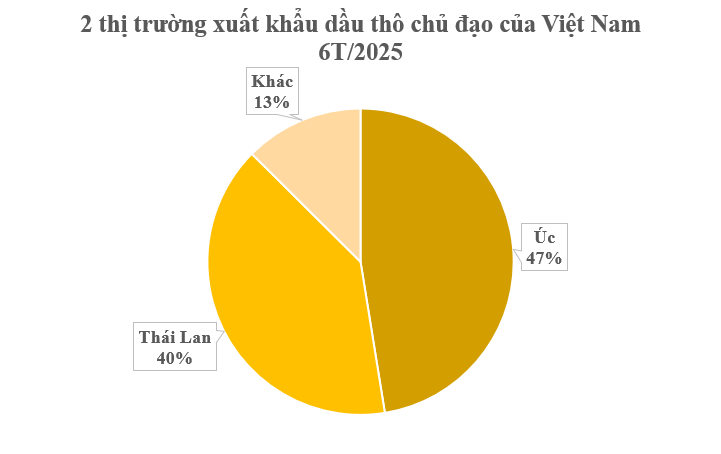

In terms of market destinations, Australia is currently the largest importer of Vietnamese crude oil, purchasing over 533,000 tons valued at over $314 million. This reflects a 10% increase in volume but a 9% decrease in value compared to the same period last year. The average price witnessed a 17% decrease, settling at $589 per ton.

Thailand follows closely as the second-largest importer, with purchases exceeding 449,000 tons valued at more than $259 million. Both volume and value experienced declines of 23% and 36%, respectively. The average export price to Thailand also dipped significantly by 17%, settling at $576 per ton.

Vietnam boasts an estimated crude oil reserve of approximately 4.4 billion barrels, ranking 28th among countries with proven oil reserves worldwide. The first stream of crude oil was extracted from the Bach Ho field in 1986, and Vietnam commenced its crude oil exports in April 1987.

Despite being a crude oil-producing and exporting country, Vietnam still relies heavily on crude oil imports to meet its refining needs. Experts attribute this to the mismatch between the types of crude oil available domestically and the requirements of existing refineries. Currently, Vietnam operates two refineries capable of processing different types of crude oil. The Nghi Son Refinery relies entirely on imported crude oil from the Gulf region, which is sourced from desert and shale deposits. Meanwhile, the Dung Quat Refinery specializes in processing crude oil from the Bach Ho field, but with declining yields from this field in recent years, alternative sources with different crude oil characteristics have been introduced.

In contrast, Thailand held over 404 million barrels of proven oil reserves as of 2016, ranking 50th globally and accounting for less than 1% of the world’s total reserves. Thailand’s total reserves fall short of meeting even a year’s consumption (estimated at 550 million barrels per year), making the country heavily reliant on oil imports to sustain its consumption levels.

So far this year, Vietnam’s crude oil exports have witnessed a slight downturn, primarily due to volatile global oil prices and subdued demand from traditional markets like China, South Korea, and Thailand. Transportation challenges arising from tensions in the Middle East have also impacted the delivery of certain shipments.

Looking ahead to the second half of 2025, prominent energy organizations such as the International Energy Agency (IEA) and OPEC anticipate oil prices to fluctuate within the range of $75–85 per barrel, contingent on OPEC+ compliance with production cuts, the pace of global economic recovery, and political instability. With the current trends, Brent crude oil prices are forecasted to average around $80 per barrel for the full year 2025. This scenario presents both opportunities and challenges for Vietnam’s oil and gas industry: while it promises higher export revenues, it also necessitates agile strategies in exploration, reserve management, and price negotiation to mitigate potential losses during market fluctuations.

Nhu Quynh

The Evolution of ESCO: From a Promising Model to an Ambiguous Concept in Vietnam

The Energy Service Company (ESCO) model was once touted as a pivotal driver for energy conservation in Vietnam. However, over a decade into its implementation, the industry is still charting its course for effective development.

The Scenic Transformation: Ninh Binh’s Urban Development Along the Day River

The province of Ninh Binh is planning to invest in a modern riverfront development project along the Day River. This ambitious initiative involves constructing a network of scenic roads combined with state-of-the-art retaining structures. This development is envisioned to be a catalyst for urban growth and the emergence of new service industries in the entire region.

The Banking Sector Prepares a Massive 500 Trillion VND Preferential Credit Package

The State Bank of Vietnam (SBV) convened a meeting with representatives from the Ministries of Finance, Construction, Industry and Trade, and Science and Technology, along with leaders of 21 commercial banks participating in the preferential credit program worth VND 500 trillion for enterprises investing in infrastructure and digital technology. The meeting was chaired by Deputy Governor Nguyen Ngoc Anh.

Streamlining Agricultural and Environmental Business Procedures: Cutting Red Tape, Simplifying Processes

With the new scheme, there is a focus on reducing and streamlining administrative procedures related to production and business operations across 13 sectors. This also includes the reduction and simplification of investment and business conditions in 36 sectors, specifically for regulated industries in agriculture and the environment.