Valuation using P/E ratio as an international standard for TCBS

The expected offering price approved by TCBS’s Board of Directors for its initial public offering is VND 46,800 per share, equivalent to a P/E ratio of 20 times, based on expected 2025 earnings and the number of shares outstanding.

The Price to Earnings (P/E) ratio is a widely used method for valuing securities companies and WealthTech businesses similar to TCBS by international financial institutions. The P/E ratio directly reflects the market’s assessment of a company’s profit-generating capacity, especially suitable for business models with stable and consistently growing profits. In the case of TCBS, the company has consistently demonstrated high profitability over the years, making P/E-based valuation reasonable and realistic.

Renowned WealthTech companies such as eToro, Robinhood, Interactive Brokers, and TradeWeb are all valued based on their P/E ratios. This group averages around 36 times P/E, with Robinhood at 80 times earnings, Interactive Brokers at approximately 32 times, and eToro at 23 times. These companies share common characteristics with TCBS, including a technology platform business model, positive and growing profits, and no longer needing to “burn money” like startups.

Comparing TCBS’s P/E ratio to the overall industry average

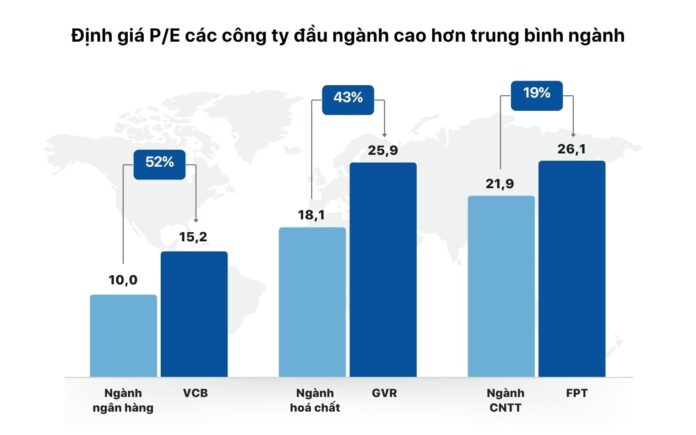

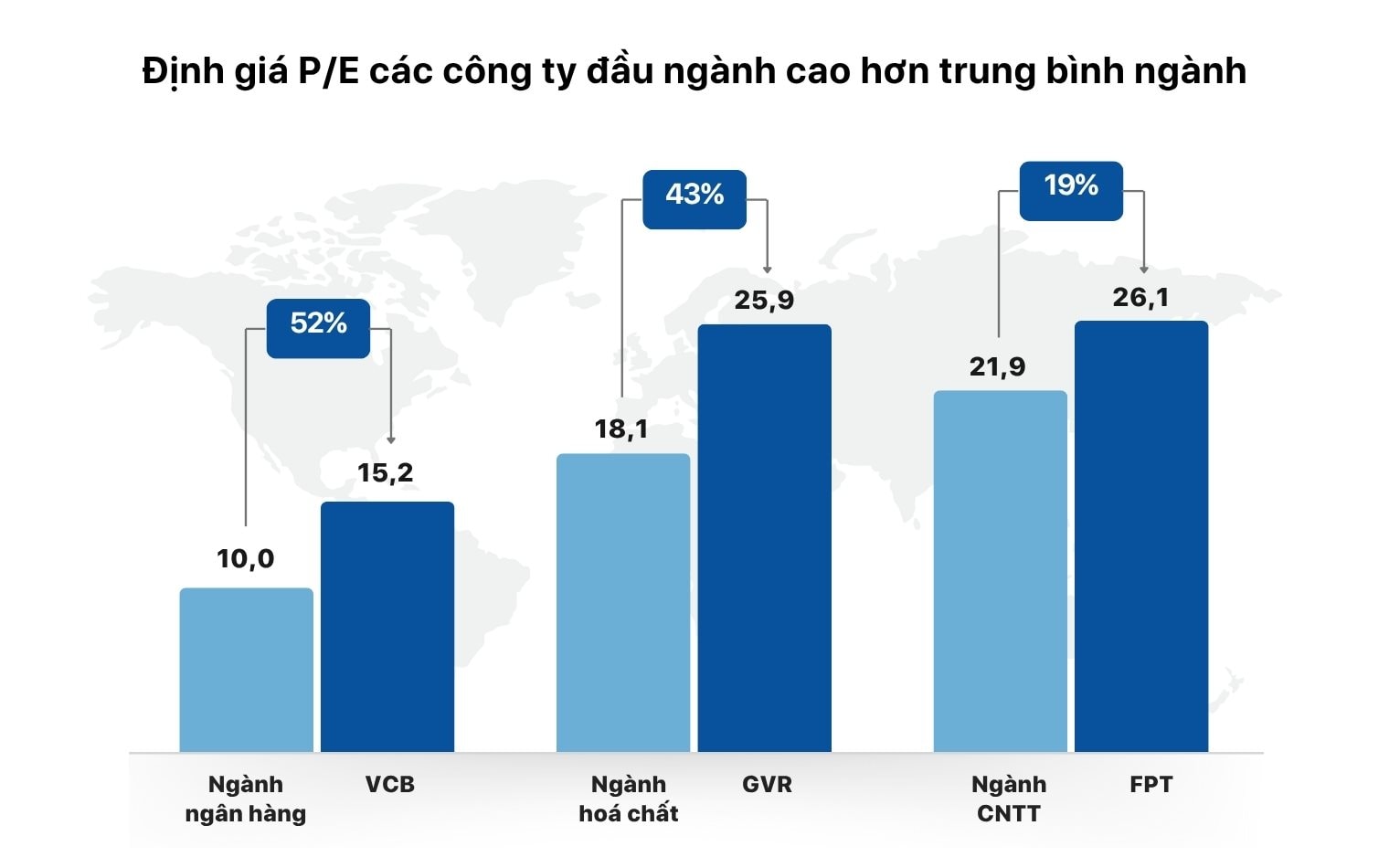

Currently, the P/E valuation range for the top 10 securities companies in Vietnam is approximately 20-25 times. Thus, the approved P/E range for TCBS’s IPO is on the lower end of this average. Notably, leading companies in the market often attract investors who are willing to pay a premium of 20-30% above the industry average.

Leading companies have higher P/E ratios than the industry average

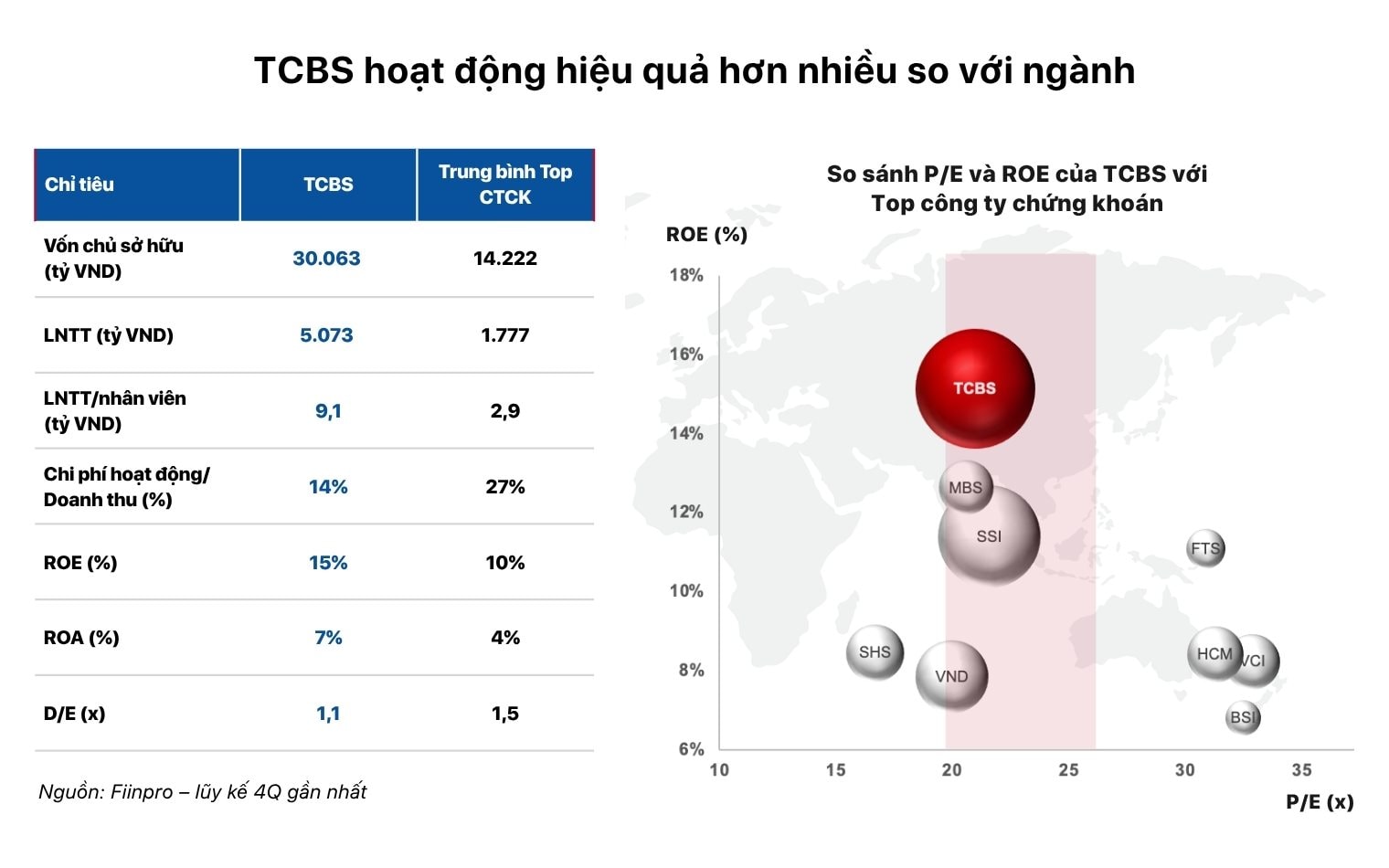

TCBS’s leading position in the industry, in terms of both owner’s equity (over VND 30,000 billion) and consecutive years of leading profits, is a crucial factor supporting its valuation. In the first half of 2025, the company recorded more than VND 3,000 billion in pre-tax profits, with earnings per share (EPS) for the last four quarters reaching VND 2,060 per share, the highest among the top securities companies.

Operational efficiency, with an operating expense ratio (CIR) of approximately 14%, is only half of the industry average of 32% (2024). TCBS’s return on equity (ROE) and return on assets (ROA) are among the highest in the market (ROE 15% and ROA 7% in the four quarters ended June 30, 2025), thanks to its diverse revenue structure and operational advantages. Notably, the company also holds the largest market share in important business segments, including corporate bond issuance advisory and margin lending.

Following the IPO, TCBS expects to raise nearly VND 11,000 billion in new capital in the early fourth quarter of 2025, increasing its equity base by approximately 35% and providing a solid financial foundation for its next phase of development. TCBS’s market capitalization could reach approximately USD 4.1 billion, just 20% short of the USD 5 billion target set in its 2020-2025 strategy.

According to TCBS’s leadership, achieving the USD 5 billion market capitalization target depends on the interest and demand from individual and foreign investors when the company is listed, expected by the end of this year.

Another factor that could directly impact TCBS’s share price after listing is the prospect of an upgrade for the Vietnamese stock market. If the market is upgraded, the P/E range could expand by an additional 15-20% due to inflows of foreign capital, as seen in international markets.

WealthTech growth potential in Vietnam: A wide-open playing field, with TCBS poised to take the lead

Analysts believe that the current IPO valuation does not fully reflect TCBS’s long-term growth pillars. In addition to its financial foundation and operational efficiency, TCBS continues to expand its ecosystem with a strategic focus on pioneering technology, laying the groundwork for numerous new and promising business areas not yet included in the current valuation model.

First, the shift in Vietnamese investors’ asset allocation from real estate and bank deposits to financial investments is creating significant growth opportunities for products such as stocks, bonds, open-ended funds, and crypto assets. TCBS, with its well-established WealthTech platform, is well-positioned to capitalize on this trend.

Second, Vietnam’s financial market is expected to expand rapidly in the 2026-2030 period. The corporate bond market, currently accounting for about 12% of GDP (~USD 45 billion), is targeted to reach 25% of GDP by 2030 (~USD 163 billion). Simultaneously, the stock market is entering a new growth cycle, with a capitalization target of 120% of GDP by 2030. Meanwhile, the total margin lending outstanding across the market is currently about USD 11 billion, with the margin lending-to-market capitalization ratio at 4.5%. This ratio could increase to USD 35 billion in the next five years, triple the current level. TCBS already leads these markets and has attracted 50% of the domestic open-ended fund AUM transacted on its Fundmart platform, positioning it to benefit significantly from the expected market expansion.

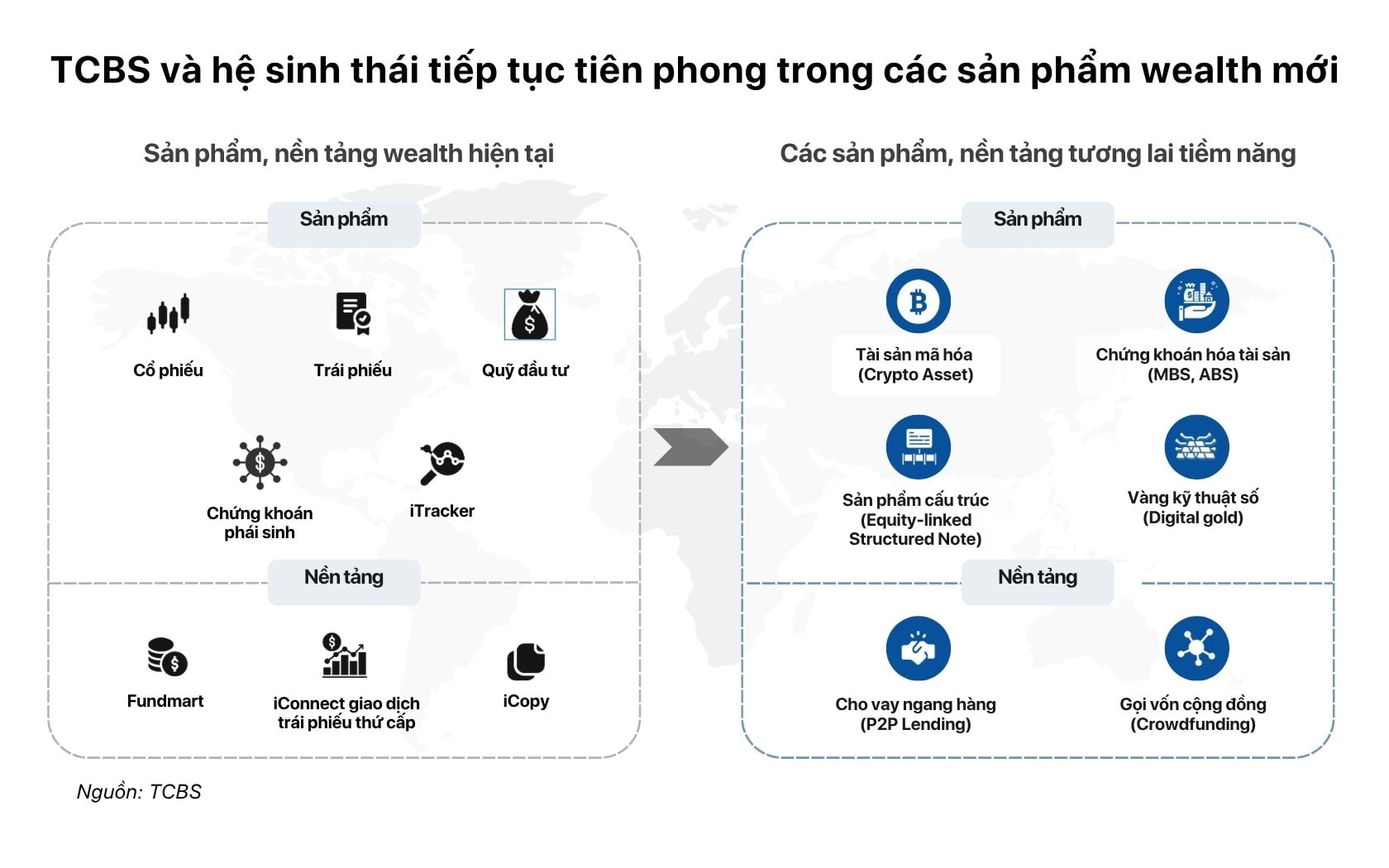

Third, TCBS is incubating several breakthrough projects , including crypto assets, crowdfunding, digital gold, structured products linked to stocks, peer-to-peer lending, and asset-backed securities (MBS/ABS). These are emerging markets, and TCBS has already pioneered the development of the operational foundation, ready for deployment when legal conditions permit. Expanding into these new areas will not only diversify revenue streams but also create significant room for stock re-rating in the near future.

TCBS is incubating multiple projects within the WealthTech ecosystem

Finally, after listing, TCBS shares are likely to be included in major indices such as VN30, VN Diamond, and FTSE Vietnam Index. These indices are closely monitored by many domestic and foreign ETFs and active investment funds. Inclusion in these indices will boost demand for TCBS shares and affirm its blue-chip status in the market.

In conclusion, the TCBS share price reflects not only its current performance but also encompasses multiple layers of long-term growth value not initially factored into its IPO valuation. With its current strengths and future preparations, TCBS deserves to be a leading stock in the WealthTech wave in Vietnam and an attractive choice for strategic investors.

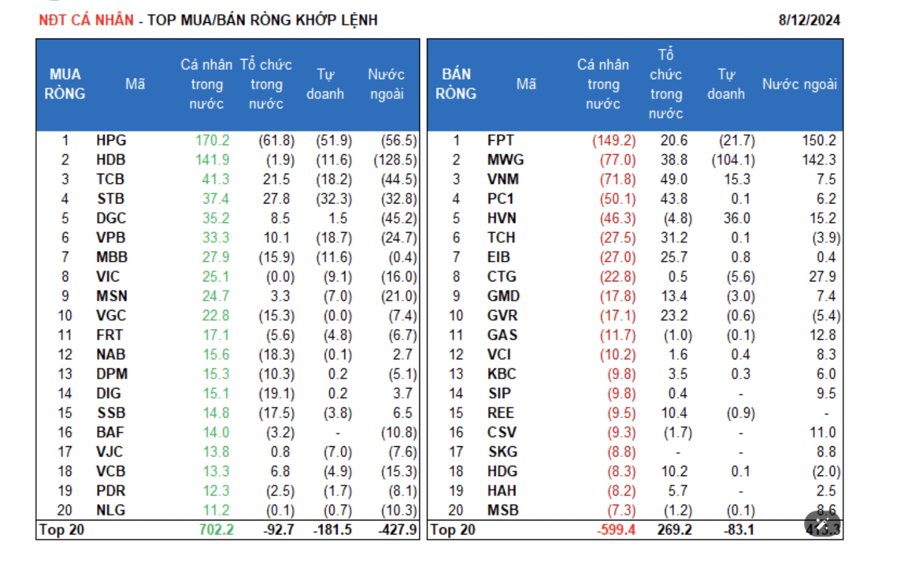

“Foreign Sell-Off Reaches New Heights: Over 10,000 Billion Liquidated – Which Stocks Are in the Eye of the Storm?”

The foreign investors showed strong buying interest in GEX stocks, with a net buy value of approximately VND 151 billion, while NVL stocks also witnessed a notable net inflow of VND 100 billion during today’s trading session.