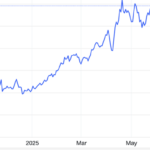

News just in that the US has imposed tariffs on imported 1kg gold bars, sending US gold futures to a record high.

As of 1 pm Vietnam time today, December 2025 gold futures rose 1.3% to $3,499.30 an ounce, after hitting an all-time high of $3,534.10. Spot gold also traded sideways at $3,394.36 an ounce. Gold prices have gained about 1% so far this week.

Following media reports that the US has imposed tariffs on imported 1kg gold bars, the spread between New York gold futures and spot prices widened to over $100. Financial Times reported that a document from the US Customs and Border Protection, dated July 31, stated that 1kg and 100-ounce gold bars should be classified under a higher tariff code. This move could impact Switzerland, the world’s largest gold refining center.

US Tariff Decision Impacts Gold Prices

Image: Bloomberg

The US decision to impose tariffs on 1kg gold bars contradicts the gold industry’s previous expectations that gold bars would be classified under a duty-free tariff code. In reality, 1kg gold bars are the most commonly traded type on the Comex exchange, one of the world’s largest gold trading platforms, and account for a significant portion of Switzerland’s gold bar exports to the US. Furthermore, gold is also one of Switzerland’s top exports to the US.

According to the Financial Times, as of June 2025, Switzerland had exported $61.5 billion worth of gold to the US. However, this gold will now be subject to an additional $24 billion in tariffs, based on the 39% retaliatory tariff rate imposed by the US on Swiss imports. The new tariff took effect on August 7, 2025.

Experts say that large gold bars are typically transported between London and New York via Switzerland, where they are melted down into various sizes. While London uses 400-troy-ounce bars, roughly the size of a brick, 1kg bars, about the size of a smartphone, are preferred in New York.

Brian Lan, CEO of GoldSilver Central in Singapore, commented that the tariff on gold bars will likely cause disruptions or issues with payments for major banks.

In the Vietnamese market, as of 4 pm on August 8, Saigon Jewelry Company (SJC) listed gold bar prices at VND 122.6-124 million per tael (buy-sell), an increase of VND 200,000 compared to the previous close. Other brands are also listing similar prices.

What Does the World Gold Council Say About Gold Prices?

Mr. Shaokai Fan, Regional CEO, Asia Pacific (ex-China) and Central Banks, World Gold Council. Source: WGC

At a press conference on August 7, Mr. Shaokai Fan, Regional CEO, Asia Pacific (ex-China) and Central Banks at the World Gold Council, stated that the Trump administration is one of the most unpredictable in history when it comes to policies and their impact. As a result, there remains a great deal of uncertainty surrounding trade agreements.

According to Mr. Fan, the world is currently focused on the trade tensions between the US and India, with tariffs much higher than initially anticipated. At the same time, the world awaits the final outcome of the US-China trade agreement. In reality, there are numerous aspects of the US-China relationship that will influence the gold market in the coming period. Therefore, trade remains unclear, and instability persists. Additionally, central banks still have room to cut interest rates, which will benefit gold in the coming period, not disadvantage it.

According to the expert, as the world becomes more unstable, gold is increasingly valued as an important asset in major global markets.

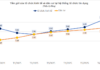

The World Gold Council predicts that global gold exchange-traded funds (ETFs) still have growth potential in the coming period. However, they may face short-term obstacles before recovering growth in the second half of the year. Central bank gold demand is also expected to continue to increase rapidly as gold prices become less of an obstacle in the latter half of the year.

Mr. Fan stated that investors will continue to pay attention to gold in the coming period. According to a recent World Gold Council survey, 95% of central bank reserve managers believe that the trend of increasing gold reserves will continue over the next 12 months. Additionally, 43% of the central banks surveyed indicated that they would continue to buy at a record pace over the next 12 months.

However, the short term remains unpredictable, as the gold market’s performance depends heavily on how India and China invest in gold bars and coins and the resolution of trade tensions. Moreover, the gold market also depends on the final outcome of trade negotiations between the US and China. An unexpected factor is the higher-than-expected US tariffs on India, which will boost gold investment demand in India. However, according to the World Gold Council, we need to wait for further developments.

Why is the Gold Price in Vietnam Higher than the World Price?

Gold prices hit a new record high on August 8. Image: FT

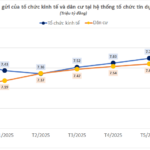

According to a recent report by the World Gold Council, total gold demand in the second quarter reached 1,249 tons, up 3% from the same period in 2024, as gold prices rose. Central banks continued to buy gold, adding 166 tons in the second quarter. The National Bank of Poland continued to lead gold purchases, buying 19 tons, while the Central Bank of Turkey bought 11 tons, nearly doubling the first quarter’s increase…

However, Vietnam is an exception. According to the Global Central Bank Director at the World Gold Council, the depreciation of the domestic currency and the appreciation of the US dollar have caused domestic gold prices to soar to record highs. The reason for the higher gold prices in Vietnam compared to the world is due to limited supply and high demand.

Sharing with Thanh Nien newspaper, the World Gold Council expert emphasized that, to narrow the gold price gap, the immediate and effective solution is to relax gold import regulations. Increasing the gold supply through imports will positively impact reducing the gold price gap. Additionally, establishing a gold exchange will help align domestic gold prices with world prices.

Mr. Fan emphasized that considering the possibility of narrowing the gold price gap between Vietnam and the world is essential when investors consider investing in gold. However, much depends on the nature, extent, and policy changes in Vietnam going forward.

The Price of Gold Treads Water as SPDR Gold Trust Dumps Holdings

“After several consecutive buying sessions, SPDR Gold Trust has just witnessed a significant bout of selling.”