The list of Voting Council members will be announced after the scoring process is completed to ensure independence and objectivity in the evaluation process.

Financial Institutions – A Dual Pillar in IR Evaluation

In the capital market ecosystem, financial institutions, including securities companies (sell-side) and investment funds (buy-side), are not only intermediaries in capital mobilization but also play a crucial role in establishing transparency standards.

The involvement of these financial institutions is a key factor in ensuring professionalism and comprehensiveness in the IR evaluation process of listed companies.

Financial institutions play a dual role:

– Sell-side: Analyzing companies and issuing investment recommendations to support individual investors in their decision-making process.

– Buy-side: Representing large investment fund managers, making direct buying and selling decisions, and significantly influencing market trends.

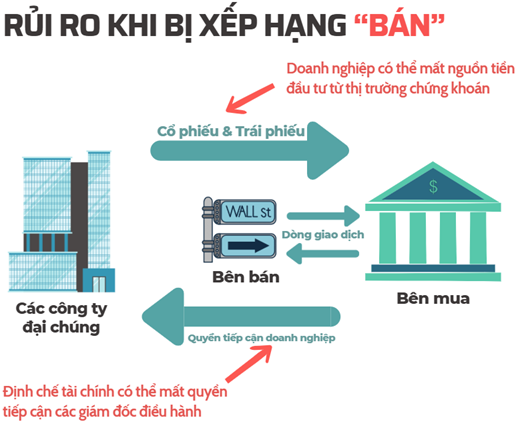

According to Forbes, financial analysts often use a three-tier rating system: Buy – Hold – Sell. A downgrade can lead to significant changes in stock valuation, market confidence, and capital-raising opportunities.

Source: Forbes

|

IR Evaluation Based on 7 Pillars of Expertise

In the category of “Highest Rated by Financial Institutions,” nearly 40 professional investment organizations will participate in scoring listed companies across 4 capitalization groups: Financial Large Cap, Non-Financial Large Cap, Mid Cap, and Small Cap. The nominated companies have already excelled in the previous two quantitative survey rounds.

IR activities are assessed based on 7 pillars of expertise:

1. Information Disclosure Quality

2. IR/Shareholder Relations Website

3. Financial Communications

4. Corporate Governance and IR Strategy

5. IR Events

6. IR Engagement with Financial Institutions

7. Equity Issuance

IR Awards 2025 Ceremony – Connecting Businesses with Market Expectations

The IR Awards 2025 Ceremony, to be held in Ho Chi Minh City in September, will officially announce the companies with the best IR practices based on independent evaluations from financial institutions and votes from the community of individual investors.

Organized annually since 2011, IR Awards is a program by Vietstock, in collaboration with VAFE Association and FiLi Electronic Magazine, to honor companies with outstanding IR practices in Vietnam’s stock market.

More than just an awards ceremony, the program aims to promote the professionalization of IR activities, enhance transparency standards, strengthen investor confidence, and support businesses in effectively raising long-term capital.

IR Awards 2025 Organizing Committee

– 08:00 09/08/2025

A New Era of Collaboration with Africa

Chairman Luong Cuong’s visit to Egypt and Angola served a dual purpose: to elevate Vietnam’s relationships with these key regional partners to new heights and to reinforce the important message of our Party and State’s policy towards the African continent as a whole.

“Engaging with the ‘Japanese Banking Giant’: PM’s Vision for an 11-Nation Community with a Pan-Asian Mission”

“This thriving community boasts an impressive 11 partner nations, each bringing their own unique strengths and perspectives to the table. With such a diverse range of contributors, this community is poised to become a hub of innovation and collaboration, fostering growth and opportunity for all involved.”

Hundreds of Proposals from Businesses at the Local Round of the 2025 Private Economic Forum: Many Issues Addressed Promptly.

The local dialogue sessions have garnered a wealth of insights and proposals from the business community, all aimed at fostering the growth of the private economic sector in this new era.

‘Mega-Project’ $20 Billion Petrochemical Refinery: Avoiding Past Pitfalls

The construction of the Dung Quat National Petrochemical and Energy Center, with a staggering investment of over $20 billion, is a testament to the capabilities of Vietnamese enterprises. This ambitious project serves as a pivotal milestone, testing the mettle of local businesses in terms of execution and operational prowess.