Prime Minister Pham Minh Chinh.

Prime Minister Pham Minh Chinh has just signed Official Dispatch No. 128/CD-TTg dated August 6, 2025, requesting ministries, sectors, and localities to implement several important tasks and solutions to promote growth, control inflation, and stabilize the macro-economy, ensuring the major balances of the economy.

In the first seven months of 2025, Vietnam’s socio-economic situation achieved many important and positive results in almost all fields. Many key indicators on growth, production and business, enterprises, state budget revenue, investment, exports, consumption, and more continued their positive trends, with each month and quarter performing better than the previous one. However, compared to the goals and requirements, we must strive and work harder, especially in terms of renewing our thinking and taking more decisive, focused, and result-oriented actions.

For the remaining months of 2025, the government’s goals, directions, and management focus on continuing to prioritize promoting growth in tandem with maintaining macro-economic stability, curbing inflation, ensuring the major balances of the economy, and keeping the budget deficit and public debt within the limits permitted by the National Assembly. We are determined to strive for an economic growth rate of 8.3-8.5% for 2025 and to keep the average consumer price index (CPI) increase below 4.5% for the year. At the same time, we aim to continue enhancing the material and spiritual life of the people.

To achieve the above goals, specific and feasible solutions are needed to increase resources for production and business activities. The Prime Minister requests the State Bank of Vietnam to take the lead and coordinate with relevant agencies:

a) Closely monitor the economic situation and growth scenarios, both domestically and internationally, to proactively, flexibly, timely, and effectively manage monetary policy. This should be in line with macro-economic developments and monetary policy goals as per the Government’s Resolution No. 154/NQ-CP dated May 31, 2025, the resolutions of the regular Government meetings, and the Prime Minister’s directives. It should also be harmoniously coordinated with fiscal and other macro-policies to contribute to promoting growth while controlling inflation according to the set targets, stabilizing the macro-economy, ensuring the major balances of the economy, and meeting the capital needs of the people and businesses.

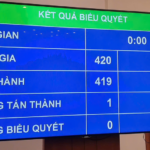

b) Expedite the development of a roadmap and pilot the removal of credit growth targets, with implementation from 2026 onwards. This should include setting standards and criteria for credit institutions to operate effectively and healthily, with good governance and management, compliance with safety ratios in banking activities, and high-quality credit indices. Ensure transparency and accountability, with the State Bank of Vietnam taking responsibility for inspection, supervision, and post-inspection to prevent systemic risks, ensure the security and safety of the credit institution system, and control inflation according to the set targets.

c) Strive to achieve the highest possible results in the “Project on Restructuring the System of Credit Institutions in Association with Handling Bad Debts in the 2021-2025 Period” as approved by the Prime Minister in Decision No. 689/QD-TTg dated June 8, 2022. Focus on intensifying bad debt handling and implementing measures to tightly control credit in potential risk areas, improve credit quality, and minimize new bad debts, ensuring safe and healthy credit growth in tandem with tight control over bad debts.

d) Strengthen the monitoring, inspection, and comprehensive supervision of credit institutions’ activities; prevent, inspect, supervise, and strictly handle in accordance with the law any acts of manipulation, cross-ownership, providing credit to unhealthy “backyard” enterprises or ecosystem-related enterprises, and lending to leaders, managers, and related individuals in violation of regulations. Ensure the safety and security of the banking system and the national monetary security.

d) Continue to direct credit institutions to cut costs, simplify administrative procedures, and promote digital transformation to create more space for reducing lending interest rates. Support production and business activities of enterprises and people with the spirit of “harmonious interests and shared risks”. Orient credit capital towards priority areas and traditional growth drivers of the economy (investment, export, consumption) as well as new growth drivers (science and technology, innovation, digital economy, green economy, circular economy, etc.) in line with the Government’s policies. Ensure safe and effective credit growth.

e) Review, build, and promptly supplement preferential mechanisms and policies to effectively and vigorously implement the credit program for young people under 35 years old to buy, rent, or rent-to-own social housing. Effectively implement the VND 500,000 billion credit program for businesses investing in infrastructure, science and technology, innovation, and digital transformation. Ensure that policies are implemented in a timely and effective manner, without formalities, and that disbursement is done when funds are available.

g) Expedite the development of a monetary policy management plan for the last months of 2025 and for 2026, reporting to the Government before August 30, 2025.

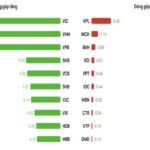

“Undervalued Bank Stocks with Positive Growth Prospects Attract Cash Flow.”

“In the past 1-3 months, a select few bank stocks have witnessed an impressive surge, with gains of several dozen percentage points. These stocks share common traits: they boast low to medium price-to-book ratios compared to the industry average, exhibit improved financial indicators, and possess unique catalysts that set them apart. These factors have likely contributed to their outstanding performance, outpacing their peers in the banking sector.”

Prime Minister Directs SBV to Pilot Removal of Credit Growth Targets from 2026 Onwards

The latest dispatch from the Prime Minister’s office, Directive 128/CD-TTg dated August 6, 2025, is a significant development. It mandates various ministries, sectors, and localities to implement crucial tasks and solutions to boost growth, curb inflation, stabilize the macro-economy, and ensure the broader economic balance.