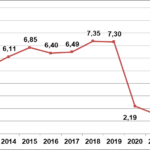

In Q2 of 2025, Vietnam’s GDP grew impressively by 8.0%. However, the consumer goods industry faced a significant adjustment as new tax regulations disrupted the operations of tens of thousands of individual business households, the backbone of traditional trade channels. Simultaneously, the prevalence of counterfeit and imitation products in rural areas made consumers more cautious about small retail outlets.

Against this backdrop, modern retail systems with advantages in traceability, quality management, and shopping spaces are becoming trusted destinations. The shift from traditional trade to modern trade (MT) channels is more evident than ever, not only in urban but also in rural areas, covering over 60% of Vietnam’s population. This is not merely a change in shopping channels but a step towards modern, safer, and more transparent consumption expectations.

Expanding Rural Outlets

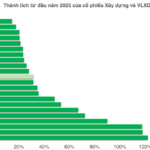

In this context, WinCommerce (WCM) emerges as a pioneer in modernizing Vietnam’s retail industry. As of June 2025, WCM operated 4,146 supermarkets and stores nationwide, with nearly 75% of new stores in rural areas, especially in Central Vietnam, the fastest-growing region.

Despite Q2 being a low consumption period, WCM’s revenue grew by 16.4% year-on-year, reaching VND 9,130 billion. A remarkable 83.1% increase in EBITDA reflected efficient operations. This was the fourth consecutive profitable quarter for WCM, attributable to superior operations and effective network expansion strategies. Notably, WinMart+ stores in rural areas achieved almost the same average revenue as those in urban areas (90%), up from 80% in the previous year, indicating stimulated demand with the introduction of modern retail infrastructure.

During this period, WinMart+ stores recorded a 15.6% growth, remaining the fastest-growing segment. Many new stores became profitable in the first half of the year, indicating that WinCommerce has successfully navigated the transition to a new model.

Consumer Experience: No Longer Exclusive to Cities

Beyond improving consumer access, the more significant transformation lies in the consumer experience. In many provinces like Nghe An, Ha Tinh, and Quang Ngai, shopping at nearby supermarkets with traceable and quality-assured products is becoming the preferred choice.

A key differentiator for WinMart+ is its ecosystem of high-quality domestic products, notably MEATDeli and WinEco, two brands specializing in fresh produce and agricultural products. As consumers in rural areas can now access European-standard packaged meat or VietGAP and Global GAP-certified fruits and vegetables at their local stores, a new consumption standard is being set.

“In the past, we were afraid of buying fake and counterfeit candies in the countryside. Now, with WinMart+ nearby, I feel much more secure,” shared Ms. Hong Nga from Nghe An. Mr. Thanh Trung from Ha Tinh also remarked, “The supermarket is clean, offering MEATDeli meat and WinEco vegetables with clear origins. Shopping here feels like I’m in the city, but the prices are still reasonable.”

Evidently, rural consumers are no strangers to the concept of “supermarket shopping,” which was once associated with urban areas. As demands for food safety, traceability, and civilized shopping experiences increase, modern retail will dominate the market in the coming years.

With a population of over 100 million, Vietnam is one of the most attractive retail markets in Asia. However, the retail infrastructure, especially in rural areas, still has significant gaps. Investments by companies like WinCommerce in network expansion and consumer experience improvements in remote areas benefit not only the business but also play a crucial role in modernizing the nation’s retail infrastructure and enhancing the shopping experience for all Vietnamese consumers.

Accelerating New Store Openings, WinCommerce Profitable for the Fourth Consecutive Quarter

WinCommerce continues to thrive and profit for the fourth consecutive quarter, attributing its success to a robust expansion strategy targeting rural areas. By proactively embracing modern consumer trends and catering to the challenges faced by traditional channels, WinCommerce has effectively positioned itself at the forefront of the industry.

“Vietnam’s Economy Surges Past Expectations in 2024: On Track to Lead ASEAN in the Coming Year?”

In 2024, Vietnam’s GDP is estimated to grow by 7.09%. This projected growth showcases the country’s thriving economy and highlights its potential as an emerging market. With a population of over 90 million and a rapidly developing landscape, Vietnam presents a plethora of opportunities for businesses and investors alike. The country’s economic expansion opens doors for new ventures, trade partnerships, and innovative endeavors, making it a captivating prospect for those seeking lucrative opportunities in Asia.

“Sense City: A Decade of Driving Local Economic Growth”

With the inaugural Sense City mall in Can Tho as its ‘launchpad’, Saigon Co.op’s network of shopping centers has, over the past decade, been lauded for its positive impact on the economies of the regions it serves.