At the Government press conference on August 7, Deputy Minister of Finance Nguyen Duc Chi answered the press about the issue of the personal income tax exemption amount in the draft Law on Personal Income Tax (amended).

Deputy Minister of Finance Nguyen Duc Chi

According to the Deputy Minister, during the drafting process, experts and professionals proposed several options to determine the personal income tax exemption amount, including calculations based on regions and areas.

“We believe that if we consider dividing the exemption amount by region, there will be limitations and difficulties in implementation,” said Mr. Nguyen Duc Chi.

Specifically, even within a province or city, different areas have varying living costs and require different considerations for personal income tax exemption amounts, which can be significantly diverse.

For example, in Ho Chi Minh City or Hanoi, the core urban areas have very high living costs, while the rural areas have lower living expenses and personal living costs.

Therefore, in the latest draft, the Ministry of Finance proposed two options for calculating the exemption amount: based on the CPI as currently applied or based on the growth rate of per capita income.

In an earlier interview with NLD reporters, Dr. Nguyen Quoc Viet, a lecturer at the University of Economics – Vietnam National University, Hanoi, opined that adjusting the personal income tax exemption amount solely based on a 20% increase in the CPI threshold, as is currently practiced, has become outdated and no longer suitable.

He suggested that the personal income tax policy should be built on regularly measured indices that closely reflect the actual living standards and conditions of the people, instead of relying solely on a general index like the CPI.

The expert also recommended that the reform should be implemented synchronously within the framework of amending the Law on Personal Income Tax, instead of issuing a temporary resolution.

A notable proposal from Dr. Viet is to determine the personal income tax exemption amount based on the regional minimum wage, that is, using the minimum wage as a basis and multiplying it by a reasonable coefficient to arrive at an appropriate exemption amount for each region.

This option, according to Dr. Viet, is both scientific and reflective of the differences in living costs across regions.

In addition, the regional minimum wage also needs to be regularly adjusted to reflect the cost of living in each locality and can even serve as a reasonable basis for designing a more equitable tax policy.

Previously, as reported by NLD, the Ministry of Finance is developing a draft resolution of the Standing Committee of the National Assembly (NA) to adjust the personal income tax exemption amount from the 2026 tax period.

The draft resolution has proposed two options for the exemption amount. Option 1: The exemption amount for taxpayers is VND 13.3 million/month (VND 159.6 million/year), and the exemption amount for each dependent is VND 5.3 million/month.

Option 2: The exemption amount for taxpayers is VND 15.5 million/month (VND 186 million/year), and the exemption amount for each dependent is VND 6.2 million/month.

According to the current regulations, the personal income tax exemption amount for individuals is VND 11 million/month, and the exemption amount for each dependent is VND 4.4 million/month, which has been in effect since July 2020.

Thus, in Option 1, the personal income tax exemption amount for taxpayers will increase by VND 2.3 million/month, and for dependents by VND 0.9 million/month. Option 2 will increase the exemption amount for taxpayers by VND 4.5 million/month and for dependents by VND 1.8 million.

The Tax Conundrum: Trapped in a 30sqm Home, While Thousand-Hectare Projects Remain Untouched

The expert pointed out an unfair and distorted situation: residents living in 30-50 sq. m houses have to pay land use tax annually, while investors holding thousands of hectares of land for 20 years without any development, leaving it overgrown with weeds, are exempt from such taxes. This discrepancy cries out for a market-oriented and equitable solution.

The Vice-Premier: Clampdown on Unreasonable Price Gouging

Vice Prime Minister Ho Duc Phoc emphasizes the importance of effective implementation and monitoring of pricing policies, including price declaration, listing, and transparency. He also underscores the need to address unreasonable price hikes that disrupt market stability with appropriate measures.

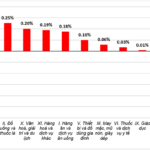

The CPI for the first seven months is estimated to increase by 3.2-3.3%.

The Ministry of Finance reports that the consumer price index (CPI) for the first seven months of the year is estimated to have increased by 3.2-3.3% compared to the same period last year. This is an appropriate level that supports economic growth, especially as resources are being focused on achieving the highest possible economic expansion. Vietnam’s inflation is being carefully managed within the target range set by the National Assembly and the Government of 4.5-5%, contributing to macroeconomic stability.

“US Tax Cut Creates Competitive Pressure, Says Vinatex”

The reduction of tariffs on exports to the US from 46% to 20% is undoubtedly positive news, but Vinatex remains vigilant about the intense competition, complex rules of origin, and stringent quality standards that lie ahead. The company is aware that maintaining orders and employment stability for the remainder of 2025 will be a challenging endeavor.