The morning’s aggressive clearance sale caused the VN-Index to plunge as much as 16 points (-1.03%) at one point, signaling what seemed like an unsuccessful Friday session. However, bottom-fishing funds continued to flow in the afternoon, pulling the index up by 3.14 points (+0.2%) at the close.

The recovery of the index was, of course, largely influenced by large-cap stocks, but bottom-fishing activities were also widespread. The clearest evidence is that while the VN-Index breadth at the bottom had only 92 gainers/214 losers, it ended with 177 gainers/155 losers. If it were purely a matter of pulling a few large caps to boost the score, such a balanced breadth could not have been achieved.

The three stocks with the most significant impact in the large-cap group were VIC, VPB, and GAS. Among these, VPB staged the most impressive comeback. All morning, VPB plummeted from a peak of a 2.07% increase right after the market opened to a 3.28% loss before the lunch break. The entire afternoon saw a reversal: the price recovered to the morning’s peak, rising 2.07% from the reference price. VPB’s liquidity was among the top five most traded stocks in the market today, reaching VND 1,303.1 billion.

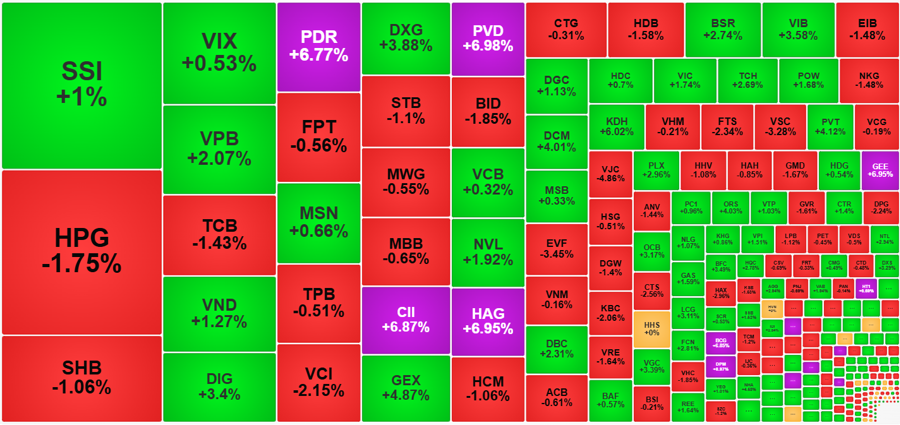

In the remaining stocks, VIC rose 1.74%, and GAS increased by 1.59%, being the only two notable gainers among the top-capitalized stocks. VHM, BID, TCB, CTG, HPG, and MBB were in the red, with BID falling by 1.85%, TCB by 1.43%, and HPG by 1.75%. The VN30 basket had only 11 gainers/18 losers, and the representative index even fell by 0.33% from the reference price. Some mid-cap stocks in this basket, such as VIB, PLX, SSB, and DGC, also rose by more than 1%, but their impact on the score was very limited. In contrast, the declining side of the basket included up to 10 stocks falling by more than 1%, many of which belonged to the largest capitalization group.

The rest of the market also experienced significant volatility with a large amplitude – the breadth of the HoSE floor clearly reflected this – but there was also a good recovery in the end. However, buying power was uneven. Of the 177 green codes at the close, 104 stocks recorded an increase of more than 1%, and about 35 codes traded in the hundreds of billions of VND in liquidity. PDR, CII, PVD, HAG, and GEE were the ceiling-priced stocks with excellent liquidity. The lower-liquidity group included DPM, BIC, TCD, TDC, OGC, HTN, BCG, and HT1, which also hit the ceiling.

The rest were mainly in the Midcap group, with the VN30 basket contributing only seven codes. VND and DIG were two stocks with liquidity exceeding one thousand billion VND, with prices rising sharply by 1.27% and 3.4%, respectively. DXG, GEX, NVL, BSR, DCM, DBC, TCH, POW, and KDH were the remaining stocks with matching orders of over 300 billion VND. The Midcap index closed up 1.05%, outperforming all other capitalization group indices. Liquidity in this group also increased by 25.5% compared to the previous day, while VN30 and Smallcap rose by 3.4% and 9.4%, respectively.

On the downside, the buying power to pull the market back up was also quite effective. At its worst, the HoSE floor had up to 193 stocks falling by more than 1% from the reference price, but at the close, only 77 codes remained in negative territory. However, the selling pressure to lower prices could not be taken lightly. Although there were only 77 stocks, their liquidity still accounted for about 32% of the total matching value on this floor. Dozens of codes saw large transactions, even in the trillions of VND, such as HPG falling by 1.75%, SHB by 1.06%, and TCB by 1.43%. Others like VCI, down 2.15%, EIB down 1.48%, EVF down 3.45%, FTS down 2.34%, and VSC down 3.28%… also traded in the hundreds of billions of VND each.

Foreign investors resumed net selling today, focusing on the morning session. In the afternoon, this group recorded a net buy of VND 146.3 billion, while in the morning, they net sold VND 980.1 billion. The most sold codes were BID -216 billion, SSI -202.1 billion, HPG -148.6 billion, FPT -134.1 billion, VCB -105.8 billion, and VRE -97.4 billion… Just the VN30 basket saw a net sell of VND 902.7 billion today. On the net buying side, there were VPB +224.7 billion, GEX +132.2 billion, CII +124.7 billion, DCM +123.4 billion, PDR +82 billion, VIC +79.4 billion, and PVD +75 billion…

Stock Market Outlook for Tomorrow, August 8: As VN-Index Hits New Highs, What Should Investors Do?

Despite the sell-off pressure in the session on August 7-8 not being too significant, Dragon Vietnam Securities Joint Stock Company forecasts that the session on August 8 will see strong competition between supply and demand for stocks.

“WCS Shares 20% Profit, Hits Quarterly Earnings Peak as HNX’s Priciest Stock”

In Q2 of 2025, Western Bus Terminal Joint Stock Company (HNX: WCS) reported a record-breaking profit of over VND 22 billion. The company also announced a 20% stock dividend, increasing its charter capital to VND 30 billion to meet the minimum capital requirements for public companies. WCS’s share price soared to VND 411,000 per share, the highest on the HNX exchange.

Market Beat: VN-Index Recovers in Afternoon Trade, Energy Stocks Shine

The trading session concluded on a positive note, with the VN-Index climbing 3.14 points (+0.2%) to reach 1,584.95, while the HNX-Index rose 1.6 points (+0.59%) to 272.46. The market breadth tilted slightly in favor of advancers, as 439 stocks gained compared to 363 decliners. However, the large-cap VN30 index painted a different picture, with 18 stocks closing lower, 11 advancing, and one remaining unchanged, resulting in a sea of red.