F88 Makes a Grand Entrance on UPCoM, Soaring Past Veterans in Market Capitalization

On August 8, 2025, Vietnam’s stock market witnessed a remarkable debut as F88 Investment Joint Stock Company (Stock Code: F88) listed 8.26 million shares on the UPCoM exchange at a staggering price of VND 634,900 per share, triple the company’s book value as of the end of 2024 (VND 209,062 per share).

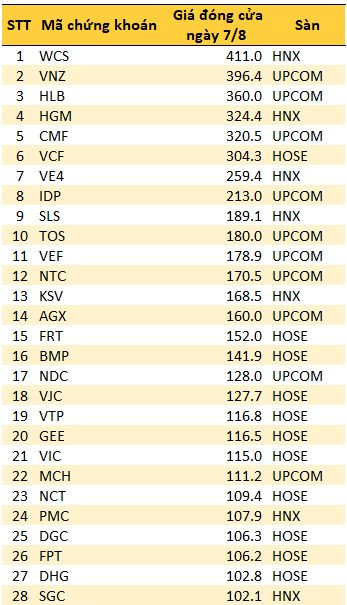

With this pricing, F88 has instantly surpassed veteran companies such as Western Bus Station (WCS – VND 411,000) and VNG (VNZ – VND 396,400) in terms of share price across the entire Vietnamese stock market. The company’s market capitalization at the reference price is estimated at nearly VND 5,250 billion.

F88’s impressive market debut

The hype surrounding F88 was evident even before its listing, with OTC (over-the-counter) market investors trading the shares at prices ranging from VND 900,000 to VND 1,000,000.

On its first trading day on UPCoM, the stock soared to the maximum allowed limit of 40%, reaching a price of VND 888,800 per share, corresponding to a market capitalization of nearly VND 7,300 billion.

While Vietnam’s stock market has seen shares of VNG trading above the VND 1,000,000 mark in the past, as of August 7, VNZ’s price stood at VND 396,400 per share.

Furthermore, F88 has ambitious plans for a substantial capital increase. The company’s General Meeting of Shareholders approved a strategy to issue shares to increase capital from owner equity (bonus shares) for existing shareholders at a ratio of 1:12, to be executed after the completion of the ESOP share issuance program with a maximum ratio of 2.5%.

This share split will increase F88’s charter capital to over VND 1,100 billion and adjust the share price to a level that Mr. Phung Anh Tuan, Chairman of F88’s Board of Directors, believes will be more ‘accessible’ to investors.

At today’s ceiling price of VND 888,800, the share price after the split is expected to adjust to around VND 68,000 per share.

Even with a post-split price of over VND 130,000 per share, F88 would still remain in the exclusive “club” of stocks with a share price above VND 100,000.

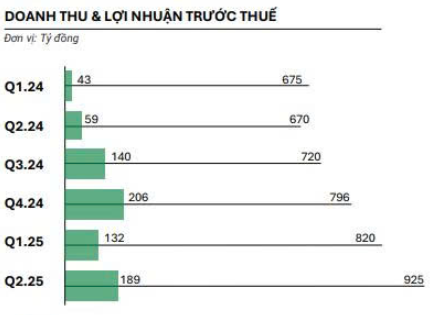

Prior to its listing, F88 made a remarkable turnaround in 2024, recording a profit after tax of VND 351.3 billion for the parent company, compared to a loss of over VND 545 billion in 2023.

The company has set an ambitious profit after tax target of VND 538.6 billion for 2025, representing a 53% growth compared to the previous year.

F88’s impressive turnaround and future prospects

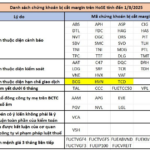

Adding TAL Stock to the List of Margin-Ineligible Securities: A Strategic Move by HOSE

The Ho Chi Minh Stock Exchange (HoSE) has announced that it will add the ticker symbol TAL, representing Taseco Real Estate Investment Joint Stock Company, to the list of securities ineligible for margin trading. This decision has been made due to the company’s short listing period of less than six months.

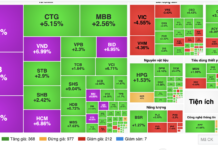

HOSE Updates August Margin Cuts: 62 Tickers Including HAG, NVL, LDG, BCG, and HVN Make the No-Margin List.

“As per the new regulations, investors will no longer be able to utilize the margin credit facility provided by brokerage firms to purchase these 62 specific stocks. This means that investors will have to rely on their own funds or other sources of financing if they wish to invest in these particular securities.”