The market witnessed significant profit-taking activities, but the selling pressure wasn’t strong enough to drive down stock prices as bottom-fishing funds remained robust. Additionally, the VN Index’s resilience contributed to a potential recovery.

Sellers were active early on, with the morning session witnessing a selling spree on the Ho Chi Minh Stock Exchange, resulting in a turnover of around VND 25.9 trillion. The VN Index dipped by over 1% at one point but rebounded strongly in the afternoon, with a turnover of VND 21.9 trillion. Hundreds of stocks surged, reversing the downward trend and closing above the reference level.

With a combined matching order value of over VND 52.9 trillion on the Ho Chi Minh and Hanoi Stock Exchanges and a wide range of fluctuations, the market experienced significant conflicts in perspectives. Several stocks exhibited dramatic fluctuations, such as VPB, which fluctuated by 5.54% in a single day, with a turnover of over VND 1,300 billion. Since the beginning of July, this stock has surged by more than 60%, and each time it experiences a shake-up, large amounts of money continue to flow in. GEE reversed its nearly 5.6% loss and hit the ceiling, fluctuating by 13.3% during the day. PDR also rebounded from a 1% loss to hit the ceiling, fluctuating by 7.85%… The high liquidity of these stocks indicates intense capital inflows and outflows.

To achieve such wide fluctuations and high liquidity, many investors must have decided to exit their positions. These are investors who are content with their current profits. On the other hand, the strong rebound in the afternoon indicates that many others anticipate further price increases. From this perspective, the range of fluctuations, the direction of fluctuations, and the closing prices reflect which side emerged victorious in this battle of supply and demand. Stocks with enthusiastic capital inflows stood out.

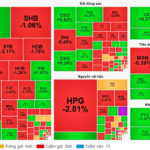

Conversely, not all stocks emerged victorious in this supply-and-demand contest. The market exhibited clearer differentiation than the previous day, despite minimal changes in the index. This type of fluctuation is unlikely to persist, and soon, stocks witnessing capital outflows will likely undergo noticeable corrections.

The VN30 stocks are showing signs of exhaustion in this contest, with only a few stocks, such as VPB and VIB, exhibiting breakthrough potential. The VN30 Index even turned red today, with the number of declining stocks dominating. However, this group managed to balance the index, and this equilibrium is sufficient for capital flows to create waves in the penny and midcap groups.

Currently, the focus is on individual stocks and their respective capital flows, rather than the VN Index, as long as the downward amplitude remains modest. The intraday pullback rallies are instilling a sense of reassurance among investors. However, this habit also poses a risk.

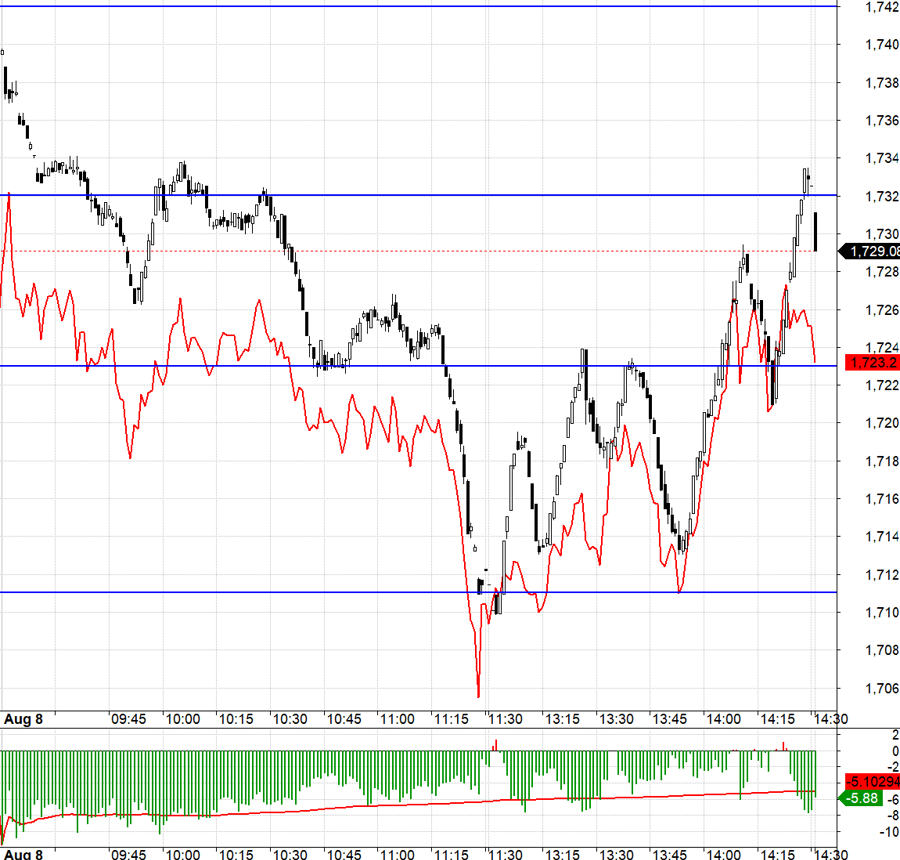

The derivatives market is influenced by blue chips, resulting in significant fluctuations. The levels of 1732.xx and 1723.xx offer safe short-selling opportunities, despite the basis loss. In such cases, it’s crucial to monitor the pressure exerted by the pillars because at each support/resistance level, a “push” of the pillar can easily break the level. Recovery trading is more challenging; the first rebound from 1711.xx back to 1723.xx was unstable, and it was only on the second test of 1711.xx that clear momentum emerged.

As the blue-chip group is showing signs of weakness, the upward momentum of the index is likely to remain slow or stagnant, with only specific stocks experiencing significant waves. The perspective remains unchanged, suggesting that investors take a break and conserve their energy for the next phase, as derivatives trading is more manageable at this point.

The VN30 closed today at 1729.08. The nearest resistance levels for the next session are 1733, 1742, 1758, 1764, 1771, and 1783. The support levels are 1722, 1711, 1698, 1690, and 1684.

“Blog Securities” reflects the personal perspective of the investor and does not represent the views of VnEconomy. The opinions and assessments expressed are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published opinions and investment perspectives.

“WCS Shares 20% Profit, Hits Quarterly Earnings Peak as HNX’s Priciest Stock”

In Q2 of 2025, Western Bus Terminal Joint Stock Company (HNX: WCS) reported a record-breaking profit of over VND 22 billion. The company also announced a 20% stock dividend, increasing its charter capital to VND 30 billion to meet the minimum capital requirements for public companies. WCS’s share price soared to VND 411,000 per share, the highest on the HNX exchange.

Market Beat: VN-Index Recovers in Afternoon Trade, Energy Stocks Shine

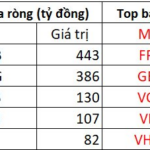

The trading session concluded on a positive note, with the VN-Index climbing 3.14 points (+0.2%) to reach 1,584.95, while the HNX-Index rose 1.6 points (+0.59%) to 272.46. The market breadth tilted slightly in favor of advancers, as 439 stocks gained compared to 363 decliners. However, the large-cap VN30 index painted a different picture, with 18 stocks closing lower, 11 advancing, and one remaining unchanged, resulting in a sea of red.

“High-End Demand Weakens, Market Awaits Massive “Account Shock” Influx”

The morning session witnessed a notable dip in excitement, possibly due in part to concerns over the massive volume of stocks on August 5th and their settlement on the afternoon of the same day. Both the VN-Index and stock prices peaked early on, only to gradually weaken as trading volume increased by nearly 9% compared to yesterday’s morning session.