Taseco Real Estate Investment Joint Stock Company (Taseco Land, code: TAL) has approved August 19, 2025, as the record date to seek shareholders’ approval via written resolutions.

Accordingly, shareholders will consider the plan to issue private placement shares to professional securities investors. The time and venue for the implementation, as well as the detailed issuance plan, have not yet been announced by Taseco Land.

Taseco Land plans to issue private placement shares following the first trading session of TAL shares on HoSE on August 1, 2025.

The company’s transfer to HoSE was approved by shareholders at the 2025 Annual General Meeting of Shareholders held on April 21, 2025. As of now, the parent company, Taseco Group Joint Stock Company (TASC), holds 72.89% of TAL shares.

In terms of business performance, in the second quarter of 2025, Taseco Land recorded net revenue of VND 557 billion, a decrease of 11.5% compared to the same period last year. Thanks to a 19% reduction in cost of goods sold, gross profit increased by VND 15 billion to VND 185 billion.

During the quarter, the company’s financial expenses decreased by 36% to VND 51.2 billion, offsetting the threefold increase in selling expenses, which amounted to VND 34 billion.

As a result, Taseco Land reported an after-tax profit of VND 37.6 billion, 5.4 times higher than the same period last year.

For the first six months of 2025, Taseco Land recorded net revenue of VND 933 billion, a slight decrease of VND 6 billion. Due to improved gross profit margin, the company’s after-tax profit reached VND 60 billion, 3.51 times higher than the same period in 2024.

According to the 2025 plan, Taseco Land targets consolidated revenue of VND 4,332 billion and after-tax profit of VND 536 billion. The real estate segment is expected to contribute VND 3,709 billion, construction VND 239 billion, and services – industrial infrastructure VND 384 billion.

155 Masan Employees Get a Great Deal on ESOP Shares

“Masan has concluded its distribution of 7.56 million ESOP shares to 155 employees. The offering price was VND 10,000 per share, a significant 86% discount on the market price. This move underscores Masan’s commitment to recognizing and rewarding its talented workforce, fostering a culture of ownership and long-term commitment to the company’s success.”

“High-End Demand Weakens, Market Awaits Massive “Account Shock” Influx”

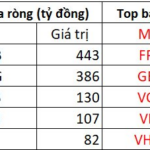

The morning session witnessed a notable dip in excitement, possibly due in part to concerns over the massive volume of stocks on August 5th and their settlement on the afternoon of the same day. Both the VN-Index and stock prices peaked early on, only to gradually weaken as trading volume increased by nearly 9% compared to yesterday’s morning session.

Adding TAL Stock to the List of Margin-Ineligible Securities: A Strategic Move by HOSE

The Ho Chi Minh Stock Exchange (HoSE) has announced that it will add the ticker symbol TAL, representing Taseco Real Estate Investment Joint Stock Company, to the list of securities ineligible for margin trading. This decision has been made due to the company’s short listing period of less than six months.