There are speculations that the trade tensions between the US and other countries have cooled down, and central banks have run out of room to cut interest rates further. As a result, by the end of the year, gold prices could plummet to the $3,000/ounce level.

Mr. Shaokai Fan, Regional Manager for Asia Pacific (excluding China) and Central Bank Manager at the World Gold Council (WGC). Photo: WGC

Providing his perspective on this prediction, Mr. Shaokai Fan, Regional Manager for Asia Pacific (excluding China) and Central Bank Manager at the World Gold Council, stated that the Trump administration is one of the most unpredictable in history when it comes to policies and their impact. Therefore, there are still many uncertainties surrounding trade agreements.

Currently, the world is focused on the trade tensions between the US and India, with tariffs being significantly higher than initially anticipated. More importantly, the world is awaiting the final outcome of the trade negotiations between the US and China. There are numerous aspects of the US-China relationship that will influence the gold market in the upcoming period. Hence, trade remains unclear, and uncertainties persist for the foreseeable future.

Additionally, according to Mr. Shaokai Fan, central banks still have room to cut interest rates. US President Donald Trump has consistently urged the Federal Reserve to reduce interest rates. “So, interest rate cuts will remain a favorable factor for gold, not a disadvantage, in the coming period,” asserted Mr. Shaokai Fan.

Investors will continue to show interest in gold in the upcoming period

According to the World Gold Council’s Q2 2025 Gold Demand Trends report, global gold demand reached 1,249 tons in the last quarter, a 3% increase compared to the same period in 2024.

Mr. Shaokai Fan also mentioned that central bank purchases continued to support gold prices, with an additional 166 tons added in Q2. Among these banks, China ranked fourth.

However, Vietnam was an exception. The depreciation of the local currency, coupled with the rise in the US dollar, caused domestic gold prices to soar to record highs. This affordability challenge led to a 20% decline in gold demand in Q2 compared to the previous year, totaling 9 tons. Nonetheless, when considering the long-term trend, demand remains high, and the total value of gold investments in Vietnam actually increased by 12% in US dollar terms year-over-year, reaching $997 million. Gold jewelry demand in Vietnam also decreased by 20% compared to the same period last year and by 29% compared to Q1.

Mr. Shaokai Fan believes that investors will continue to show interest in gold in the upcoming period.

According to a World Gold Council survey, 95% of central bank reserve managers believe that the trend of increasing gold reserves will persist over the next 12 months. Additionally, 43% of the surveyed central banks indicated that they would continue to purchase gold at a record pace over the next 12 months. However, the short-term outlook remains uncertain.

The upcoming dynamics of the gold market will depend on how India and China invest in gold bars and coins, the resolution of trade tensions, and the final outcome of the US-China trade negotiations. An unexpected factor is the higher-than-expected tariffs imposed by the US on India, which will boost gold investment demand in India. However, we need to wait for further developments.

The demand from central banks remains robust, but it may not reach the record levels of the past three years. The global central bank survey indicates that purchases are still on the rise, but due to the increase in gold prices, the amount bought by investors remains to be seen.

Previously, Ms. Louise Street, Senior Market Analyst at the World Gold Council, commented: “In the first half of 2025, gold prices recorded a significant increase of 26% in US dollar terms. With such a strong start, gold prices are likely to fluctuate within a relatively narrow range in the second half of 2025. However, the macroeconomic environment remains highly uncertain, which could continue to favor the upward trend of gold prices. Any significant deterioration in the global economic or geopolitical landscape could further enhance gold’s appeal as a safe-haven asset, pushing prices higher.”

Today’s Silver Price Extends Its Bullish Run

Today’s silver prices in both the domestic and international markets continue their upward trajectory as US economic data signals weakness, boosting investor confidence.

The Return of Cheap Money: Real Estate Enters a New Cycle of Acceleration

The real estate market is witnessing a resurgence, rebounding from a challenging period of high-interest rates, weak liquidity, and cautious investor sentiment. A pivotal factor in this recovery is the return of “cheap money,” a phenomenon that previously fueled the real estate investment boom of 2020-2021.

“Securities Lending Makes Up 1.5% of Total Outstanding Credit in the Economy”

Amid concerns of surging credit growth funneling into risky sectors such as real estate and securities, the Governor of the State Bank of Vietnam has assured that the authority remains vigilant. The central bank is closely monitoring key safety indicators, proactively steering interest rates, and keeping a watchful eye on exchange rate movements to safeguard macroeconomic stability.

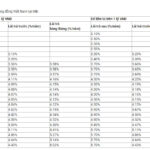

The Ultimate Guide to MB Bank’s Interest Rates: Maximizing Your Returns with the 24-Month Term Deposit

As of August 2025, Military Bank (MB) offers a competitive interest rate of up to 5.8% p.a. for personal savings accounts with a tenure of 24 months or more in the Central and Southern regions of the country. Customers in other regions can also enjoy attractive interest rates, with the highest rate being 5.7% p.a.