According to preliminary statistics from the General Department of Customs, Vietnam’s cotton imports in July reached over 144,000 tons, valued at more than $244 million, a slight decrease from the previous month.

Cumulative imports in the first seven months of the year exceeded 1 million tons, worth over $1.8 billion, an increase of 27.2% in volume and 8.6% in value compared to the same period last year.

The United States remained Vietnam’s largest cotton supplier in the seven-month period, with 535,000 tons worth more than $939 million, a significant increase of 133% in volume and 93% in value compared to the same period in 2024. In July alone, the increase was over 300% in volume and more than 200% in value.

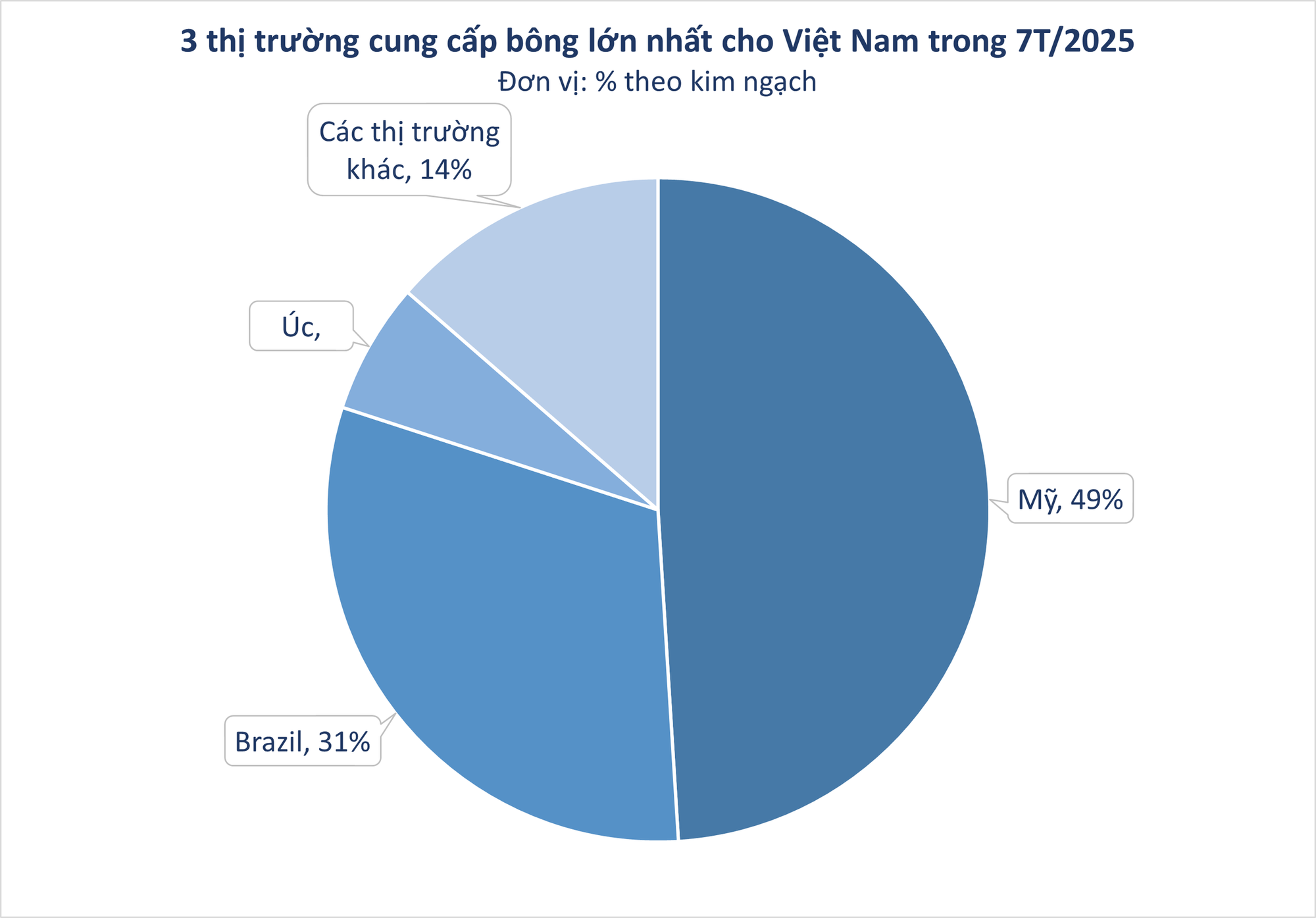

The average price stood at $1,756 per ton, a 17% decrease compared to the previous year. The US market is increasingly capturing a larger share of Vietnam’s total cotton imports, accounting for approximately 49%.

Brazil ranked second with 338,000 tons in the first five months, equivalent to $590 million, increasing in volume but decreasing in value. Meanwhile, imports from Australia declined sharply in both volume and value.

Vietnam is the third-largest cotton importer in the world, with a consumption volume of 1.5 million tons per year. The country is also the sixth-largest exporter of fiber and the third-largest exporter of garments, only behind China and Bangladesh.

Despite being a key export industry, Vietnam’s garment sector still heavily relies on imported raw materials, with a ratio of up to 60%. Cotton is an indispensable material in the production of yarn, fabric, and clothing. The US is the world’s largest cotton exporter, known for its stable fiber quality, favored by the global market.

Major textile factories in Hai Duong, Nam Dinh, Thai Binh, and Ho Chi Minh City are increasing their cotton imports from the US to meet their 2025 production and export plans.

Domestic enterprises have implemented various strategies to adapt to the US countervailing duties. In the context of the US imposing a 20% countervailing duty on certain export items from Vietnam, the country is gradually implementing strategic solutions to maintain balance in bilateral trade relations.

Particularly, to rebalance the trade deficit, Vietnam has proactively increased imports of high-value-added products from the US, including pharmaceuticals, medical equipment, high-tech products, and agricultural produce.

The Vietnam Textile and Apparel Association (Vitas) shared that they are boosting cotton, chemical, and accessory imports from the US to enhance domestic value addition and ensure clear traceability in the supply chain.

The USDA forecasts a significant increase in US cotton exports to Vietnam in 2025, driven by Vietnam’s record-high demand. Vietnam’s cotton demand is expected to continue rising as the global textile market recovers and foreign investment in the industry increases.

Why does Vietnam spend over 2.8 billion USD on importing millions of tons of a product “made in” Australia, the United States, and India?

Vietnam has spent over $2.8 billion to import hundreds of thousands of tons of this product in 2023.