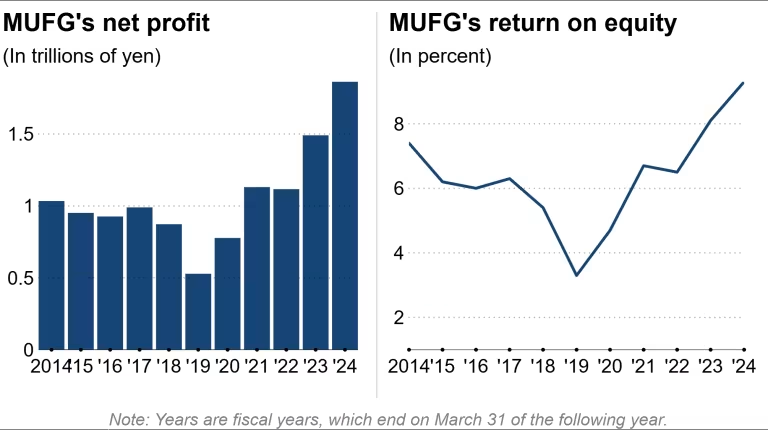

In May, MUFG raised its mid-to-long-term ROE target from 9-10% to around 12%. For the fiscal year 2024, the company achieved an ROE of 9.3%, nearly triple the 3.3% recorded five years ago.

“We want to take MUFG to new heights,” said Hironori Kamezawa, President and CEO of MUFG, in an interview with Nikkei. “We haven’t set a specific deadline, but we will achieve this goal soon.”

Hironori Kamezawa, President and CEO of MUFG (Photo: Nikkei)

|

American financial institutions such as JPMorgan Chase and Goldman Sachs have achieved ROEs above 12% in the April-June quarter of 2025. MUFG aims for similar results by taking on higher risks, following a period of improved profitability during Japan’s negative interest rate environment.

For the fiscal year ended March 2025, MUFG reported a net operating profit of 1.5 trillion yen (equivalent to $10.2 billion). Kamezawa estimates that achieving an ROE of 12% will require an additional profit of 1.2 trillion yen ($8.15 billion).

“We can achieve an 11% ROE through organic growth, such as expanding our existing services, without the need for investments or M&A,” he said. “We can increase profits by 600 billion yen by raising interest rates and expanding our balance sheet.”

Regarding the remaining 600 billion yen (equivalent to 1 percentage point of ROE), Kamezawa stated: “We will achieve this by taking on higher risks in our M&A and investment banking activities.” He also added that the 12% ROE target does not include gains from the sale of strategic equity holdings.

|

MUFG’s Net Profit and ROE

|

Focus on M&A in the US and Asia

MUFG will focus its M&A activities in the areas of asset management and custody services. “These areas currently contribute 6-7% of our total revenue, but we aim to double that. To achieve this, we need to pursue M&A,” emphasized Kamezawa.

“Geographically, we will target the US. In asset management, we want to acquire companies that specialize in supporting businesses and managing pension funds.”

MUFG is also eyeing investments and M&A in Asia, particularly in the Philippines and Vietnam, which offer high growth potential.

|

During the meeting on August 7, Prime Minister Pham Minh Chinh invited Mr. Hironori Kamezawa, CEO of Mitsubishi UFJ Financial Group (MUFG), to participate in the International Financial Center in Vietnam. Kamezawa praised Vietnam as one of the most attractive investment destinations in the region, increasingly important to Japanese businesses. |

The group has also invested in Asian financial companies with digital technology applications. “In the next five years, I want 20% of our total profits in Asia to come from digital investments,” he shared.

In India, MUFG is considering M&A and other options. The bank currently has six offices serving businesses, a fund investing in startups, and has invested in the non-bank lender DMI Finance.

“To capitalize on India’s growth and potential, we need to invest more,” Kamezawa said.

One significant challenge is the domestic retail sector, where Sumitomo Mitsui Financial Group leads with its comprehensive personal finance service, Olive. MUFG launched its new personal finance brand in May.

“Olive only makes money from credit cards. We, on the other hand, generate profits by combining all financial services: banking, cards, securities, and asset management,” Kamezawa explained.

He cited Rakuten Group as an example of a “near-perfect business model” due to its diverse revenue streams from finance, telecom, and retail.

MUFG also aims to use BaaS (Banking as a Service) – currently partnered with Isetan Mitsukoshi Holdings and Recruit – to expand into other sectors such as telecom, retail, and transportation.

However, MUFG’s online securities and card businesses lag behind their competitors in terms of customer numbers. The strategy of attracting customers with low fees has not been effective, resulting in a loss for Mitsubishi UFJ eSmart Securities in the April-June quarter of 2025.

Views on the Economy and Monetary Policy

Regarding the 15% retaliatory tariffs imposed by the US on Japanese goods, Kamezawa stated: “15% is high, but at least the situation is now clearer, which is positive.”

He predicted a 0.5-0.8% decline in Japan’s GDP but added that “the foundation for economic recovery remains intact.”

On the Bank of Japan’s interest rate policy, Kamezawa commented: “We previously expected a rate hike around March next year, but I think it could happen as early as this October. Inflation has been higher than expected, and the number of goods with price increases has quintupled compared to last year.”

Vu Hao (According to Nikkei Asia)

– 10:23 08/09/2025

The Thai Investor: Leading the Charge in Vietnam’s M&A Landscape

After a slowdown since its peak in 2020, Thai investors have reclaimed their leading position in M&A activity in 2024.