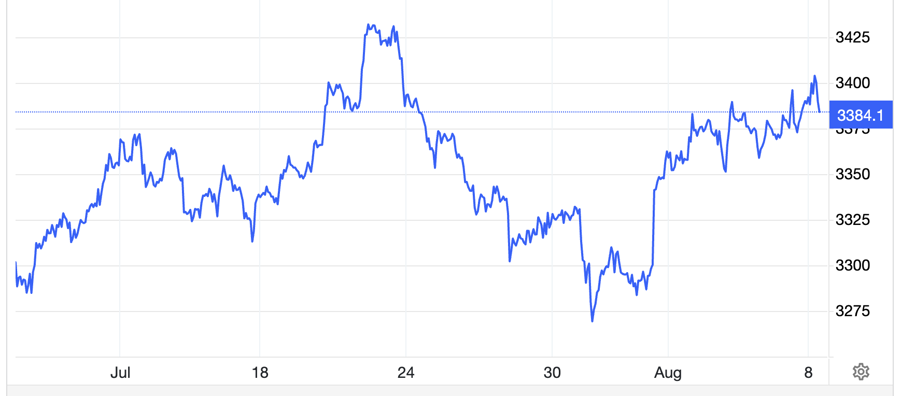

Global gold prices have surged to a two-week high amid rising risk aversion as the US reciprocal tariffs have come into force. The prospect of an interest rate cut by the Federal Reserve next month also boosted the precious metal’s price, pushing it towards the key level of $3,400 per ounce.

As of 8 a.m. Vietnam time on August 8, according to Kitco, the world gold exchange price decreased by $6.1 per ounce compared to the previous trading session, equivalent to a drop of 0.18%, trading at $3,391.4 per ounce. With the selling rate of USD at Vietcombank, this price is equivalent to about VND 107.8 million/tael, up VND 300,000 per tael compared to the previous day.

At the same time, Vietcombank listed the USD buying rate at VND 26,000 and the selling rate at VND 26,390, a decrease of VND 20 at both ends compared to the previous day.

Earlier, the world gold price had surpassed the threshold of $3,400 per ounce but failed to maintain this important threshold.

On Thursday, in New York, the world gold price closed at $3,397.5 per ounce, up $27.3 per ounce compared to the previous session, equivalent to an increase of 0.81%.

Gold prices are at their highest level in two weeks as President Donald Trump’s reciprocal tariff plans with the US trading partners have officially taken effect since August 7, with tax rates ranging from 10-50%. Some partners facing high taxes, including Switzerland, Brazil, and India, are still negotiating with the US for tax reductions.

“The continued trade tensions and unresolved geopolitical issues will continue to support gold prices as the demand for safe-haven assets will remain high,” said Peter Grant, a strategist at Zaner Metals.

Gold prices found further support as weekly data from the US Department of Labor showed that the number of people claiming unemployment benefits rose to a one-month high. While not as worrying as the dismal July jobs report released last week, this data indicates a weakening trend in the US job market, reinforcing the likelihood of a Fed rate cut in the upcoming meeting.

According to the US Labor Bureau (LBS), the number of people filing for unemployment benefits for the week ending August 2 was 226,000, an increase of 7,000 from the previous week and higher than the forecast of 221,000 in a Dow Jones poll of economists.

Mr. Grant commented that this report supports the rate cut outlook, and “if US economic data continues to weaken, this expectation will increase, favoring gold prices.”

According to data from the FedWatch Tool of CME Exchange, market participants in the futures market are betting on a nearly 93% chance that the Fed will cut interest rates by 0.25 percentage points in September.

This week, three Fed officials expressed concern about the weakening job market. On Wednesday, Minneapolis Fed President Neel Kashkari said it would be reasonable for the Fed to cut rates twice by the end of the year, with each cut being 0.25 percentage points.

Also, on Thursday, President Trump announced the appointment of Stephen Miran, Chairman of the Council of Economic Advisors, to the Board of Governors of the Federal Reserve System. Mr. Miran will replace Adriana Kugler, who will resign on Friday. Earlier this week, President Trump also mentioned that he would announce a candidate to replace Fed Chairman Jerome Powell when his term ends in May 2026.

After net selling 3.1 tons of gold in the session on Wednesday, the world’s largest gold ETF, SPDR Gold Trust, strongly net bought gold in the session on Thursday. In this session, the fund net bought 6.3 tons of gold, bringing the total amount of gold held to 959.1 tons.

Next week, the outcome of the US-Russia summit is likely to significantly impact global investors’ risk sentiment.

On Thursday, Kremlin aide Yuri Ushakov said President Vladimir Putin and President Trump would meet in the coming days. This event will be the first summit between the leaders of Russia and the US since 2021, aiming to end the war in Ukraine. Earlier on Thursday, a White House official said the meeting between President Trump and President Putin could take place next week.

The US dollar strengthened during Thursday’s trading session, with the Dollar Index closing at 98.4 points, up from 98.18 in the previous session. This morning, the index declined, falling below 98.2 points at times.

Today’s Silver Price Extends Its Bullish Run

Today’s silver prices in both the domestic and international markets continue their upward trajectory as US economic data signals weakness, boosting investor confidence.

The Ultimate Guide to Unemployment Benefits: 13 Scenarios Where Your Payments May Be Affected

As of January 1st, 2026, the new Employment Law of 2025 will come into effect, bringing about significant changes. One of the key aspects of this new legislation is the introduction of stringent conditions that could result in the discontinuation of unemployment benefits for many recipients. These provisions are designed to ensure a more efficient and targeted allocation of resources to those in need.