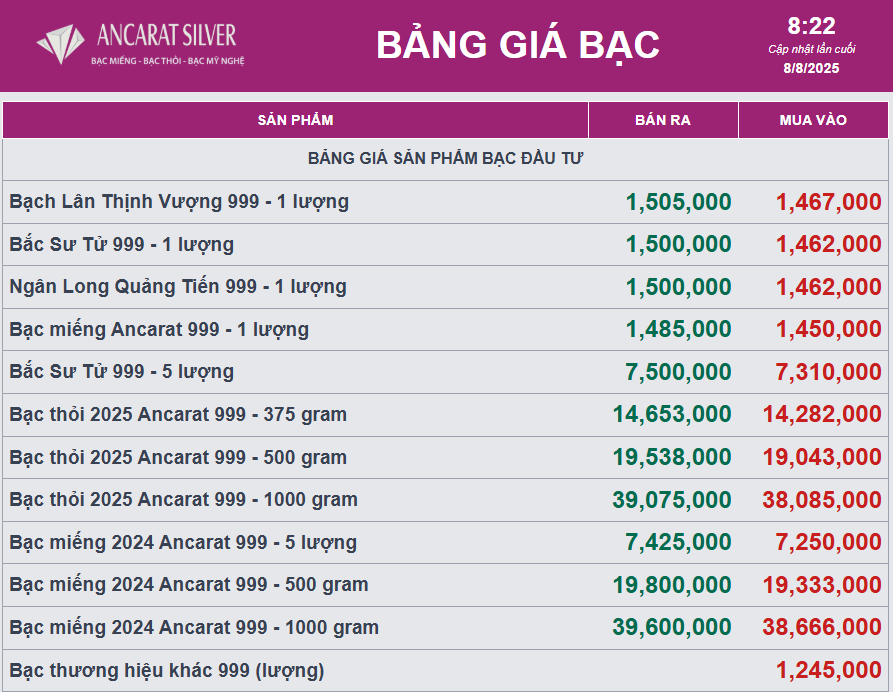

Silver prices continued their upward trend at Ancarat Vietnam JSC, reaching 1,467,000 VND per tael for buyers and 1,4505,000 VND per tael for sellers in Hanoi. In the past week, the price of silver has increased, bringing nearly a 5% profit to investors.

Meanwhile, the price of 1kg 999 silver bars was recorded at 38,666,000 VND per bar for buyers and 39,600,000 VND per bar for sellers, as of 8:22 am on August 8th.

Globally, silver prices rebounded, trading at 38.1 USD per ounce.

Silver prices surged past 38 USD per ounce, reaching their highest level in over a week, as expectations grew for the Federal Reserve to cut interest rates amid signs of a weakening US labor market.

Investors are now awaiting the latest weekly jobless claims data for further confirmation. Adding to the dovish outlook, President Donald Trump is expected to nominate a successor to the soon-to-depart Fed Governor, Adriana Kugler, by the end of the week, and has narrowed down four candidates to replace Fed Chair Jerome Powell.

Geopolitical tensions also supported safe-haven demand. President Donald Trump announced a doubling of tariffs on Indian goods to 50% in response to India’s continued imports of Russian oil.

Analyst Christopher Lewis remarked that the current price level is a significant support area, which also acted as a previous resistance zone. He added that if silver prices break above 38.50 USD per ounce, the metal could target the 40 USD per ounce level. However, if selling pressure increases, prices could pull back to the 35.50 USD per ounce level.

Given the weak US dollar and positive global trade prospects, a “buy-on-dips” strategy remains a suitable option for silver investors.

The Return of Cheap Money: Real Estate Enters a New Cycle of Acceleration

The real estate market is witnessing a resurgence, rebounding from a challenging period of high-interest rates, weak liquidity, and cautious investor sentiment. A pivotal factor in this recovery is the return of “cheap money,” a phenomenon that previously fueled the real estate investment boom of 2020-2021.

“Securities Lending Makes Up 1.5% of Total Outstanding Credit in the Economy”

Amid concerns of surging credit growth funneling into risky sectors such as real estate and securities, the Governor of the State Bank of Vietnam has assured that the authority remains vigilant. The central bank is closely monitoring key safety indicators, proactively steering interest rates, and keeping a watchful eye on exchange rate movements to safeguard macroeconomic stability.

The Ultimate Guide to MB Bank’s Interest Rates: Maximizing Your Returns with the 24-Month Term Deposit

As of August 2025, Military Bank (MB) offers a competitive interest rate of up to 5.8% p.a. for personal savings accounts with a tenure of 24 months or more in the Central and Southern regions of the country. Customers in other regions can also enjoy attractive interest rates, with the highest rate being 5.7% p.a.