Capital flows strongly into real estate

Many banks’ Q2 financial reports indicate that real estate lending significantly contributed to several banks’ credit growth in the first half of the year.

Specifically, at Techcombank, real estate business lending (including credit and bonds) accounted for 59% of total credit debt in the first six months of this year. Including individual customers, the proportion of real estate lending at this bank exceeded 64% of the bank’s total debt. Techcombank’s consolidated real estate business credit growth (excluding bonds) reached 21.5% compared to the end of 2024 (nearly double the bank’s 11.6% loan growth).

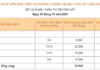

Lending to real estate businesses in the first half also recorded robust growth at other commercial banks. For instance, HDBank’s real estate business lending balance reached VND 83,125 billion, a 22% increase from the beginning of the year and accounting for 16.4% of its total debt. SHB’s real estate lending balance reached VND 163,754 billion, a nearly 28.4% increase from the beginning of the year, while MB’s real estate business lending reached VND 85,834 billion, a nearly 34% increase from the start of 2025.

Credit flows into real estate.

By the end of June 2025, real estate business lending had increased by 32% at TPBank, 30% at PGBank, 19% at VietBank, and 15% at MSB.

As of June 30, real estate credit debt stood at VND 3,180 trillion, 2.4 times higher than at the end of 2024, accounting for 18.5% of the system’s total debt.

Mr. Dinh Minh Tuan, Southern Region Director of Batdongsan.com.vn, assessed that there is a mechanism in place this year to increase credit for the real estate market. However, he pointed out that credit for people’s actual housing needs remains limited and lacks a clear mechanism.

Batdongsan.com representatives forecast that credit will continue to prioritize infrastructure and key real estate projects in the coming period. They expect the second half’s real estate supply to improve compared to the first half. Markets receiving prioritized capital will likely see faster growth. However, it is worth noting that risks may arise if credit flows into overheating areas.

Many experts are concerned that priority sectors like industrial production face challenges in accessing capital, while credit is overly concentrated in speculative channels like real estate businesses. This could lead to asset price inflation risks. In reality, most economic crises originate from the financial and real estate markets.

Proposed stable-rate medium-term credit package

In the context of strong capital flows into real estate, the Ministry of Construction has proposed that the State Bank of Vietnam (SBV) study a medium-term credit package with a stable interest rate, in addition to focusing on directing and urging banks to participate in the VND 120,000 billion preferential credit program.

The SBV has also instructed commercial banks to focus on lending and disbursement for commercial housing projects with suitable prices, promoting credit growth, and reducing procedures and conditions to facilitate people’s and enterprises’ access to controlled credit without corruption or negativity.

According to financial and banking expert Nguyen Tri Hieu, there should be a loan package for developing affordable housing with a repayment period of up to 30 years to reduce people’s monthly bank debt payments. The SBV should also promote credit scoring for individuals, with those scoring high easily obtaining loans at low-interest rates. The interest rate should be around 4.7%/year, depending on the score, with a certain margin for those with lower scores.

The Future of Gold: Will Prices Plummet or Shine?

The World Gold Council addressed queries regarding gold price trends at a press conference on August 7. The council’s insights and perspectives on the potential for a significant drop in gold prices were sought by inquisitive journalists.

Prime Minister Requests SBV to Hasten the Development of a Roadmap to Pilot the Abolition of Credit Room from 2026 Onwards.

The State Bank of Vietnam (SBV) needs to establish standards and criteria for credit institutions to operate effectively and maintain good health. These standards should emphasize the importance of strong governance and management capabilities, adherence to prudential ratios, and high credit quality indicators. Transparency and disclosure are key to ensuring the safety and soundness of Vietnam’s banking system.

The Return of Cheap Money: Real Estate Enters a New Cycle of Acceleration

The real estate market is witnessing a resurgence, rebounding from a challenging period of high-interest rates, weak liquidity, and cautious investor sentiment. A pivotal factor in this recovery is the return of “cheap money,” a phenomenon that previously fueled the real estate investment boom of 2020-2021.