Digiworld JSC (Digiworld, code: DGW, on HoSE) has just announced a resolution to issue shares under the Employee Stock Ownership Plan (ESOP) as approved at the 2025 Annual General Meeting of Shareholders.

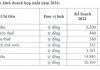

Accordingly, Digiworld plans to issue 2 million ESOP shares at VND 10,000 per share. At the closing price of VND 45,800 per share on August 8, the issuance price is 78% lower than the market price.

The issuance is offered to members of the Board of Directors and employees of DGW and its subsidiaries. ESOP shares will be restricted from transfer for 01 year. The issuance is expected to be completed in Q3-Q4 2025.

If this issuance is successful, Digiworld’s charter capital will increase to VND 2,213.2 billion.

According to the published list, 92 Digiworld employees are eligible to purchase ESOP shares in this offering. Among them, Board member and General Director Dang Kien Phuong will purchase the most with 180,000 shares.

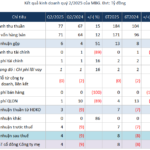

In terms of business results, according to the Q2/2025 financial report, Digiworld recorded net revenue of over VND 5,731 billion, up 14% compared to the same period last year.

After deducting taxes and expenses, the company reported a net profit of over VND 118.6 billion, up 35%.

For the first 6 months of 2025, Digiworld’s net revenue was nearly VND 11,250.8 billion, up 12.6% compared to the same period in 2024; profit after tax was nearly VND 225 billion, up 24.3%.

In 2025, Digiworld sets a business plan with revenue of VND 25,450 billion and after-tax profit of VND 523 billion, up 15% and 18% compared to 2024. Thus, after the first two quarters, the company has completed 43% of the profit plan.

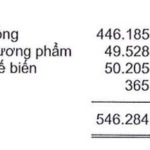

As of June 30, 2025, Digiworld’s total assets decreased by VND 155.4 billion from the beginning of the year to nearly VND 8,345 billion.

Of which, inventory was over VND 3,515.1 billion, and cash and cash equivalents were over VND 1,149.1 billion.

On the liability side, total liabilities stood at over VND 5,222.5 billion, down 4.8% from the beginning of the year. Short-term loans and finance leases amounted to nearly VND 2,864.9 billion.

“Hoang Quan Real Estate Plans to Issue 50 Million Shares to Swap Debt”

“Hoang Quan Real Estate plans to issue 50 million shares at VND 10,000 per share to swap VND 500 billion of debt. The list of creditors includes Chairman Truong Anh Tuan and Hai Phat Invest. This strategic move aims to strengthen the company’s financial position and consolidate its presence in the competitive real estate market.”

155 Masan Employees Get a Great Deal on ESOP Shares

“Masan has concluded its distribution of 7.56 million ESOP shares to 155 employees. The offering price was VND 10,000 per share, a significant 86% discount on the market price. This move underscores Masan’s commitment to recognizing and rewarding its talented workforce, fostering a culture of ownership and long-term commitment to the company’s success.”

The Masterful Wordsmith: Crafting Captivating Copy with a Twist

“Unveiling the Secrets of Capital Retreat: A Chairman’s Tale”

Quoc Bao Van Ninh JSC has announced its plan to offload its entire stake in MBG Group JSC, amounting to 4.25 million shares or 3.54% of the charter capital. The proposed transaction, aimed at restructuring the company’s finances, is scheduled to take place between August 8 and September 5.