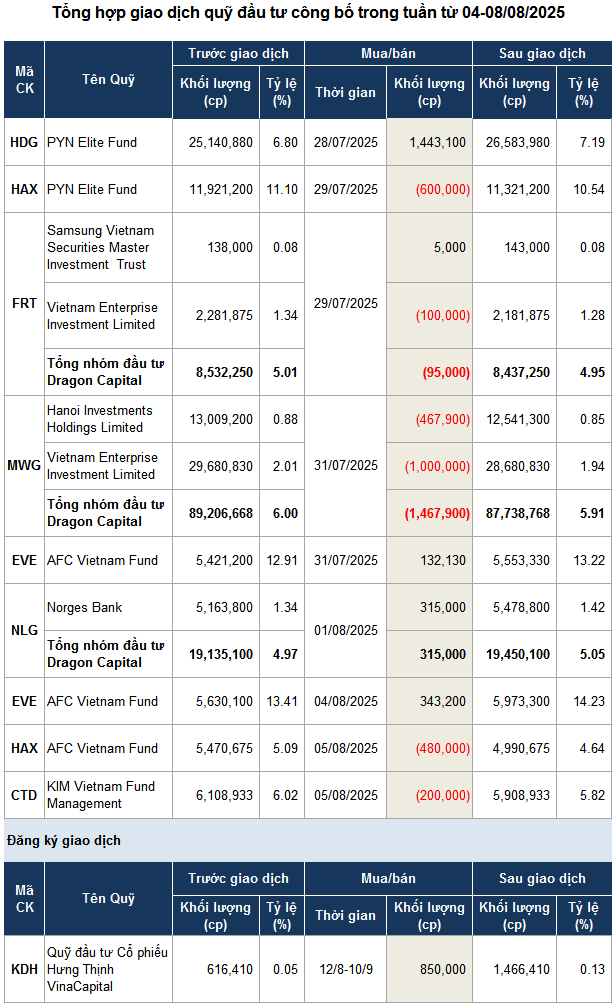

The spotlight falls on the portfolio restructuring of the AFC Vietnam Fund. Specifically, the fund purchased 343,200 shares of EVE (Everpia Joint Stock Company) during the August 4 session, then sold 480,000 shares of HAX (Hang Xanh Automobile Services Joint Stock Company) in the August 5 session.

Following these transactions, the ownership ratio of EVE held by AFC Vietnam rose to over 14% (nearly 6 million shares), while the ratio at HAX fell below 5%, thus exiting the group of major shareholders of the Mercedes dealer.

| EVE stock price movement from the beginning of 2024 to the session on August 8, 2025 |

Notably, the increase in ownership of EVE occurred as the stock hit a one-year high during the August 4 session, before adjusting to 11,300 VND/share at the end of the week.

| HAX stock price movement from the beginning of 2024 to the session on August 8, 2025 |

In contrast, the sale of HAX was carried out as the share price declined from its one-year peak on July 28, falling 12% to 15,500 VND/share by the end of the August 5 session. The downward trend continued following the news of HAX‘s unsuccessful auction of a 6,300 sq. m land lot on Vo Van Kiet Street in the former Binh Tan District, Ho Chi Minh City.

| CTD stock price movement from the beginning of 2024 to the session on August 8, 2025 |

Following a similar selling trend, the KIM fund also reduced its ownership ratio in Coteccons Construction Joint Stock Company (CTD) to below 6% (approximately 5.9 million shares) after selling 200,000 shares in the August 5 session, estimated to have raised about VND 16 billion.

This move came just before Coteccons announced its plan to issue over 5 million bonus shares (at a ratio of 20:1), increasing its charter capital from VND 1,036 billion to over VND 1,087 billion.

Source: VietstockFinance

|

– 07:28 10/08/2025

Stock Market Week of 04-08/08/2025: Holding the Line

The VN-Index remained in positive territory despite a volatile session to end the week, capping off a strong performance with a near 90-point gain. While foreign investors have been net sellers in recent sessions, a reversal of this trend in the coming week could further bolster the current upward momentum and propel the index to new highs.

Stock Market Week 11-15/08/2025: No Retreat, No Surrender

The VN-Index remained in positive territory despite a volatile session last Friday, capping off a strong week with a nearly 90-point gain. While foreign investors have been net sellers in recent sessions, creating some pressure, a reversal of this trend next week could bolster the current upward momentum and propel the index to new heights as it continues its ascent.

Technical Analysis for August 1st: Pessimism Persists

The VN-Index and HNX-Index both witnessed a decline, alongside a dip in trading volume, indicating a cautious sentiment among investors.