Total JSC Investment and Development Construction (DIC Corp, code: DIG, on HoSE) has just announced a resolution adjusting some contents related to the plan to issue shares to the public for existing shareholders.

Accordingly, DIC Corp adjusts the plan to use the expected proceeds of VND 1,800 billion from the offering.

In particular, DIG plans to use VND 600 billion to pay for the construction of Cap Saint Jacques Complex – Phase 3 (CSJ); VND 600 billion to pay for the construction of technical infrastructure, social infrastructure, and works on land at the Commercial Residential Area in Vi Thanh City; and the remaining VND 600 billion to repay the DIG12301 bonds. The disbursement is expected to take place from Q4/2025 to 2026.

In case the proceeds from the offering are insufficient to cover the entire plan, DIC Corp will prioritize the CSJ Phase 3 project, followed by the Vi Thanh Commercial Residential Area project, and then the bond repurchase.

Compared to Resolution No. 107/NQ-DIC Group – BOD dated July 8, DIG only adjusts the capital usage plan for the Vi Thanh Commercial Residential Area project.

DIC Corp plans to offer 150 million shares to shareholders. The entitlement ratio is 1,000:232, meaning that for every 1,000 shares owned, shareholders will receive 232 new shares.

The issued shares will be freely transferable. The expected timeline for the offering is from Q3/2025 to Q1/2026.

The issue price is VND 12,000 per share, aiming to raise a maximum of VND 1,800 billion. Currently, DIG shares are trading around VND 22,000 per share, making the offer price approximately 45% lower than the market price.

CSJ Tower Vung Tau – The tourism apartment block has been put into use

In March 2025, DIC Corp issued Resolution No. 96/NQ-DIC Group-BOD on completing the dossier for not proceeding with the additional public offering of shares to existing shareholders.

Accordingly, the Board of Directors of DIC Corp decided not to proceed with the public offering of shares to existing shareholders as stipulated in the Certificate of Registration for Public Offering of Shares No. 231/GCN-UBCK dated December 12, 2024, issued by SSC.

The reason given was that the remaining time for securities distribution was insufficient to continue with the offering as planned.

According to the previously announced plan, DIC Corp intended to offer 200 million DIG shares to existing shareholders at a price of VND 15,000 per share, with the entitlement ratio being 1,000: 327.94. This meant that for every 1,000 shares owned, shareholders would have the right to buy 327.94 new shares.

The book-building period was from January 21, 2025, to February 19, 2025, and the transfer of subscription rights was from January 21, 2025, to February 11, 2025.

DIC Corp expected to raise VND 3,000 billion, with most of the proceeds going towards the company’s projects.

However, considering the current unfavorable conditions in the stock market, including low liquidity, strong and persistent net selling pressure from foreign investors since the beginning of 2024, exchange rate pressure, and interest rate-related policies, the Board of Directors decided to halt the share offering to existing shareholders.

The implementation of the share offering will be rescheduled for a more favorable time in the stock market, ensuring the benefits of shareholders and the corporation.

In terms of business results, in Q2/2025, DIC Corp recorded a revenue of VND 274 billion, down 67% over the same period.

In terms of revenue structure, construction revenue decreased the most by 93% over the same period to VND 35 billion; real estate business revenue decreased by 39.3% to VND 164 billion…

Gross profit decreased while expenses increased, resulting in a 58% decline in net profit to VND 52 billion in Q2/2025 compared to the previous year.

Accumulated in the first half of 2025, DIC Corp’s revenue decreased by 48% over the same period to VND 427 billion, and after-tax profit reached VND 6.75 billion, up 70.5% over the same period last year.

For the full year 2025, DIG Corp targets a revenue of VND 3,500 billion, up 143.2% year-on-year, a pre-tax profit of VND 718 billion, up 354.2% year-on-year, a total investment capital of VND 6,690 billion, and a dividend rate of 7-10%.

With a pre-tax profit of nearly VND 16 billion in the first half of 2025, DIC Corp has achieved only 2.2% of its full-year plan.

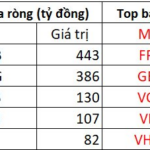

Foreign Block Surprises With Net Buy of Over 750 Billion Dong in VN-Index’s New Peak: Which Stocks Were “Cornered”?

In a stark contrast to the general trend, foreign investors offloaded Vietnamese shares at an alarming rate, with FPT being the primary target. The massive sell-off by foreign funds resulted in a staggering volume of 775 billion Vietnamese dong changing hands.

“High-End Demand Weakens, Market Awaits Massive “Account Shock” Influx”

The morning session witnessed a notable dip in excitement, possibly due in part to concerns over the massive volume of stocks on August 5th and their settlement on the afternoon of the same day. Both the VN-Index and stock prices peaked early on, only to gradually weaken as trading volume increased by nearly 9% compared to yesterday’s morning session.