VN-Index Extends Winning Streak, Broad-Based Gains Boost Benchmark

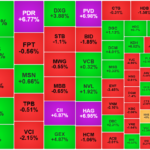

The VN-Index shone brightly on August 6th, closing at a new all-time high. Turnover on the HoSE remained robust, surpassing VND 37,800 billion, despite falling short of the previous record-breaking session.

A key highlight was foreign investors’ net buying, which totaled VND 753 billion across the market:

HoSE: Net Buying of Approximately VND 528 Billion

STB witnessed the strongest net buying by foreign investors, attracting VND 250 billion. This was followed by robust net purchases in a slew of Bluechip stocks: MWG (VND 167 billion), VIX (VND 139 billion), VPB (VND 136 billion), and VHM (VND 131 billion).

On the other hand, FPT witnessed an unusual surge in net selling, totaling VND 775 billion. KDH, VCI, and MSN also faced net selling of VND 86 billion, VND 69 billion, and VND 64 billion, respectively. Additionally, the FUEVFVND fund experienced net outflows of VND 54 billion.

HoSE: Foreign Investors’ Net Buying Boosts Market Sentiment

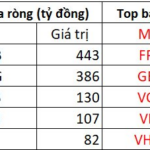

HNX: Net Buying of Approximately VND 213 Billion

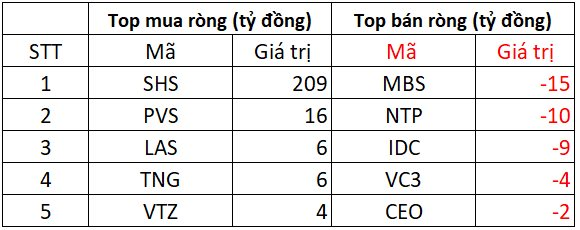

SHS dominated the buying side on the HNX, with net purchases totaling VND 209 billion. Foreign investors also injected several billion dong into PVS, LAS, TNG, and VTZ.

Meanwhile, MBS and NTP faced net selling of around VND 10-15 billion each. IDC, VC3, and CEO witnessed net outflows ranging from VND 2 billion to VND 9 billion.

HNX: Foreign Investors’ Net Buying Supports Market

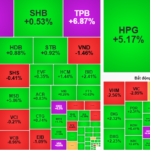

UPCOM: Net Buying of Approximately VND 13 Billion

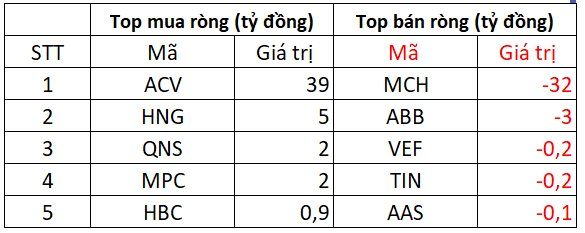

ACV attracted strong net buying of around VND 39 billion on the UPCOM. HNG, MPC, and QNS also witnessed net purchases of VND 2-5 billion each.

On the selling side, MCH faced net outflows of VND 32 billion, while ABB saw net selling of VND 3 billion. VEF, TIN, and AAS experienced negligible net selling.

UPCOM: Foreign Investors’ Net Buying and Selling Activities

The Business is in the Red, but Stock Prices Soar: What do Experts Make of It?

Stock price increases are merely symptomatic; discerning investors must focus on the underlying causes. Is it a reflection of improved financial performance, positive news, or perhaps a result of price manipulation? Savvy investors delve beyond surface-level indicators to uncover the true drivers of stock price movements.