Agribank is embarking on a journey of cultural transformation, starting with embracing green initiatives internally. This approach not only optimizes operations but also lays a strong foundation for spreading green consciousness to its customers and the community, solidifying its position as a responsible financial institution.

Initiating a Sustainable Journey

As a leading financial institution in agricultural and rural development, Agribank recognizes that greening its internal operations is crucial to achieving ESG (Environmental, Social, and Governance) criteria, especially the environmental pillar. The recently launched “Action Program towards Environmental Protection in Internal Activities for the period of 2025-2026” is designed based on the ESG standards for the period of 2024-2030, aligning with Vietnam’s green growth strategy, circular economy goals, and net emission reduction commitments.

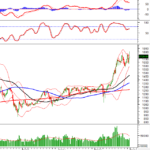

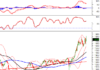

While some initiatives, such as energy and water conservation, paper reduction, and single-use plastic waste minimization, along with the pilot of green transaction points, have yielded initial positive results, most solutions in this program represent new, comprehensive, and systematic steps toward profound internal changes.

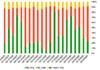

Firstly, the bank continues to intensify and expand measures for efficient resource utilization and waste reduction. Agribank has successfully digitized office procedures, adopted digital signatures, implemented electronic document storage, and encouraged email correspondence instead of traditional printing. Additionally, default double-sided printing and the use of QR codes instead of paper documents in meetings will significantly reduce paper consumption and operational costs. This approach not only protects forests but also showcases Agribank’s leadership in leveraging technology for sustainable development.

Along with paper reduction, a meaningful change is taking place across all Agribank branches: a campaign saying “No to Single-Use Plastic.” The bank is proactively phasing out single-use plastic products and replacing them with environmentally friendly alternatives like glass bottles, bamboo straws, and cloth bags. These actions convey a message of environmental awareness and encourage everyone to join hands in combating plastic waste, one of the most pressing global issues.

As Agribank continues its green journey, it also focuses on energy and water conservation. To optimize usage, Agribank plans to implement smart solutions such as installing energy-efficient LED lights and light sensors to maximize the use of natural light. Additionally, water-saving measures include sensor-equipped faucets and regular leak inspections. Agribank goes a step further by exploring graywater reuse for auxiliary purposes, reflecting a scientific and sustainable approach to resource management.

Electronic document storage not only reduces manual tasks but also saves paper, increasing efficiency.

Understanding the impact of transportation emissions, Agribank has launched initiatives to encourage green mobility. The bank is working on proposals to provide bus transportation for employees and promote the use of bicycles and electric scooters. For official vehicles, optimizing routes and fuel efficiency is a priority, with a near-term goal of transitioning to energy-efficient alternatives. This effort will contribute significantly to reducing air pollution in urban areas.

In addition to the above goals, the bank will implement scientific waste management practices, including waste segregation at the source, providing color-coded bins with visual instructions, and ensuring proper wastewater treatment and periodic inspections. While some branches have already implemented these practices, the program will ensure standardization and enhanced effectiveness across the entire system.

Fostering a Green Lifestyle and Rigorous Monitoring

What sets this program apart is its focus on instilling a green lifestyle from the ground up. Agribank not only establishes regulations but also conducts training, workshops, and internal communication campaigns to raise awareness among its staff.

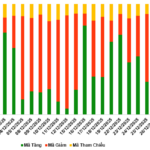

Initiatives such as “For a Green Future,” “No to Plastic Waste,” “Green Commute Day,” and “Green Living Challenge” have sparked a dynamic and positive competition across the entire system. Agribank has also successfully piloted and expanded the “Green Transaction Point” and “Green Office” models, integrating green criteria into its performance appraisal system to motivate individuals.

The “Green Transaction Point” model has left a positive impression on customers.

The program’s implementation is closely monitored and transparent. Units regularly report their progress, and successful models are recognized and rewarded, encouraging system-wide replication. Starting with these internal changes, Agribank is gradually realizing its vision of becoming a comprehensively green bank. Every cost-saving initiative and green action by its staff today not only optimizes operational costs but also builds the image of a pioneering, responsible, and sustainable financial institution. These positive green values will strongly resonate with customers, partners, and the community. Agribank not only provides financial products and services but also inspires a green and responsible way of life.

Strategic Significance of the Action Program

The launch of the Action Program carries profound strategic implications.

Firstly, it concretizes ESG commitments and aligns with national strategies. The program translates the Environmental, Social, and Governance (ESG) Standards for the 2024-2030 period into actionable steps within the Agribank system, while also supporting Vietnam’s green growth strategy and emission reduction goals. This foundation enables Agribank to not just comply with policies but also lead the green transformation in the financial sector.

Secondly, the program opens up opportunities to build long-term competitive advantages. As ESG becomes a mandatory requirement for accessing international capital and expanding collaborations, Agribank’s proactive implementation of green criteria will enhance its brand reputation, reinforce its competitive position, and stay ahead of stricter global standards.

Agribank’s green campaigns have positively impacted the environment.

Simultaneously, the program will elevate the corporate culture. Integrating green criteria into performance appraisals will shape the behaviors and mindset of employees. As a result, a green culture will transcend slogans and become a sustainable way of life, naturally spreading to customers and the community.

With this newly launched action program, Agribank is laying the foundation for a sustainable development strategy that starts from within. Some initiatives are already bearing fruit, providing a solid base, while new solutions are being prepared for implementation in the 2025-2026 period.

The Soaring Value of Residential Real Estate in the City Center: $250,000 per square meter

In the second quarter, residential land prices in Hanoi continued their upward trajectory, reaching a staggering 250 million VND per square meter. This unprecedented surge underscores the thriving real estate market in the heart of the capital city. With each square meter commanding a premium, homeowners and investors alike are witnessing the tangible value of their properties soar to new heights. This trend showcases the enduring appeal and robust demand for prime residential real estate in Hanoi’s bustling urban landscape.

Masterise Homes: A Thousand Thanks to Our Masteri Rivera Danang Community

On August 2nd, 2025, Masterise Homes hosted an exclusive art experience event, “Dual Waves in Harmony”, as a token of appreciation for over 1,000 valued customers of the Masteri Rivera Danang project.

“Major Ceramic Tile Project in Laos Receives Nearly 1,000 Billion VND Funding from CRC and BIDV”

On August 5, 2025, Create Capital Vietnam Joint Stock Company (stock code: CRC) signed a project finance loan agreement with the Vietnam Joint Stock Commercial Bank for Investment and Development – My Dinh Branch for its CRC Premier Granite Porcelain Tile Manufacturing Plant. The loan agreement is valued at VND 589 billion, with a total investment of VND 986 billion.