HoSE-listed Real Estate Trading Services Consulting Joint Stock Company (HQC: HoSE) has just announced a resolution of its Board of Directors on the implementation of a plan to issue private placement shares to swap debt.

Accordingly, Dia Oc Hoang Quan plans to issue 50 million shares at VND 10,000/share to swap VND 500 billion of debt. The shares will be restricted from transfer for one year from the end of the issuance.

The debt swap ratio is 10,000: 1, meaning VND 10,000 of debt will be swapped for one newly issued ordinary share.

The above issuance aims to improve the company’s financial and operating situation by reducing costs and increasing charter capital.

Illustrative image

If the issuance is successful, Dia Oc Hoang Quan’s charter capital will increase from VND 5,766 billion to VND 6,266 billion.

According to a list previously published by Dia Oc Hoang Quan, there will be four creditors participating in the debt-for-equity swap, including Construction Design Consulting Company Limited (VDC) with a debt value of VND 19 billion, Mr. Truong Anh Tuan – Chairman of the Board of Directors with VND 236 billion, Mrs. Nguyen Thi Dieu Phuong – Mr. Tuan’s wife with VND 33 billion, and Hai Phat Investment Joint Stock Company (Hai Phat Invest, HPX code) with a debt value of VND 212 billion.

Recently, Hai Phat Invest has announced a resolution of its Board of Directors on approving the swap of receivables into shares issued by Dia Oc Hoang Quan.

The number of HQC shares that Hai Phat Invest will receive after the swap is 21.2 million, equivalent to a ownership ratio of 3.383% of Dia Oc Hoang Quan’s charter capital.

In terms of business results, according to the consolidated financial statements for Q2/2025, net revenue was negative at over VND 10.8 billion, while in the same period last year, it was over VND 5 billion.

However, thanks to a sharp increase in financial income from nearly VND 18.4 billion to nearly VND 28.8 billion and other profits surging more than 11 times compared to Q2/2024 to VND 37.8 billion, Dia Oc Hoang Quan still reported a net profit of nearly VND 4.9 billion. This profit decreased by 53.8% over the same period last year.

According to the enterprise’s explanation, the after-tax profit in Q2/2025 decreased compared to the same period last year due to a decrease in revenue in the period. The reason is that some customers are unable to pay for the next installments, so the Company agrees to liquidate and return the goods for resale to other customers at a higher price.

For the first six months of 2025, the company’s net revenue was VND 38 billion, and net profit was over VND 10 billion, down nearly 35.5% over the same period.

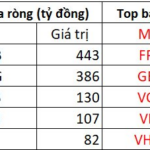

Foreign Block Surprises With Net Buy of Over 750 Billion Dong in VN-Index’s New Peak: Which Stocks Were “Cornered”?

In a stark contrast to the general trend, foreign investors offloaded Vietnamese shares at an alarming rate, with FPT being the primary target. The massive sell-off by foreign funds resulted in a staggering volume of 775 billion Vietnamese dong changing hands.

“CEO of IDV Steps Down After Over Four Years at the Helm”

Mr. Pham Trung Kien, the General Director and legal representative of VPID – JSC, has tendered his resignation, effective from September 1st, 2025. Mr. Kien’s decision to step down from his position is due to personal reasons.