Ho Chi Minh City Foreign Trade and Investment Development Joint Stock Company (Fideco, stock code: FDC, on HoSE) has just sent a clarification and proposed solutions to address the warning status of its stocks to the State Securities Commission of Vietnam (SSC) and Ho Chi Minh Stock Exchange (HoSE).

According to Fideco’s explanation, during the period, the company successfully held an election for the new Board of Management for the term 2025 – 2030. The company’s business operations proceeded as planned and approved by the Annual General Meeting of Shareholders.

Concurrently, the new Board proactively sought business opportunities through research and investment in new projects. Alongside, legal procedures for stalled projects are being expedited for completion to facilitate their continuation in the near future.

Illustrative image

It is known that FDC stock of Fideco was placed under warning status according to HoSE’s Decision No. 144/QD-SGDHCM dated March 29, 2023.

On March 19, 2025, HoSE issued Notification No. 547/TB-SGDHCM on maintaining the warning status for FDC stock based on the aforementioned decision.

The reason for maintaining the warning status is that Fideco’s undistributed post-tax profit as of December 31, 2024, remained negative at VND 187.16 billion, based on the 2024 audited financial statements, and the stock did not meet the listing requirements per the Listing Rules and Trading Rules for Listed Securities.

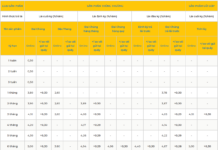

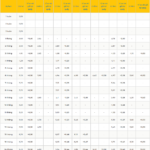

In terms of business performance, according to the second-quarter 2025 financial statements, Fideco recorded net revenue of nearly VND 18.9 billion, a 4.4-fold increase compared to the same period last year. After deducting taxes and expenses, the company reported a net profit of nearly VND 11.3 billion, while in the same period last year, it recorded a net loss of nearly VND 1.6 billion.

For the first half of 2025, Fideco achieved net revenue of nearly VND 37.5 billion, 4.1 times higher than the revenue in the first half of 2024. The after-tax profit was over VND 22.2 billion, while in the same period last year, the company recorded a net loss of nearly VND 1.2 billion.

In 2025, Fideco set a business plan with an expected revenue of nearly VND 73.6 billion, up 231% compared to the revenue achieved in 2024. The after-tax profit is estimated at nearly VND 40.5 billion, up 789%.

Thus, after the first two quarters, Fideco has completed 51% of the revenue plan and 54.9% of the after-tax profit plan.

As of June 30, 2025, Fideco’s total assets increased by 8.6% compared to the beginning of the year, reaching nearly VND 891.7 billion. Long-term receivables accounted for VND 387.4 billion, or 43.4% of total assets, while long-term work-in-progress was nearly VND 266.2 billion, or 29.9% of total assets.

On the liability side of the balance sheet, total liabilities stood at nearly VND 418.7 billion, up 13.1% from the beginning of the year. Other long-term payables accounted for nearly VND 148.3 billion, or 35.4% of total liabilities, while total short-term and long-term unearned revenue was nearly VND 139.2 billion, or 33.2% of total liabilities. Long-term financial loans and leases amounted to VND 53 billion.

“Hoang Quan Real Estate Plans to Issue 50 Million Shares to Swap Debt”

“Hoang Quan Real Estate plans to issue 50 million shares at VND 10,000 per share to swap VND 500 billion of debt. The list of creditors includes Chairman Truong Anh Tuan and Hai Phat Invest. This strategic move aims to strengthen the company’s financial position and consolidate its presence in the competitive real estate market.”

Foreign Block Surprises With Net Buy of Over 750 Billion Dong in VN-Index’s New Peak: Which Stocks Were “Cornered”?

In a stark contrast to the general trend, foreign investors offloaded Vietnamese shares at an alarming rate, with FPT being the primary target. The massive sell-off by foreign funds resulted in a staggering volume of 775 billion Vietnamese dong changing hands.