Injecting approximately VND 1,560 trillion into the economy

According to data from the State Bank of Vietnam (SBV), as of the end of July, the credit of the whole system has increased by about 10% compared to the end of 2024, equivalent to about VND 1,560 trillion injected into the economy. This growth rate is considered high compared to the same period last year, when credit increased by only about 6%.

Many sectors have recorded outstanding credit growth. Specifically, by the end of May, credit for the supporting industries sector increased by 15.69%, while credit for high-tech enterprises increased by up to 17.59%.

Notably, banks are aggressively deploying preferential loan packages for social housing purchases, especially for young people under 35. Many customers have accessed loans with interest rates as low as 5-6%/year (fixed for the first 2-3 years) and loan terms of up to 40-50 years. This is considered a positive signal in the context of the increasing housing needs of young people.

In addition, banks are also actively expanding lending to private enterprises, an orientation promoted by Resolution 68-NQ/TW in 2025 on the development of the private economy.

Market lending rates have decreased by 0.4 percentage points compared to the end of 2024. Photo: LAM GIANG

In the investment field, credit is also flowing strongly into real estate and securities. As of the trading session on August 8, the VN-Index continued to hit a new peak at 1,584 points, extending the upward trend that has lasted for many months. The strong cash flow into the stock market, including a significant portion from credit capital, raises some concerns about potential risks.

Speaking at the July 2025 Government meeting, SBV Governor Nguyen Thi Hong acknowledged that the credit growth rate in real estate and securities is higher than the average, but affirmed that this is in line with the orientation of removing difficulties for the market.

Specifically, when real estate projects are unblocked legally, capital demand for implementation is inevitable. For the securities market, although credit growth is high, the outstanding loan balance accounts for only 1.5% of the whole system, which has not created significant risks.

According to the Governor, the SBV is closely monitoring financial safety indicators and found that the ratio of short-term capital used for medium and long-term loans is still below the 30% threshold, ensuring the safety of the system. “The lending interest rates in the whole market have decreased by 0.4 percentage points compared to the end of 2024, reflecting the flexible management to support the capital costs for the economy,” emphasized Governor Nguyen Thi Hong.

Inflation and exchange rate pressures

Regarding the task of further reducing lending interest rates, the banking industry leaders said that in 2025, the industry targets credit growth of about 16%, corresponding to the government’s GDP growth target of over 8%. This is a big challenge in the context of rising deposit interest rates and increasing inflationary pressures.

Currently, average inflation is being controlled at 3.6%, lower than the National Assembly’s target of 4.5-5%. However, factors such as electricity price adjustments, medical service prices, and rent… are increasing input costs and pushing up core inflation month by month.

At the Agricultural Bank of Vietnam (Agribank), Mr. Pham Toan Vuong, General Director, said that credit capital demand is high from the beginning, forcing the bank to maintain stable market liquidity. However, Agribank did not increase deposit interest rates but instead reduced short-term deposit interest rates from April.

Thanks to good control of capital costs, Agribank’s average lending interest rate as of July 31 has decreased by 0.37 percentage points compared to the beginning of the year. In the first seven months, the disbursement for preferential credit programs reached more than VND 300,000 billion, with interest rates 2-3 percentage points lower than usual.

Similarly, Mr. Nguyen Viet Anh, Deputy General Director of Tien Phong Bank (TPBank), said that the bank is also deploying large-scale credit packages to support production recovery, promote green transformation, and sustainable development. According to Mr. Nguyen Viet Anh, the bank is participating in packages such as VND 120,000 billion for social housing, worker housing, and old apartment renovation; a package of VND 500,000 billion for enterprises investing in infrastructure, digital transformation, and green transformation.

In addition, TPBank also designs separate loan packages for each customer group, such as households and private enterprises, with interest rates from 5.7%/year; maintain fixed-rate credit products from 5.5-8.8%/year for home buying and consumption purposes. “We continue to implement debt restructuring policies, waive and reduce interest rates and fees in accordance with the SBV’s guidance to ensure the benefits and recovery capacity of customers,” said Mr. Viet Anh.

To continue to have the conditions to reduce lending rates, Agribank proposed a need for more synchronous coordination of policies, especially between monetary and fiscal policies, typically speeding up public investment disbursement to stimulate demand and support system liquidity.

However, the SBV Governor acknowledged that challenges from both domestic and international factors remain significant. The USD/VND exchange rate has increased by 2.9% compared to the end of 2024, affected by economic fluctuations and market psychology. If the exchange rate pressure continues to escalate, the SBV will consider not reducing interest rates further to ensure exchange rate stability and avoid macro risks.

Developing the capital market to reduce the burden on banks

According to economic expert Tran Du Lich, the biggest weakness of Vietnam’s capital market today is that it has not been able to develop medium and long-term direct capital mobilization channels for enterprises. Most long-term loans still depend on the commercial banking system, which mainly provides short-term capital.

Mr. Lich believes that Vietnam needs to soon develop the stock market into an effective medium and long-term capital mobilization channel for enterprises, towards a sustainable financial development.

This view is also emphasized by the Prime Minister in Official Dispatch 128, which requests ministries and sectors to promote solutions to develop the capital, stock, and corporate bond markets in a stable, healthy, and safe direction, thereby reducing dependence on the banking credit system and meeting the long-term capital needs of the economy.

The Power of Persuasion: Crafting Compelling Headlines

“Unleashing the Potential: PYN Elite’s Stellar Performance with Two Stock Codes”

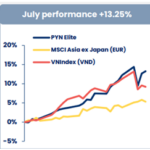

In July 2025, PYN Elite Fund, a foreign-owned investment fund, boasted an impressive 13.25% return, the highest it has seen in 55 months since January 2021. This remarkable performance surpasses the VN-Index’s 9.2% gain, which peaked at a historic high of 1,557 points on July 28.

Unlocking the Secrets to Effective Real Estate Investment: A Comprehensive Guide by the Ministry of Construction

The growth rate of credit for real estate across many banks has reached an impressive 20-30%, an astounding threefold increase compared to the overall credit growth rate of the system. The Ministry of Construction suggests that the State Bank should develop a credit package for reasonably priced housing to further boost this credit growth.

Prime Minister Requests SBV to Hasten the Development of a Roadmap to Pilot the Abolition of Credit Room from 2026 Onwards.

The State Bank of Vietnam (SBV) needs to establish standards and criteria for credit institutions to operate effectively and maintain good health. These standards should emphasize the importance of strong governance and management capabilities, adherence to prudential ratios, and high credit quality indicators. Transparency and disclosure are key to ensuring the safety and soundness of Vietnam’s banking system.

The Evolution of Structural Dynamics

“Development is often likened to ‘running and queuing simultaneously’. Speed is represented as ‘running’, while structure is likened to ‘queuing’. Queuing is fundamental and long-term; it not only affects the running speed but also impacts various states of stability and crisis, agriculture or industrialization, market-oriented or non-market-oriented economy, and so on. Given its significance, structure and structural transformation deserve more attention.”