**Corporate Dividend Payouts: A Snapshot of Vietnam’s Thriving Economy**

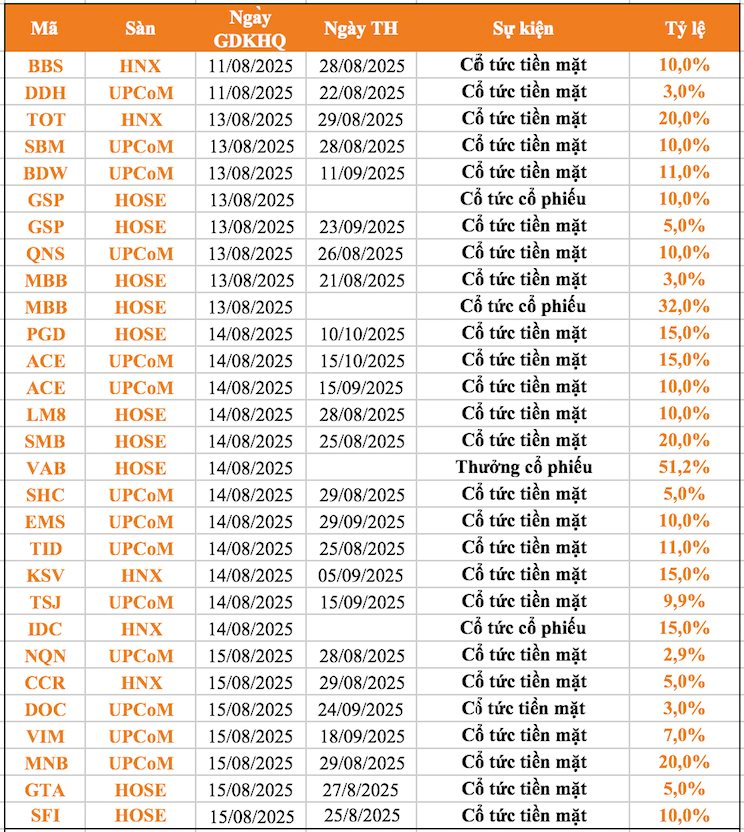

According to recent statistics, 26 companies announced dividend lock-in during the week of August 11-15, with 22 of them opting for cash dividends. The highest rate announced was 25%, while the lowest was 2.9%.

In addition, one company chose to distribute stock dividends, while another offered bonus shares. Notably, two companies decided on a hybrid approach, offering a combination of cash and stock dividends.

On August 14, Quang Ngai Sugar Joint Stock Company (code: QNS) will finalize its list of shareholders to distribute the first round of 2025 interim cash dividends at a rate of 10% (equivalent to VND 1,000 per share). Payments will be made on August 26.

With approximately 368 million shares in circulation, Quang Ngai Sugar is expected to disburse nearly VND 368 billion in dividends for this round.

According to the resolutions of the 2025 Annual General Meeting of Shareholders, Quang Ngai Sugar aims to maintain a minimum dividend rate of 15% in cash, equivalent to a total payout of nearly VND 551.5 billion. In the preceding years of 2023 and 2024, the company distributed dividends at a rate of up to 40% – the highest in its operational history.

An Giang Centrifugal Concrete Joint Stock Company (code: ACE) has recently announced its plan to distribute the final 2024 cash dividends at a total rate of 25%, equivalent to VND 2,500 per share. The ex-dividend date is set for August 14.

This payout will be executed in two phases. Specifically, the first phase will involve a 15% distribution on September 15, followed by a second phase with a 10% distribution on October 15. The total value of this dividend exceeds VND 7.6 billion.

Earlier in May, ACE completed the first round of 2024 dividend distributions at a rate of 10%. Therefore, the total cash dividend for 2024 amounts to 35% (VND 3,500 per share), totaling nearly VND 10.7 billion.

Military Commercial Joint Stock Bank (code: MBB) announced that on August 14, it will finalize its list of shareholders for dividend distribution at a total rate of 35%.

Specifically, MB intends to issue over 1.95 billion new shares for dividend distribution at a rate of 32%. This means that for every 100 common shares held, shareholders will receive 32 new shares. Any fractional shares or unallocated shares arising from this distribution will be managed and distributed by the MB Trade Union Base, subject to the approval of the Bank’s Board of Directors.

The issuance source for these new shares is derived from MB’s undistributed profit balance from 2024, in accordance with legal regulations.

On the same day, MB will also finalize the list of shareholders for a 3% cash dividend distribution, which equates to VND 300 per share. With over 6.1 billion shares in circulation, the Bank estimates a dividend payout of approximately VND 1,830 billion. The expected payment date for this cash dividend is August 21.

Vietnam Asia Commercial Joint Stock Bank (VietABank – code: VAB) will finalize its shareholder list on August 15 for the purpose of increasing charter capital through the issuance of new shares from owner equity. The ex-dividend date is set for August 14.

Accordingly, VietABank will issue over 276.4 million new shares to existing shareholders at a ratio of 100:51.19. In practical terms, for every 100 shares owned, shareholders will receive 1 right, and for every 100 rights held, they will be entitled to receive 51.19 new shares. Any fractional shares arising from this issuance will be canceled.

The issuance source for these new shares comprises undistributed profit balance as of December 31, 2024 (over VND 2,604 billion), and the Supplementary Capital Reserve Fund (over VND 160 billion). Following this issuance, VietABank’s charter capital will increase by 50%, rising from nearly VND 5,400 billion to VND 8,164 billion.

Prime Minister Requests SBV to Hasten the Development of a Roadmap to Pilot the Abolition of Credit Room from 2026 Onwards.

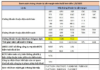

The State Bank of Vietnam (SBV) needs to establish standards and criteria for credit institutions to operate effectively and maintain good health. These standards should emphasize the importance of strong governance and management capabilities, adherence to prudential ratios, and high credit quality indicators. Transparency and disclosure are key to ensuring the safety and soundness of Vietnam’s banking system.

“Creating Value for Customers and Shareholders”

Enhancing value for customers and shareholders alike is always a pivotal and long-term strategic goal for any business in any country. While operational efficiency is undoubtedly crucial, are there any supplementary solutions that can boost a company’s market capitalization and augment value for shareholders?

The Resilient Vietnamese Economy: A Stable Foundation for a Promising Future

“Vietnam’s macroeconomic stability and agility in a volatile global economic environment have been applauded by prominent organizations such as the World Bank, the Asian Development Bank, and Standard Chartered. Their recognition underscores the country’s robust foundation and adaptive capabilities, fostering resilience and potential for growth amidst global uncertainties.”

KAFI Expert: Vietnam’s Stock Market Outlook Remains Highly Promising in the Near Term

“At the seminar titled “Investment Opportunities in the Last 6 Months of 2025,” experts from KAFI Securities argued that the “fab four” pillars, with a focus on Resolution 68, will be the key to addressing the uncertainties and instability that the economy has been experiencing. In the short term, the outlook for the Vietnamese stock market is very promising.”