Vietnam’s Q2 2025 Corporate Earnings Report: Market Overview and Sector Performance

Vietnam’s Q2 2025 Corporate Earnings at a Glance

The latest report from Mirae Asset Securities reveals a remarkable improvement in the overall Q2 2025 corporate earnings for the market as of July 31, 2025, compared to the same period last year. The number of sectors with positive after-tax profit growth increased from the previous quarter, and the overall market’s after-tax profit growth rate reached its highest level in the last six quarters.

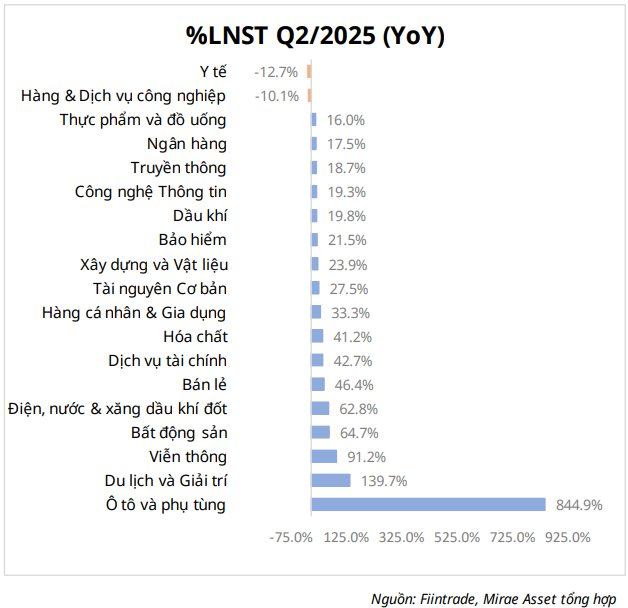

According to FiinTrade data as of July 31, 2025, the total after-tax profit for Q2 increased by 33.6% year-over-year, surpassing the growth rates of previous quarters (20.7% in Q1/2024, 21.4% in Q2/2024, 21% in Q3/2024, 19.3% in Q4/2024, and 12% in Q1/2025).

Breaking it down, the non-financial sector witnessed a 53.8% surge in profits, while the financial sector posted a 17.9% increase. The following sectors contributed to this growth: Automobiles & Components (+844.9%), Travel & Entertainment (+139.7%), Telecommunications (+91.2%), Real Estate (+64.7%), Utilities & Energy (+62.8%), Retail (+46.4%), Financial Services (+42.7%), Chemicals (+41.2%), Personal & Household Goods (+33.3%), Basic Resources (+27.5%), Construction & Materials (+23.9%), Insurance (+21.5%), Oil & Gas (+19.8%), Information Technology (+19.3%), Media (+18.7%), Banking (+17.5%), and Food & Beverage (+16.0%).

On the other hand, the Industrial Goods & Services sector witnessed a decline of 10.1%, and the Healthcare sector saw a drop of 12.7%. Overall, the Q2 2025 profits reflect a positive growth trend across various sectors, indicating a recovery led by multiple industries. The financial sector also showed improvement, with profit growth outpacing that of Q1, despite a lack of significant credit breakthroughs.

Turning to the stock market, Mirae Asset notes that after a steep correction of nearly 20% in the early days of April, the VN-Index rebounded slightly in Q2 and continued to climb over 10% in July, reaching new historical highs.

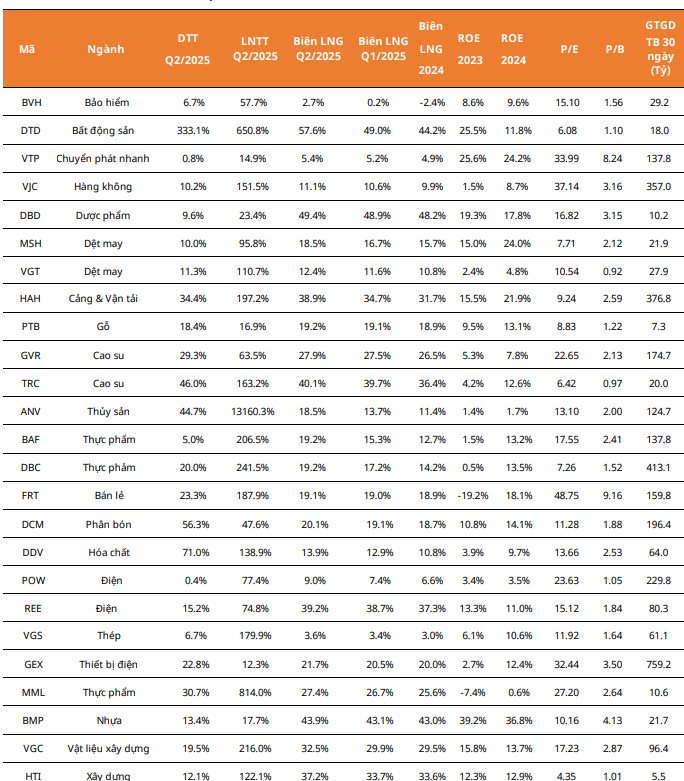

Based on the Q2 2025 financial results, Mirae Asset applied stringent filters to identify stocks with stable and robust growth trajectories, as well as unique investment narratives. The selection criteria combined the SEPA stock-picking method of Mark Minervini and William O’Neil’s Canslim investment strategy, both renowned for their fundamental approaches.

Sector Insights and Stock Recommendations

Essential sectors such as Food & Beverage and Utilities are considered safe bets by Mirae Asset due to their inherent stability. The revised Power Plan 8 and the amended Law on Electricity, which foster a more competitive electricity market, bode well for the Utilities sector, especially with the expected rise in electricity consumption in 2025.

Additionally, sectors with compelling narratives and recovery prospects become attractive when their valuations become appealing. For instance, Real Estate is poised for a rebound, benefiting from persistently low-interest rates and the resolution of legal hurdles for various projects. The new Laws on Real Estate Business and Construction, which came into effect in early 2025, further bolster the sector’s prospects.

The Fertilizer sector is also looking promising due to increased demand, improved selling prices, and supportive policies (as of July 1, 2025, output VAT for fertilizers is set at 5%, enabling companies to claim input VAT refunds, reduce production costs, and enhance profit margins). Global supply shortages and sustained high rubber prices, with export prices surging by 27.3% in the first five months of 2025, bode well for the Rubber sector.

The Oil & Gas sector remains relatively attractive, given the high Brent crude oil prices, along with the revival of various exploration and production projects after a period of stagnation. The industry is entering a new era with numerous large-scale exploration and production projects planned for 2025–2027. The simultaneous development of upstream projects is expected to spur demand for logistics, floating storage, and other ancillary services. With the government targeting an 8% GDP growth rate, public investment disbursements are likely to increase, creating a positive outlook for the Construction sector.

Mirae Asset recommends a portfolio of 25 “Super” stocks, characterized by strong fundamentals and robust gross profit margins in Q2 2025, outperforming both the previous quarter and the full year 2024. These include companies from the Food & Beverage (BAF, DBC, MML), Retail (FRT), Real Estate (DTD), Textiles (MSH, VGT), Aviation (VJC), Utilities (POW, REE), Fertilizer-Chemicals (DCM, DDV), Rubber (GVR, TRC), and Electrical Equipment (GEX) sectors.

Mirae Asset’s “Super” Stock Recommendations

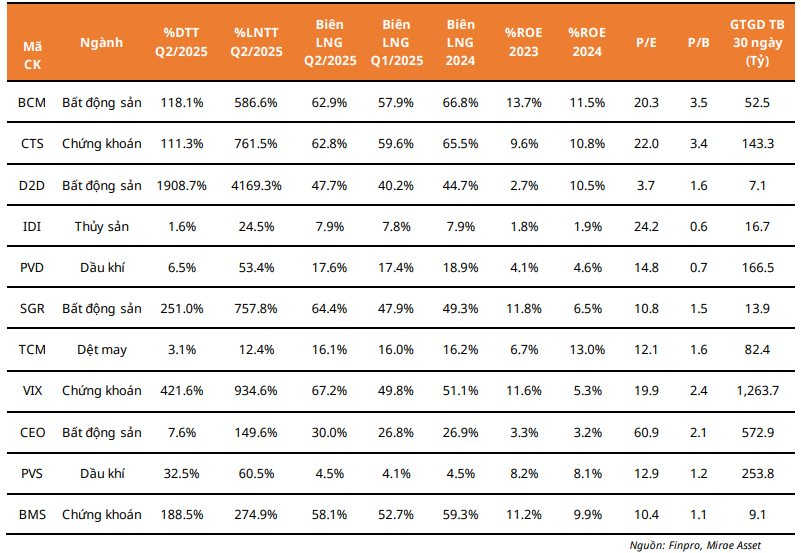

Additionally, the analytics team has identified 11 “Good” stocks, defined by their improved gross profit margins in Q2 2025 compared to the previous quarter. These include BCM, VIX, PVD, CTS, CEO, PVS, BMS, and others.

Mirae Asset’s “Good” Stock Picks

The Stock Market Tug-of-War: Pawn Shop IPO Debuts

The domestic stock market witnessed a tug-of-war during the weekend session (8/8) as large-cap stocks faced corrective pressures. Today, F88’s stock debuted, marking the first time a pawnshop business listed and traded on the stock exchange.